America parties on – but it won’t be able to avoid the hangover

Since 2009, the US economy has enjoyed an unusually long expansion, while stocks have risen across the world. But is it now time to prepare for the next recession? Matthew Partridge investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

We've had a long, hot summer that has felt endless at times. Some people feel the same way about the overheating US economy and stockmarket. The S&P 500 index last week set a record for a bull market a period of rising stock prices without a 20% decline. The upswing that began in March 2009 has surpassed the previous record of 3,452 days, set between October 1990 and March 2000.

The US economy is also in historic territory. The post-crisis rebound has lasted for 38 quarters, just shy of the all-time record of 40 (March 1991-March 2001), as measured by the National Bureau of Economic Research. The Bureau's analysis spans the last 164 years, during which the average economic expansion has lasted for 39 months. So this one has been unusually protracted and it still seems to be fizzing along.

GDP growth accelerated to an annualised 4.1% in the second quarter of 2018, the fastest pace in almost four years. "Confetti is flying, disco balls are spinning, and champagne corks are popping across the length and breadth of American business," as Geoff Colvin puts it in Fortune. But will the party soon end and leave investors with a nasty hangover? Strong growth figures are obscuring vulnerabilities that could exacerbate a downturn, and headwinds are strengthening.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Fighting the Fed

There is "no natural limit to the length of economic expansions", as Lakshman Achuthan of New York's Economic Cycle Research Institute points out: Australia has been growing for more than two decades. And this US recovery has been slower than average, as it has taken some time to shake off the effect of the financial crisis, which suggests it could have more mileage in it. But it certainly seems closer to the end than the beginning.

If you look closely at the data you can see that parts of the American economy have already passed their peak, says Achuthan. Real growth in personal income, for example, "has actually been slowing since last summer, and is now approaching a one-and-a-half-year low". Given that consumer spending accounts for almost 70% of US GDP, "the question is not if the US economy will slow, but when the slowdown will become obvious to the consensus".

Expansions rarely just peter out; they are often inadvertently killed off by the Federal Reserve, the US central bank. "Nearly every Federal Reserve tightening has resulted in some sort of recession," says Societe Generale's Albert Edwards. This is because "when the good times roll people tend to ignore risk, creating problems when the cycle turns". In the 2000s consumers loaded up on debt to buy overpriced houses. This time round companies are the key debtors. Instead of using the era of money printing and near-zero interest rates to reduce borrowings and get their balance sheets under control, American firms have opted to borrow more. That could endanger the financial system, reckons Edwards.

He is not alone in sounding the alarm about high levels of corporate debt. In April 2017 the International Monetary Fund released a report warning that US corporate leverage is now higher than during the financial crisis, for example. In particular, it said that if interest rates rise significantly, up to 20% of firms could be at risk of default and bankruptcy. Indeed, the Bank for International Settlements puts US non-financial corporate debt at 73.5% of American GDP, the highest since records began in 1952. "Using credit to elongate the business cycle inevitably makes the downturn worse," says Edwards.

Achuthan points out that interest-rate hikes usually take around a year to have an impact on the economy, so they are unlikely to produce an immediate recession. However, in the medium term "policy tightening into a slowdown tends not to work out too well for the economy". As a result, he thinks that "the biggest threat to the US economy is that Fed tightening will culminate in a serious slowdown", leaving it weak enough for "any significant shock" to push it into recession. It's also worth bearing in mind that Fed tightening isn't just a matter of dearer money.

The central bank is also unwinding its quantitative-easing (QE) programme: the cash it injected into the system by buying bonds with printed money is now being drained as the bonds are sold back onto the market. These days, then, the Fed is implementing quantitative tightening (QT).

Shielded by the stimulus

The impact of Fed tightening has been tempered by the Trump administration's fiscal stimulus package. But when the sugar rush of tax cuts and higher spending wears off, the liquidity squeeze will become all the more apparent. By next summer, says Michael Pearce of Capital Economics, "the stimulus from Donald Trump's tax cuts will have faded", resulting in a "significant slowdown". Indeed, the Fed may be all the more inclined to tighten because it will be worried that the stimulus package will make the economy overheat.

If Fed tightening does end up killing the US boom then President Trump will only have himself to blame, says Julie Dean, a fund manager at TM Sanditon. Jerome Powell, chairman of the Fed, "is only cleaning up the mess created by Trump's fiscal policy". She also expects Powell to "stand firm" against any calls to reverse course, especially since "the labour market is incredibly tight", which "always happens in the late stages of the economic cycle".

