The charts that matter: Tesla and Turkey

As Elon Musk surprises investors - and possibly the SEC - and Turkey's woes worsen,John Stepek looks at what the charts that matter most to the global economy make of the week's events.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

First things first if you're in Edinburgh this month, make sure you get to see MoneyWeek editor-in-chief, Merryn Somerset Webb.

Merryn will be at Panmure House Adam Smith's only surviving residence debating everything from populism to economics to Brexit to Trump to Tesla to Turkey, with a range of comedians, authors, politicians and investment analysts.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you missed any of this week's Money Mornings, here are the links you need.

Monday:What Dr Copper is telling us about China's tough balancing act

Tuesday:I have a big problem with this idea that investing can ever be "passive"

Wednesday:Gold has been so bad that it's now starting to look good

Thursday:If Elon Musk takes Tesla private, that'll mark the top of the market

Friday:Things are getting ugly in Turkey what does that mean for global markets?

And don't miss this week's issue of MoneyWeek magazine! If you're not already a subscriber, sign up here now. (And podcasts will return soon).

And now over to this week's charts.

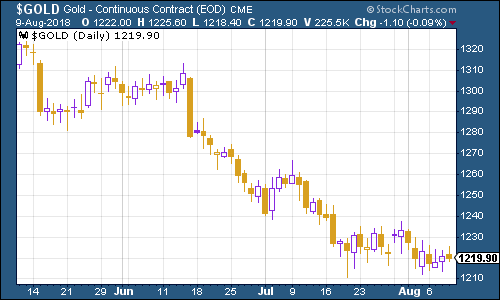

Gold (measured in dollar terms) remains under pressure from the US dollar strength, but my colleague Dominic reckons for the traders among you that we may be at or near a buying opportunity.

(Gold: three months)

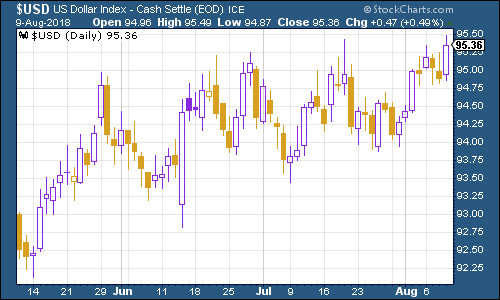

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners had another good week. The latest inflation data with core consumer price index inflation hitting its highest since September 2008 helped buoy the US currency.

(DXY: three months)

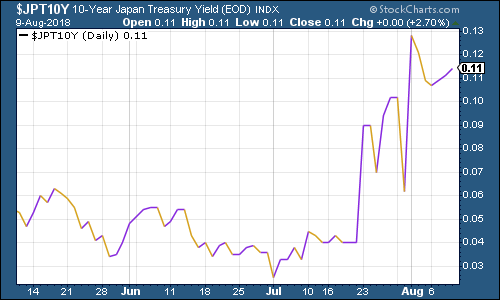

The Japanese government bond (JGB) yield remains close to the 0.1% level after the Bank of Japan's recent decision to let it move around a little more.

(Ten-year Japanese government bond yield: three months)

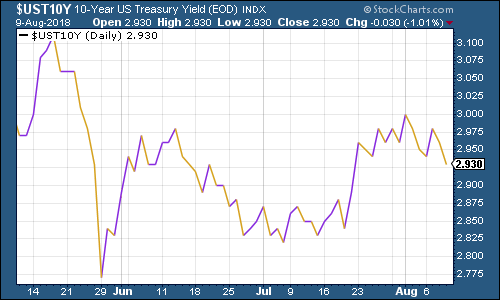

The yield on the ten-year US Treasury bond eased back below 3% this week.

(Ten-year US Treasury yield: three months)

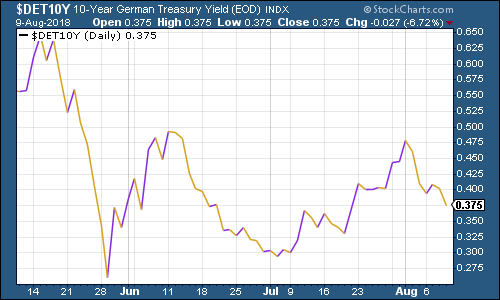

Meanwhile, the yield on the ten-year German bund (the borrowing cost of Germany's government, which is Europe's "risk-free" rate) fell a lot harder than its US counterpart, partly as fears over contagion from Turkey's woes ripple through eurozone markets.

(Ten-year bund yield: three months)

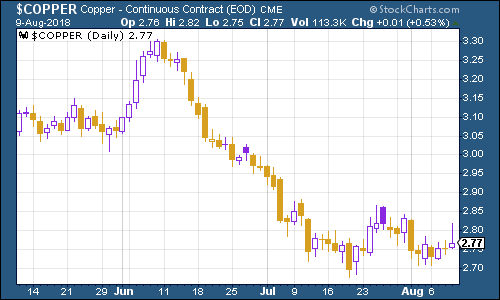

Copper appears to have found a bottom for the time being. The future movements in the price depend to a great extent on what happens next to the Chinese economy.

