Don’t get oil-shocked – prepare your portfolio for pricier crude

Brent crude had been trading at under $45 a barrel. Now it’s around $70 – and it could be a very long time before we see prices that low again.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

One year ago, a barrel of Brent crude was trading at under $45. Now it's around $70 and it could be a very long time before we see prices that low again. Matthew Partridge looks at the best ways to profit.

A few weeks ago, my household energy contract expired, and I began to shop around for a new supplier. One thing that rapidly became very clear was that, whichever supplier I chose, I was going to have to pay a lot more for my gas and electricity. This isn't down to some energy-company conspiracy it's more a reflection of the fact that, in the past 12 months, the price of oil has shot up from less than $45 a barrel (as measured by the European benchmark, Brent crude) to more than $70 a barrel. Indeed, at one point in the past month it touched $80, a level not seen since the end of 2014, when prices dramatically crashed in the space of a few months.

That's a pretty rapid rise. Gains have stalled in the last week or so, leading some to wonder whether we're on the verge of another slide in the crude price, but we wouldn't get too excited. The reality is that, if you consider the fundamentals, today's oil price is more likely to be a floor than a ceiling or at least, it would be a mistake to expect oil to fall drastically in a 2014-style manner. Below I explain what's going on, and look at the best ways to profit.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Geopolitical risk is on the rise

The most obvious reason behind the strong rebound in oil prices over the past 18 months can be summed up in one word: politics. Up until December 2016, oil giant Saudi Arabia, ignoring the entreaties of its fellow members of oil cartel Opec, kept increasing oil production. It did this, even in the face of collapsing prices, to undermine the economies of its rivals Iran and Russia, as well as to put pressure on American shale-oil producers. Low prices did hurt the Iranian and Russian economies, and certainly led to some touch-and-go moments for shale producers.

But the slump also blew a hole in Saudi Arabia's capacity to fund the lavish public spending that helps to keep its population relatively happy in an otherwise discontented region. Meanwhile, low interest rates enabled shale producers to soldier on and even threaten to steal market share from Opec. So at the end of 2016, Saudi Arabia agreed a deal with both Russia and the rest of Opec to cut production sharply. This "helped to restrain supply growth and rebalance the market", says Thomas Pugh of Capital Economics.

However, the voluntary production cuts are not the only ones helping to prop up the price of oil. In May, the US decided to re-impose sanctions on Iran. This is "already putting major constraints on Iranian production", says Andy Lees of AML Macro. While the sanctions only apply to the US, some countries aiming to maintain good relations with America are considering slashing their Iranian oil imports, too. As a result, reckons Lees, Iranian output "will start falling" and "Opec won't be able to make up the difference". That's before you consider the potential for unrest in Iran, where inflation is rocketing and unemployment is high, particularly among the young, notes Nick Butler in the Financial Times.

Many other key oil-producing nations are in trouble, too. Venezuelan production has been hit badly by the long-running fight for control between the authoritarian populist president Nicolas Maduro and the opposition. In 2015, Venezuela was producing more than 2.3 million barrels of oil a day. Now the number is closer to 1.3 million and falling the International Energy Agency expects it to drop to below one million by the end of this year. Despite China's ongoing intervention in the form of financial aid to prop up the regime, a rapid resolution to the crisis looks very unlikely, says Andreas Economou of the Oxford Institute for Energy Studies. Indeed, with existing infrastructure in dire need of maintenance, production is likely to fall further. Libya is another hotspot, where fighting between various forces vying for control of the country regularly disrupts oil production and exports. Prior to the 2011 uprising, Libya produced around 1.6 million barrels a day now the figure is around one million.

There is even the risk of political turbulence erupting in Saudi Arabia itself, disrupting oil supplies. Crown Prince Mohammed Bin Salman, the de facto Saudi leader, is attempting to modernise his country. On the one hand he has been happy to demonstrate his authority by locking up many of the country's most influential or wealthiest individuals on corruption charges. Yet on the other, he is attempting to gently liberalise the country's harsh social laws. Even modest reforms such as allowing women to drive are controversial in the conservative state. While welcomed by many, they have also resulted in an intense backlash from a fundamentalist faction, says fund manager Niels Jensen, author of The End of Indexing, and Mark Moloney of ARP Investments.

Shale supply could be disappointing

Geopolitical risk is, of course, an ever-present issue in regions where oil is typically found in large quantities. It's hard to think of a time when unrest, war or sanctions haven't been a concern for the oil market. A perhaps more important factor in today's rising prices is that supply might be more constrained than the market currently expects. For the past decade, "US shale oil has accounted for over half of global oil production growth", notes Lees. But this boom seems to be coming to an end, at least for now.

