A risky bet in the digital Derby

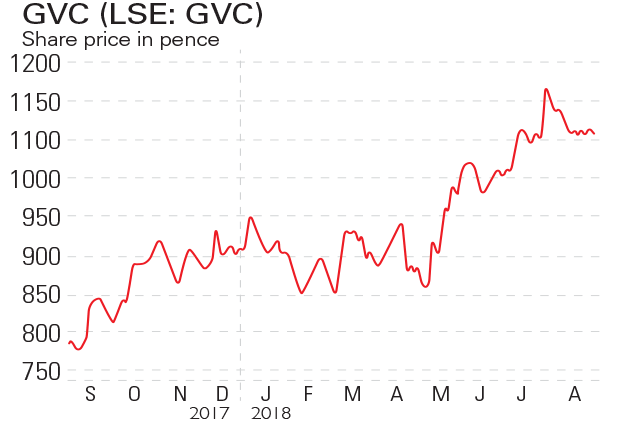

Online gaming group GVC is bidding for Ladbrokes Coral – just as a regulatory clampdown looms. Alice Gråhns reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Online gaming group GVC is bidding for Ladbrokes Coral just as aregulatory clampdown looms. Alice Grhns reports.

Bookmakers adjust the odds to ensure they make money whatever happens. "GVC's £3.9bn bid for Ladbrokes Coral Group is trying to do something similar, by using financial engineering to hedge the risk of a government clampdown," says Liam Proud on Breakingviews. The Foxy Bingo and Partypoker owner's announcement last week the third time in a year it has been in talks with the bookmaker surprised markets. A regulatory review of fixed-odds betting stakes, expected early next year, could knock off a fifth of Ladbrokes' operating profit.So most analysts had expected GVC to wait.

Instead, its proposal "seems needlessly effortful", says Lex in the FT a convoluted mix of cash and shares that involves seven possible scenarios. The baseline is 161p per share payable if the government cuts the maximum bid on a fixed-odds betting terminal (FOBT) from £100 to £2. But why the rush? The haste suggests GVC does not expect there to be a severe crackdown.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

"The move is a gamble," says Chris Hughes on Bloomberg Gadfly. But GVC "has done its best to hedge its bet". Buying Ladbrokes would give GVC extra scale, making "its high technology and compliance costs go further". And expanding geographically puts it in a better position to cope with "unexpected regulatory changes" in any one local market. "For these benefits, the purchaser is willing to take on some additional risk."

For Ladbrokes' bosses, on the other hand, "this deal would be a corporate humiliation", says Nils Pratley in The Guardian. The firm is one of the oldest names in British bookmaking. In 1993 Ladbrokes was worth £2bn. Now, a quarter of a century later and with Coral on board, it is in talks to surrender for between £3.1bn and £3.9bn. With half-year net gaming revenue of £427m compared with Ladbrokes Coral's £1.2bn, GVC is smaller.

Yet Ladbrokes was "late to the starting gate in the digital Derby" and loaded up with "so much debt in the pre-financial crash years that a £286m rights issue was required when recession arrived in 2009". Last year's merger with Coral gave Ladbrokes greater size, but it also boosted its appeal to GVC.

But for Ladbrokes' shareholders, getting the deal done makes sense, says Lex. If the FOBT stake cap is extreme, the impact will fall on a bigger group that is less reliant on the UK for revenue. And as traditional betting shops fall out of favour, GVC should be able to improve Ladbrokes' online business. Looked at like that, it's a win-win situation. "GVC wins the pot at a decent price. Ladbrokes lays off the risk of a draconian FOBT cap."

Mouse stalks Fox

"The Force could be with a Walt Disney deal for 21st Century Fox," says Jennifer Saba on Breakingviews. The Magic Kingdom is reportedly nearing a deal to buy $40bn-worth of Rupert Murdoch's $60bn empire. The deal would include assets such as Fox's FX cable network, film studios, and global properties including Star India and its 39% stake in pay-TV group Sky. Disney could "add to its clout with global outlets and cable content", while the Murdoch family may fancy shares in a bigger group.

But "the most intriguing aspect of matching Mickey Mouse with Fox relates to succession planning". Disney boss Bob Iger is due to retire in 2019 so buying "most of 21st Century Fox and installing James Murdoch as its head might be a fairy-tale ending", says Lex in the FT. Murdoch's experience at Sky and Star India means he "understands the global TV market better than anyone".

However, it's only five years since broadcast regulator Ofcom, referring to Murdoch's handling of the phone-hacking scandal at his UK newspapers, said his conduct "repeatedly fell short". And it is less than a year since Fox News' Bill O'Reilly was offered a $25m-a-year contract despite the Murdochs knowing of allegations of sexual harassment against him. "Could Mickey and friends live with this?" Under Murdoch's tenure at Sky, the shares underperformed. So even if it ends up buying "the Fox assets, acquiring a CEO as part of the package might be too cute even for Disney".

City talk

"Is media-shy visionary' a contradiction in terms?" asks Matthew Vincent in the FT's Lombard column. "Not in the case of Lancastrian real-estate billionaire John Whittaker, who as 25% shareholder in Intu will become deputy chairman of its new owner, Hammerson." He may be the only person ever to "envisage a Florentine shopping mall on the Manchester Ship Canal, and reimagine Salford as a BBC luvvies' enclave". Yet he has only given two interviews since 1987. "One suspects board members will hear more from him."

"No wonder Andrew Goodsell was keen to sail out of Saga," says Alistair Osborne in The Times. Six weeks ago, the chairman said he would leave in May, having made £195m from his 26 years aboard the over-50s cruise-to-insurance outfit. That day, the shares stood at 192.25p. Now they stand at 128.5p after last week's profit shocker sent them diving a fair bit below 2014's 185p float price.

Goodsell also used to run Acromas the outfit owned by Permira, CVC Capital and Charterhouse that once housed the AA and Saga. The AA was listed in 2014 at 250p, but today the shares stand at 156.25p. Naturally, the "buyout firms are long gone", and now Goodsell is off, too. "At least they proved it is actually possible to make money out of the AA and Saga."

Even if its share price has slipped, the arrival of activist investor Scott Ferguson on the share register of 275-year-old hospitality giant Whitbread which owns Costa Coffee among other brands ought to go down like a cup of cold sick, says Alex Brummer in the Daily Mail. Ferguson, who runs the Sachem Head hedge fund and is a protg of Pershing Square boss Bill Ackman, was among those agitating for "the sale of British tech champion Worldpay to the Americans. Whitbread chairman Richard Baker should be wary of engaging."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how