The unemployment rate is near a 17-year low, and there are other signs of tightening that presage an inflationary jump in wages: America's small businesses, for instance, say they have never found it so difficult to fill jobs, according to the National Federation of Independent Business. The prospect of the stimulus ultimately causing a sharper downswing worries former Fed chairman Ben Bernanke. In 2020, the post-stimulus US economy, like the cartoon character Wile E. Coyote, is "going off the cliff", he warns.

Another danger, though one much harder to assess, is the prospect of a trade war. The last one occurred in the 1930s, says Fortune's Geoff Colvin, "when today's intricate, light-speed global supply chains would have been nearly unfathomable". But every Trump tweet on the subject will undermine business confidence. And the strong dollar will hamper US export growth. Another worry is that the administration's big increase in borrowing to fund the tax cuts will preclude a major stimulus to counteract the next downturn.

How will this affect the stockmarket?

The biggest problem with the American stockmarket is its stark overvaluation. The cyclically adjusted price-earnings (p/e) ratio is 33, a figure exceeded only during the dotcom bubble. That means it's not enough for America simply to avoid a recession, but corporate earnings need to keep growing, says Russ Mould of AJ Bell. With corporate margins at records levels, this is going to be hard enough, even if the US economy doesn't turn down. Note that Warren Buffett's holding company Berkshire Hathaway has been accumulating a large amount of cash (now up to $129.6bn) on its balance sheets, suggesting it can't find a way to deploy it effectively.

Mould points out that Buffett has a pretty good track record when it comes to anticipating economic cycles, with Berkshire accumulating cash prior to both the bursting of the dotcom bubble in 2000 and the financial crisis of 2008 (and using it to scoop up bargains after the slump). The combination of an absurdly overvalued market, mean-reverting valuations, and a slowing US economy could lead to carnage, says Edwards. He thinks the recession could be as bad as the one in 2009, with investors becoming so pessimistic that shares end up trading at single-digit p/e ratios. In this case the US stockmarket could fall by up to 70%.

What about the rest of the world?

In the 2000s, before the crash, there was widespread talk of "decoupling". The idea was that the days of the US dominating the world economy and tending to lead the global business cycle were numbered as developing economies and their stockmarkets gradually emancipated themselves from Western economies. That will no doubt happen one day, but the synchronised global economic and market slump of 2008-09 showed that it certainly hadn't happened by then. And other regions are unlikely to have developed the economic weight to shake off the impact of a US economic and stockmarket downturn this time either.

If there is a recession, or even a significant slowdown, in the US then "the UK economy is likely to be affected both directly and indirectly", says Tommaso Mancuso of Hermes Investment Management. Not only is America Britain's second-largest trading partner, but its top trading partner, the EU, will also be badly hit by any US slowdown. So he expects "any meaningful correction of US stocks to affect non-US equities as well". It hardly helps matters that Europe's economic momentum has slowed over the past few months, while emerging markets are struggling with a stronger dollar, lower commodities prices and the ongoing threat of trade disruptions.The last thing these regions need is a US downturn.

How to sidestep the slowdown

While equities could have a long way to fall, rushing for the exits right now is not a good idea. Over the past few years many investors have found out the hard way that it doesn't pay to be too bearish. And as Mancuso notes, "the last phase of a cycle can see equities generate significant gains over short periods of time" the so-called "melt-up'" phenomenon, whereby widespread euphoria leads to a final surge. Investors should consider reducing exposure gradually, keeping cash aside to buy bargains after markets have fallen.

Enter Japan, one of our long-standing stockmarket favourites. It is already among the very few reasonably priced markets in the world, so a global market downturn would make it even better value. Of all the developed countries, it has done the most to reduce corporate debt. Edwards also notes that its productivity keeps improving, even in the face of poor demographics, thanks to a greater use of robots. He also thinks that if emerging-market shares continue to decline, there could even be a few bargains worth picking up.

More broadly, Mould reckons that a downturn could see value investing, the idea of buying companies trading on relatively low multiples of earnings, or price-to-book, make a comeback. While everyone has been chasing "growth" stocks notably the tech giants with burgeoning sales and profits over the past decade, the last few months have seen value shares regain some ground. Lower growth and higher interest rates are also likely to put more pressure on companies trading at high valuations. What's more, the value plays are often defensive firms (those not exposed to the economic cycle) that fall out of fashion when everyone is chasing the likes of Alphabet and Amazon. Defensive firms tend to pay an income always welcome in turbulent markets. Speaking of income, we would suggest staying away from bonds, which remain historically overpriced, offer measly yields, and are vulnerable to inflation.