There are three main American shale fields: the Eagle Ford group (in southern Texas), the Bakken formation (in North Dakota and Montana) and the Permian basin (Eastern Texas and New Mexico). Two of these already seem to have peaked, with Eagle Ford production down 20% from its peak, and Bakken flat. Permian still holds out some promise, but suffers from many problems, including poor infrastructure, which has forced some oil companies to resort to transporting oil in trucks rather than pipelines, pushing up production prices.

New pipeline capacity is set to be operational next year, says Butler in the FT, which could bring more oil to the market. Yet on that point, notes Lees, it's also possible to exaggerate the potential of these fields. He notes that companies have had to invest a lot of money in the Permian to keep it growing, and he is sceptical about how much oil is actually recoverable. Even in the most optimistic scenario, production will only grow by 30% over the next five years, which is half the current growth rate.

Lees is also sceptical on shale's potential outside the US, with the possible exception of Argentina. "Companies have spent the last decade searching for shale oil and two decades looking for shale gas, so if there are large shale oil reserves out there, why haven't they been discovered?" This is a particularly pertinent question in the case of China, the world's largest consumer of gas, and the country that should logically be the most eager to take advantage of any reserves.

Jensen and Moloney are even more scathing about shale oil, pointing out that on a cash basis the industry is barely profitable. Indeed, on a total cost basis, which also accounts for the costs of exploration and capital investment, "not a single shale field has actually made money so far". Instead, shale-oil companies have been kept afloat by the floods of cheap debt made possible by our era of ultra-low interest rates. That in turn suggests they are highly vulnerable to rate rises.

Of course, there's always a chance that shale companies find a way to significantly cut costs, or discover a completely new field, thus prolonging the boom. But if shale does disappoint, then conventional sources are unlikely to be available to step into the breach, at least not in the next few years. The major oil companies slashed capital expenditure and exploration during the recent period of low prices, notes Sue Noffke, a fund manager with Schroder's. This has been good for shareholders, she adds, because it has enabled them to sustain their dividend payouts, rather than waste money on uneconomic projects. But it also means that recent production has come from drawing down existing fields rather than finding new ones, resulting in a "large depletion of reserves". This has been particularly significant in offshore oilfields, which tend to be more expensive than onshore ones.

We might see "peak demand" but not soon

Supply is only one half of the oil price equation, of course. The other big fear stalking oil company boardrooms right now is the idea of "peak oil demand". During the boom era, "peak oil" referred to the idea that we'd run out of easily accessible oil resources in the very near future. Now, "peak oil demand" refers to the opposite idea that oil demand will top out. In a recent report, oil consultancy Wood Mackenzie forecast that the peak will come in 2036, driven primarily by a major shift in transport.

Cars and trucks account for roughly 44% of global oil consumption, so two major technological changes the rise of electric vehicles and the advent of self-driving cars will have a huge impact on oil demand. Electric vehicles don't use petrol (ideally, they'll use electricity created from renewable sources), and self-driving cars are newer and thus more fuel-efficient. Wood Mackenzie reckons that as a result of all this, petrol demand will peak in 2030.

It's certainly an issue that oil companies are aware of for example, BP recently bought Chargemaster, which runs a network of UK charging points for electric vehicles for £130m. However, it is also worth remembering that this is a long-run forecast. As Wood Mackenzie acknowledges, in the shorter term, "on the supply side you need a lot more frontier exploration to fill the gaps". And not everyone agrees with the consultancy. Concerns over Silicon Valley's sometimes cavalier approach to regulation and safety issues is a cloud hanging over the future of driverless cars, while the still-high cost of renewables in many regions suggests that mass adoption of electric cars may lie further into the future than we might hope.

For instance, as Richard Hulf of the Artemis Global Energy fund notes, even with the help of government subsidies and mandates, renewable-energy companies "are simply not generating enough returns to be worth considering, and are unlikely to do so in the next five to ten years". Schroder's Noffke is a bit more diplomatic renewables "have a role to play", especially in the future, she says. However, she's also clear that "right now, demand for crude oil is holding up". This is "especially clear in emerging markets and the Far East". So there's room in your portfolio for long-run bets on electric and autonomous vehicle technology but oil is still going to be in demand for at least a decade or more, even on the most optimistic analyses (from an environmental perspective).

Oil still looks a good bet for now

What is worth considering, however, is the "chilling" effect that the threat of oil assets being "stranded" at some point in the future has on exploration plans and on shareholder psychology. Dividend-fixated investors are unlikely to be sympathetic to ambitious expansion plans at a time when headlines are full of the need for "divestment" (whereby big investors get out of fossil-fuel providers). That in turn is likely to prevent over-enthusiastic expansion and in turn increase the risk that supply fails to keep up with demand over the medium term.

