If you'd invested in: GVC and Pets At Home

Betting firm GVC has been boosted by the US's removal on its sports gambling ban, while Pets at Home has seen profits dive.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

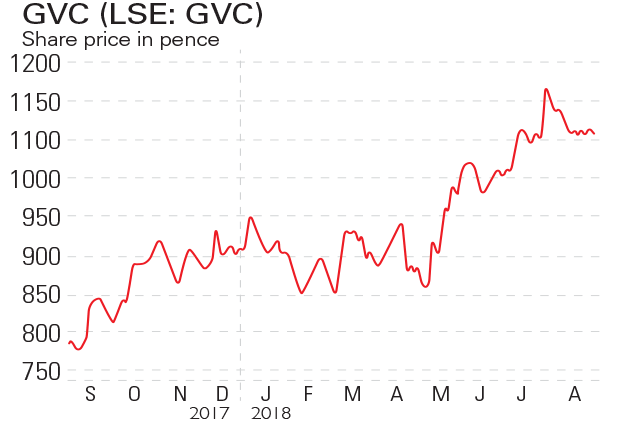

Shares in e-gaming operator GVC (LSE: GVC) rose in March as the firm completed the £3.2bn acquisition of Ladbrokes Coral, which brought it 3,500 UK betting shops and retail operations in Italy, Belgium, Ireland and Spain. The share price jumped again in May after the US Supreme Court struck down a 26-year-long nationwide ban on sports betting, claiming it was unconstitutional. GVC's shares then soared in July as GVC sealed a 50/50 joint venture worth $200m with MGM Resorts International to create a sports-betting and online-gaming platform in the US.

Be glad you didn't buy...

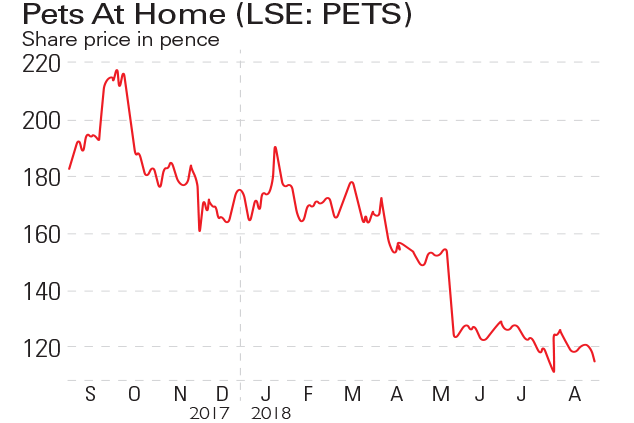

Shares in Britain's biggest pet store Pets At Home (LSE: PETS) dived in October after private-equity firm KKR sold stock worth £119m. In May, the share price slid further as Pets At Home posted a 12.3% drop in underlying pre-tax profit to £84.5m, despite a 7.8% rise in revenue to £898.9m. The results came as the firm embarked on the second year of a three-year recovery plan involving cutting costs and attempting to win back customers. Many investors doubt it will work, however: the company remains the UK's most-shorted firm, with just over 13% of the shares out on loan.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.