(Copper: three months)

It's been another tough week for cryptocurrency bitcoin. It saw a big slide earlier this week as the SEC once again delayed a decision on a proposed cryptocurrency exchange-traded fund (ETF). An ETF would of course make it easier for retail investors to get exposure to bitcoin, and thus the market clearly thinks drive the price higher by increasing demand.

(Bitcoin: three months)

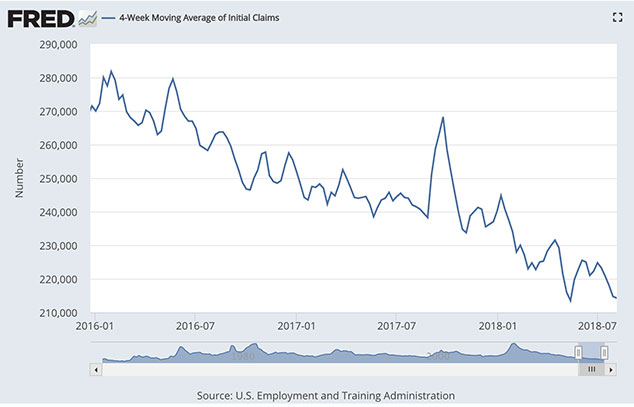

On US employment, the four-week moving average of weekly US jobless claims fell to 214,250 this week very close to a new low for this cycle while weekly claims fell to 213,000.

David Rosenberg of Gluskin Sheff has noted in the past, that when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), then a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later.

We hit a new trough of 213,500 just over two months ago, so if there's anything to Rosenberg's observations (drawn though they are from a limited pool of past cycles), then we should see the stockmarket hit new highs before this cycle is out.

More to the point, though, we could easily set a new trough soon.

(US jobless claims, four-week moving average: since January 2016)

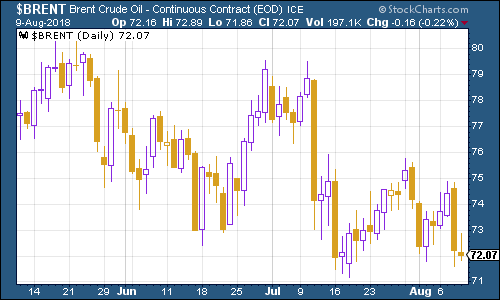

The oil price (as measured by Brent crude, the international/European benchmark) has continued to rattle around the low $70 a barrel level this week. One issue is the trade war between China and the US. China hasn't yet placed sanctions on US-produced oil, but it looks as though it will (and who's going to buy it anyway?)

As a result, more US oil will end up elsewhere in the world, putting pressure on Brent as well as West Texas Intermediate (the US benchmark).

Meanwhile, US oil supplies fell by less than expected last week while stockpiles of petrol rose to their highest levels since January.

(Brent crude oil: three months)

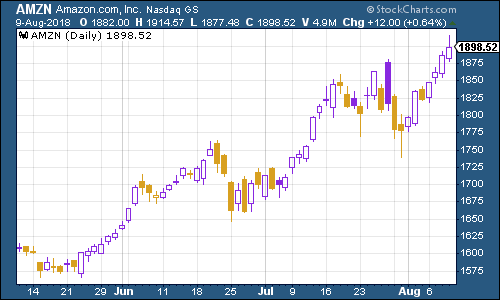

Internet giant Amazon this week yet another all-time high this week, rising to more than $1,900 a share. The current hot' rationale for buying the retailer is that many big brands are throwing in the towel and partnering up to use Amazon as a distribution platform in a "if you can't beat em, join em" move.

(Amazon: three months)

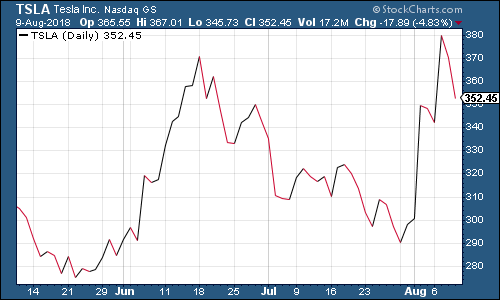

It was real fun and games for electric car group Tesla this week. Founder and CEO Elon Musk (who owns 20% of the company) issued what may prove to be the Tweet that finally gets him into a real spot of bother.

Musk is fed up with running Tesla as a public company. A part of me actually sympathises. There's a lot of attention on Tesla it's producing an exciting product. And having to keep a group of external shareholders happy is very distracting when the things they want to focus on may not be the things you want to focus on. Curse those pesky fellow owners of your company!

But on the other hand, revolutionising the car business is not easy and it takes a lot of money which is why he went public in the first place. So my sympathy is limited.

Anyway, so this week, Musk tweeted that he had the funding in place to take Tesla private at $420 a share. People treated it with a pinch of salt (as you can imagine) but the share price still moved on the news. It fell back later in the week as the story started to look even more threadbare. But In essence, if the tweet isn't true, then there's a good case that this is market manipulation and that's pretty serious.

The SEC the US securities regulator is looking into it even as I type.

Of course, if it is true, then it's a huge story. And also the top of the market, I reckon. But it has to happen first, as I explained in Money Morning earlier this week.

(Tesla: three months)

Have a great weekend.

Until next time,

John

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how