The trouble with co-ops

Co-ops have been hailed as a model for a fairer capitalism. But they remain unpopular for a reason, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Over the last decade, John Lewis Partnership has been the poster child for worker-owned businesses. It is one of the most popular chains in the country and has expanded both its department stores and its Waitrose supermarkets rapidly, while paying bonuses to staff and keeping its customers happy. If motherhood and apple pie went into business it would do so under the John Lewis brand.

The engine stalls

Right now, however, its engine has stalled. Last week, the chain announced that profits for the first half of this year would drop to "close to zero", compared with £26m in the first half of last year. The bonus would be cut, and a few Waitrose stores would close. It is the most significant setback the chain has faced in years.

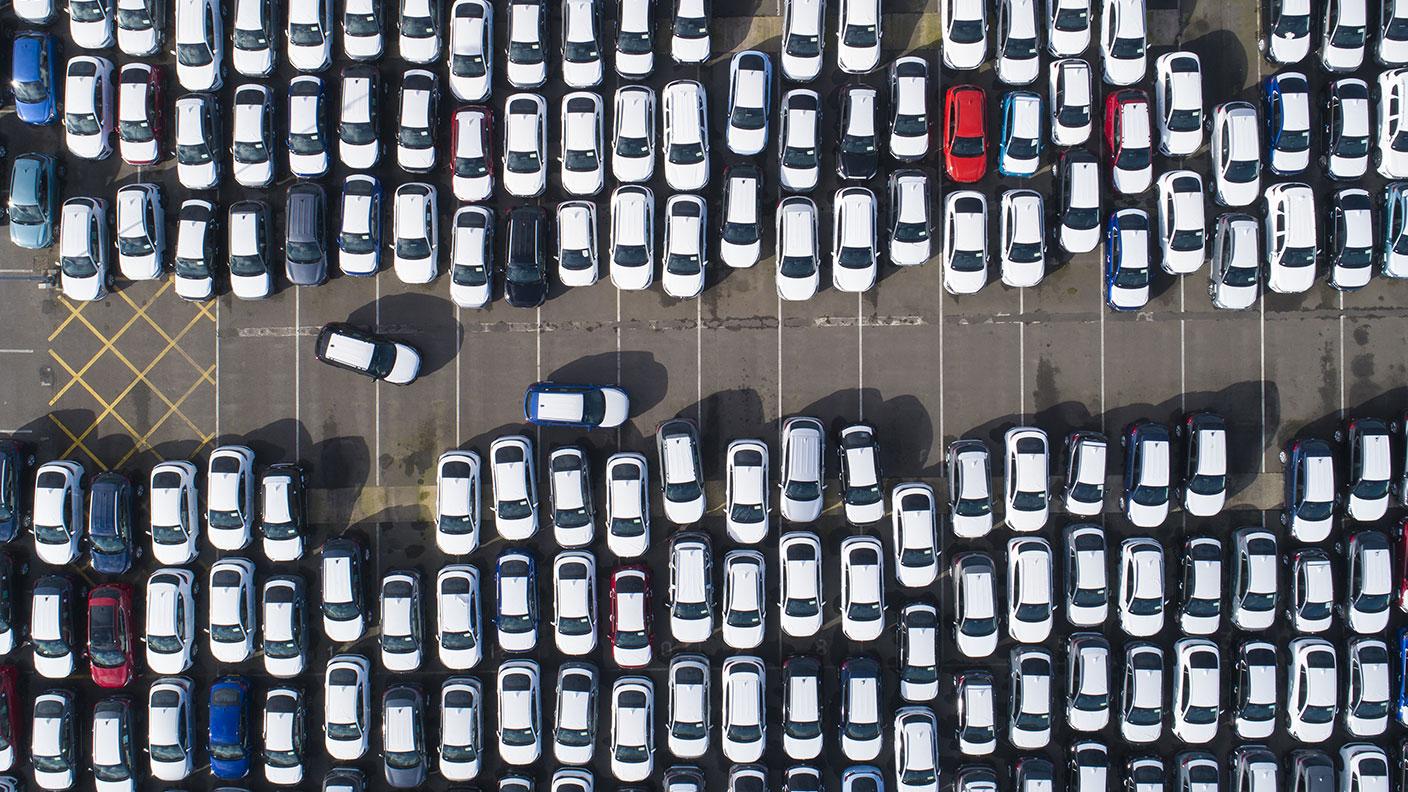

Until this month, John Lewis seemed able to rise effortlessly above the existential crisis that has gripped every other major retailer over the last few years. From its origins as a drapery shop on Oxford Street in the 1860s, it remained primarily a London-based business for much of its history. But in the last 20 years it has pushed relentlessly into new markets, opening 50 shops across the country. Its Waitrose unit has expanded even more aggressively and now has 350 supermarkets.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While just about every other retailer has had to cut back and retrench in the face of rising staff costs, punishing business rates, tepid consumer spending and ferocious competition from the internet, John Lewis seemed able to expand with ease. There was certainly an argument that its co-operative ownership model gave it a competitive edge. The trouble is, that may no longer be true. In fact, the collapse in its profits is about to expose the flaws in the model.

Three challenges for co-ops