Lees reckons that oil prices "could got a lot higher" from here, though he acknowledges that this would change if there is a global recession. Even if you're not that bullish, it does seem very likely that a retreat back to the ultra-cheap levels seen two years ago is not on the cards any time in the near future.

How to profit from a rising oil price

The most direct way to bet on a rise in the price of oil is to do so via spread betting. For example, IG Index allows you to trade both the Brent and WTI oil benchmarks. However, this is highly risky spread betting involves using borrowed money to bet on small moves in the oil price, so even if you're right in the long run, the short-term fluctuations can easily throw you out, while also potentially losing more than your initial deposit. A less dangerous although still relatively short-term way to track the oil price is via ETFS WTI Crude Oil (LSE: CRUD). This exchange-traded fund tracks the price of the most recent WTI futures contract. It has an annual management fee of 0.43%.

Artemis Global Energy is a fund run by Richard Hulf and John Dodd. Despite total fees of just over 1%, it has beaten the market over the past three years and has done particularly well over the last year, beating every other energy fund with a gain of more than 31%. The fund is invested mainly in American, Canadian and British energy companies, and is relatively focused, with the ten largest holdings accounting for 38% of the portfolio. Hulf and Dodd try to identify major trends in the industry, then look at where the big energy-producing hotspots are (and will be in the future), and buy into companies operating in them.

One of Hulf's favourite shares in his fund's portfolio is CNOOC Limited (NYSE: CEO), China's largest producer of offshore crude oil and natural gas, and a subsidiary of the China National Offshore Oil Corporation. As well as its exposure to offshore gas, CNOOC has a large stake in the Stabroek block off the shore of Guyana. Exxon has just announced a series of discoveries in the area, sparking hopes there could be extensive reserves that could significantly boost CNOOC's earnings. It also looks good from a valuation perspective, trading at a relatively modest 9.2 times 2019 earnings.

If you'd prefer the stability of one of the oil majors, then consider Royal Dutch Shell (LSE: RDSB), which looks attractive trading at only 11 times next year's earnings. High expected cashflows should enable Shell to pay down debt as well as start a share buy-back programme, all while continuing to pay its generous dividend (the stock yields around 6.3%). It is also ensuring that it is able to keep expanding, recently re-opening a natural gas field in the North Sea that had previously been considered uneconomic.

If you're willing to take more risk, try Cairn Energy (LSE: CNE). Its North Sea fields (Kraken and Catcher) now produce plenty of crude. Cairn is reinvesting this cashflow in further exploration off the coast of Norway, as well as some higher-risk projects further afield, for instance in Senegal and Mexico. An ongoing dispute with the Indian government over shares received from the sale of an Indian subsidiary continues to drag on. But the fact that it trades at a 25% discount to the value of its net assets make it a serious consideration for investors. It also trades at 11.9 times 2019 earnings.

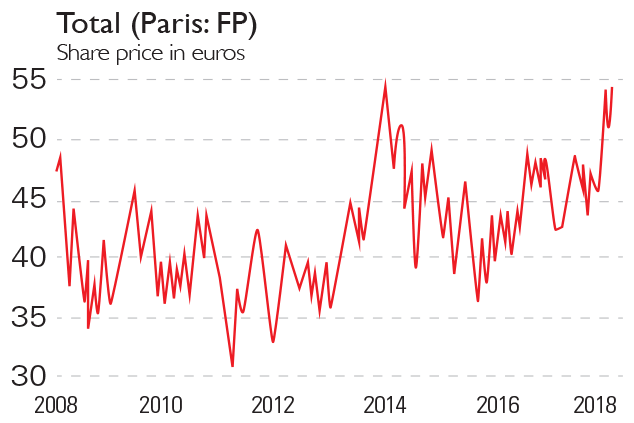

French oil giant Total (Paris: FP) embarked on such an effective cost-cutting spree during the oil bear market that it can now make money with oil at $25 a barrel. With oil at $70, it stands to make a lot of cash, especially as it seems to be on track to bolster overall output by an annual 5% over the next few years a result of new drilling projects in Russia and the Congo, along with further concessions in Libya and acquisitions in the North Sea. Exploration and production account for two-thirds of overall earnings, but the refining business is also gaining momentum now. The upshot is that Total should grow its bottom line by more than 10% to €12bn in 2018. That will help finance investment such as the petrochemicals plant it plans to build with Saudi Arabia's Aramco, as well as dividend rises and share buybacks. Total is also dabbling in green energy. Its recent takeover of Direct Energie, a French electric utility group concentrating on natural gas and renewables, has also given it 2.6 million new customers. It yields 4.6%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Student loans debate: should you fund your child through university?

Student loans debate: should you fund your child through university?Graduates are complaining about their levels of student debt so should wealthy parents be helping them avoid student loans?

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.