If you'd invested in: Tesco and Associated British Foods

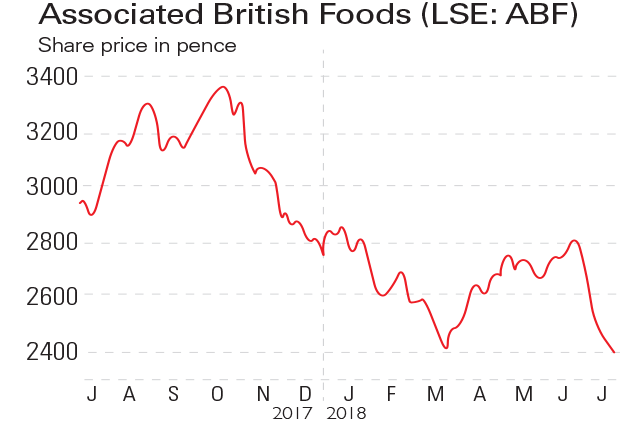

Tesco has seen its market value rise almost 50% in a year, while AB Foods has seen shares slide despite a rise in profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Tesco (LSE: TSCO), the UK's biggest retailer, has seen its market value rise almost 50% in a year. In April, barely three years after it reported the second largest loss in UK corporate history, it posted pre-tax profits of nearly £1.3bn in the year to the end of February, up from £145m the year before. This came from sales that rose 2.8% to £57.5bn. It also cut net debt by nearly 30% to £2.6bn. The results prompted it to announce a 3p dividend, the first payout in three years. In July, Tesco and its French counterpart Carrefour joined forces to fend off competition from discounters.

Be glad you didn't...

Associated British Foods (LSE: ABF) is a clothing as well as a food retailer, as it owns Primark. Last November it reported a 50% rise in pre-tax profits to £1.6bn, which was due to brisk business at Primark, a rebound in sugar profits and a boost from sterling's weakness. Yet the shares fell after the firm said it would be reducing the size of US Primark stores. This month ABF said profits would be higher than expected as the heatwave has boosted sales at Primark. But ABF also warned of lower annual profits at its sugar business as European sugar prices are currently low.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How to profit from rising food prices: which stocks should you invest in?

How to profit from rising food prices: which stocks should you invest in?Tips Food prices are rising – we look at the stocks to avoid and the one to invest in this sector.

-

It might confuse the market, but Associated British Foods is a buy

It might confuse the market, but Associated British Foods is a buyTips Associated British Foods is a unique firm: half food producer, half fashion retailer. That confuses the market, says Rupert Hargreaves, but its diverse nature can give the company strength.

-

Tesco looks well-placed to ride out the cost of living crisis – investors take note

Tesco looks well-placed to ride out the cost of living crisis – investors take noteAnalysis Surging inflation is bad news for retailers. But supermarket giant Tesco looks better placed to cope than most, says Rupert Hargreaves.

-

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bn

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bnNews Tesco has agreed to sell its southeast Asian operations to Thai conglomerate Charoen Pokphand for £8.2bn in cash.

-

Tesco should keep its Asian assets

Tesco should keep its Asian assetsOpinion The £7bn that Tesco could get for its Tesco Lotus business in Asia looks enticing. But holding on to it would be smarter, says Matthew Lynn.

-

Tesco wields the axe

Tesco wields the axeFeatures Britain’s biggest supermarket is cutting back on staff and fresh food. Will the move prove counterproductive? Matthew Partridge reports.

-

What's behind Tesco’s alliance with Carrefour?

What's behind Tesco’s alliance with Carrefour?Features Tesco is clubbing together with French rival Carrefour to bulk buy own-label goods in an effort to cut costs. Will it succeed? Ben Judge reports.

-

Lessons from Tesco’s turnaround

Lessons from Tesco’s turnaroundOpinion Retailers have it tough, but Tesco has shown that it’s still possible to thrive, says Matthew Lynn.