There are three big problems that all co-ops or worker-owned businesses face. First, there is no real discipline. It is easy for firms to overexpand and for costs to run out of control. Indeed, that may well be the problem at John Lewis. It kept on opening new stores and revamping old ones even when it was clear that retailing was in decline, and every other department store and supermarket was cutting back on space and retrenching. A limited company might have been a lot more worried about the potential impact on the bottom line, and started trimming the portfolio earlier.

Next, there is no takeover mechanism. If the management starts making the wrong decisions, then it is very difficult to change them. There are no shareholders to put pressure on the board, and there can't be a hostile bid, which is usually the ultimate sanctions for a quoted company. True, the staff can vote the board out of office, so long as a mechanism is in place for doing that. In reality, however, that is hard to do. Who is ever going to want to be the staffer who tries to oust the boss?

Finally, there is the risk that the company ends up being run for the benefit of the staff rather than the customers. Opening hours are limited, prices edge up, and holidays and benefits become more generous. There is no real pressure to perform, and not much incentive to work harder. Of course, partnerships have tremendous loyalty, and that can be a positive, especially in a relatively small business. But once it gets above a certain size, it can just as easily become an excuse for complacency.

For all their supposed virtues, co-ops remain only a tiny part of every major free-market economy. If they were as great as they are sometimes cracked up to be, there would be a lot more of them out there. Most very quickly fall victim to over-expansion, poor management, and staff indifference, and often all three at the same time. John Lewis may be about to teach us that although it can work for a while, ultimately the partnership model is even more flawed than the limited company.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