We suspect the downturn will come after inflation has taken hold, and history shows that high prices can be remarkably sticky even when growth deteriorates. Still, some sectors have considerable pricing power. Infrastructure projects are a good examples, says Mould. They tend to pay guaranteed returns that are index-linked, thus protecting investors from inflation. Gold, meanwhile, is a hedge against crises as well as inflation, and investors should always devote 5%-10% of their portfolio to it.

Where investors should look now

There are several ways to invest in the Japanese market. The simplest (and cheapest) is the Fidelity Index Japan Fund. This tracks the MSCI Japan index and comes with an ongoing charge of only 0.10%.

A top-quality actively managed Japan fund with an excellent record is the Baillie Gifford Shin Nippon trust (LSE: BGS) (our editor-in-chief, Merryn Somerset Webb, is a non-executive director at this trust).While it has a higher annual management charge of 0.95%, it trades at a 5% discount to its net assets and has comfortably beaten the index over one-, three-, five- and ten-year periods. It concentrates on fast-growing smaller firms.

An option skewed towards mid-caps is the Baillie Gifford Japan trust (LSE: BGFD). The ongoing charge is 0.88%.With dividends finally on the increase in Japan, an income fund is also worth a look. One option is the Jupiter Japan Income Fund. Its ongoing charge is 1.74%.

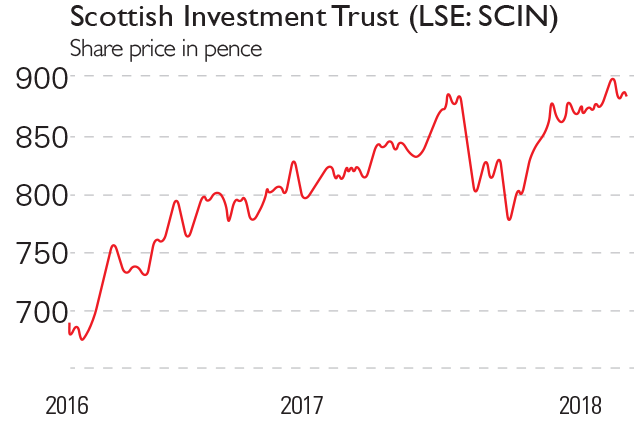

Rising interest rates and slower growth should help shift the balance towards value investing, as investors will be less willing to pay large multiples. The more value-orientated Scottish Investment Trust (LSE: SCIN) has a reputation for taking a contrarian approach. It trades at a discount of 8.8% to its net assets and has an ongoing charge of 0.5%.

You might also want to consider the Global Value Factor UCITS ETF (LSE: VVAL). This fund invests in developed-market (mostly American) companies with low price-to-book or price-earnings ratios. It has an ongoing charge of 0.22%.

One fund that puts the business cycle at the heart of its investment strategy is TM Sanditon UK. It is run by Julie Dean, who was extremely successful in her previous role with Cazenove's UK Opportunities Fund, quadrupling investors' money between 2002 and 2014. Since she's bearish on both the UK economy and the wider market, Dean has moved the fund into a much more defensive posture in an attempt to anticipate the coming downturn. The fund has outperformed the FTSE 100 over the past year and has an ongoing chargeof 0.87%.

Pharmaceuticals are a classic defensive sector, since demand for drugs should continue to grow irrespective of the state of the economy especially when you take into account the needs of an ageing population. One company that should be a safer bet for investors is GlaxoSmithKline (LSE: GSK). It trades at a reasonable 14 times 2019 earnings, and yields a solid 5.2%. Having enjoyed strong growth over the past few years, it is hoping to maintain this by branching out into consumer-healthcare products and investing further in its pipeline of new drugs.

Another drug company worth considering is the Dublin-headquartered Shire (LSE: SHP). Despite a relatively low yield of only 0.4%, Shire looks particularly interesting from a value perspective since it is currently trading at 10.7 times 2019 earnings. It is currently the focus of a takeover bid by Japanese drug company Takeda. However, even if the bid falls through, strong earnings figures and a promising drug pipeline should help it do well.

Firms dealing with infrastructure projects should also be relatively insulated from any economic downturn, especially as there is an urgent need for governments all over the world to invest more in infrastructure. John Laing Group (LSE: JLG) not to be confused with John Laing Infrastructure Fund manages projects ranging from building railways to wind farms, mostly in the US. It is currently trading at 7.3 times 2019 earnings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.