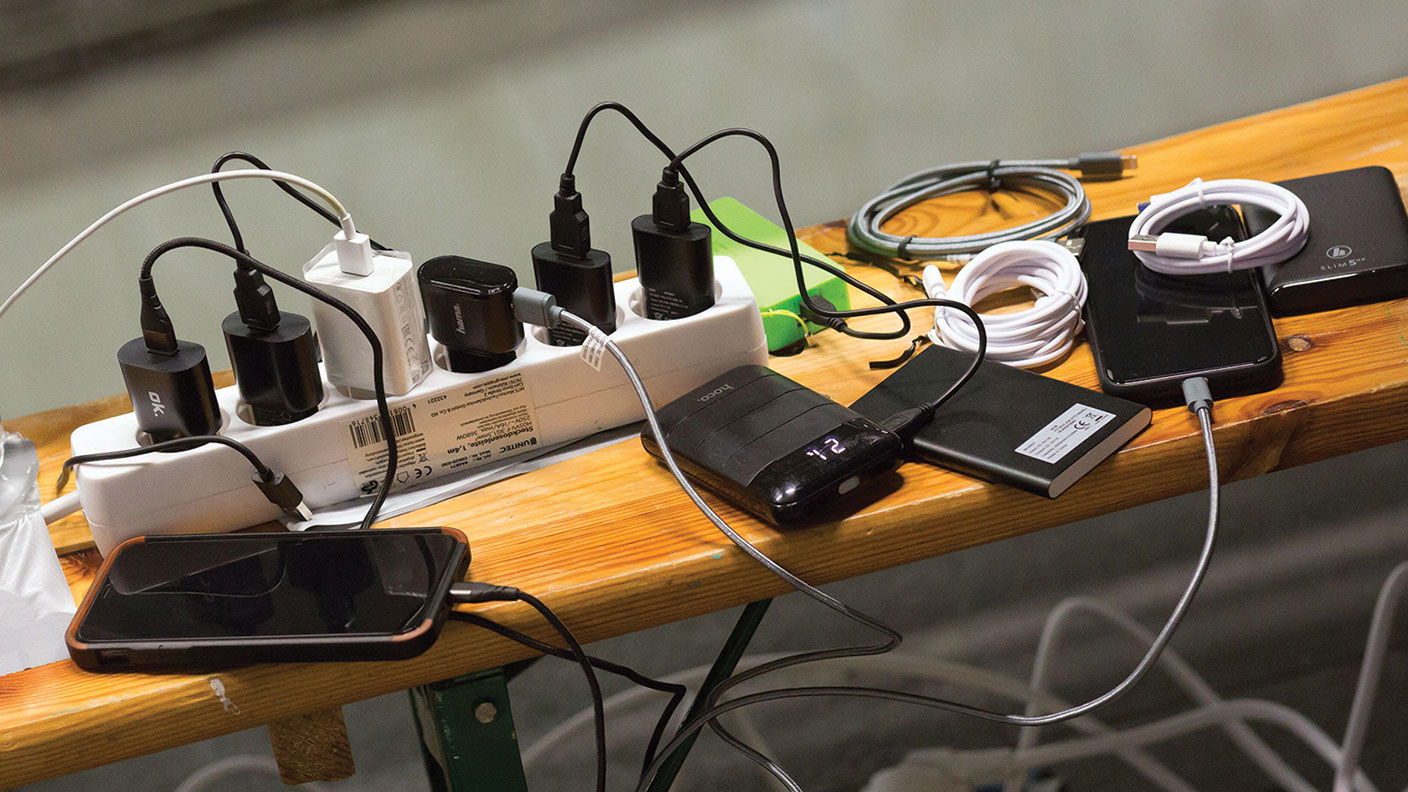

The enshittification of the internet and what it means for us

The enshittification of the internet and what it means for usWhy do transformative digital technologies start out as useful tools but then gradually get worse and worse? There is a reason for it – but is there a way out?

-

The Brussels effect – how the EU is raising standards around the world

The Brussels effect – how the EU is raising standards around the worldBriefings EU standards and consumer protection regulations have a habit of being enforced globally. Why is that? And is it such a bad thing?

-

Quiz of the week 30 January – 5 February

Quiz of the week 30 January – 5 FebruaryFeatures Tesla chief Elon Musk tweeted messages in support of an obscure cryptocurrency this week, sending its price soaring. But which one? And what else happened this week? Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

-

Quiz of the week 16-22 January

Quiz of the week 16-22 JanuaryFeatures A Japanese car-maker announced plans to continue its UK operation, safeguarding 6,000 British jobs. But which one? And what else happened this week? Test your recollection of the events of the last seven days with MoneyWeek's quiz of the week.

-

Margrethe Vestager: a symbol of all that’s wrong with the EU

Margrethe Vestager: a symbol of all that’s wrong with the EUOpinion Margrethe Vestager, the EU’s competition commissioner, wields enormous power over industry, and abuses it, says Matthew Lynn.

-

29 June 2007: Apple’s iPhone goes on sale for the first time

29 June 2007: Apple’s iPhone goes on sale for the first timeFeatures On this day in 2007, Apple's iPhone went on sale for the first time, revolutionising the mobile phone market.