Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

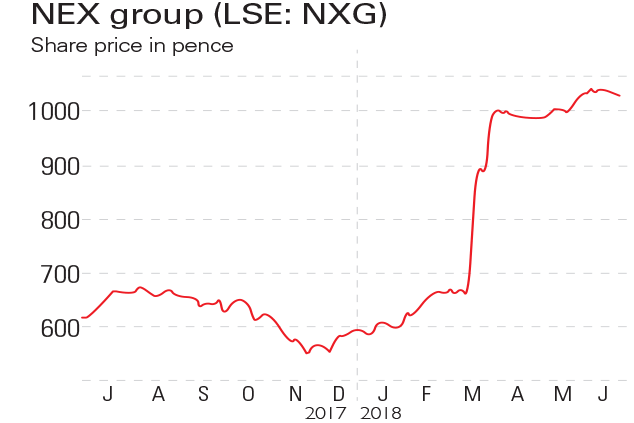

NEX Group (LSE: NXG), previously known as ICAP, runs a stock exchange for small and medium-sized companies, as well as financial systems to execute and settle forex and fixed-income trades. Its headquarters are in London, but it also has operations in Tel Aviv. The 2017-18 financial year saw revenue rise by 9%, while profits slipped by 3%. In March this year it agreed to a takeover bid from US exchange operator CME Group, which triggered a jump in the share price of more than 30%. In the past six months shareholders have been rewarded with a 70% rise in the stock.

Be glad you didn't buy...

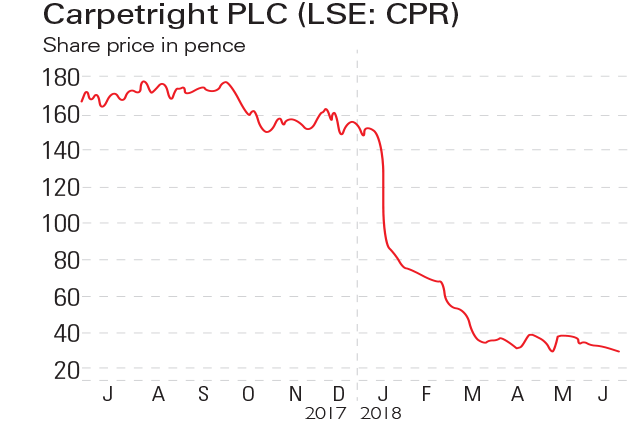

Carpetright (LSE: CPG) , which was once considered a bellwether for the UK property market, has seen its fortunes shift dramatically in recent months as high rents and too many stores have taken their toll. In what it admits was a "very difficult year" the company slumped to a loss of £70m, down froma profit of £900,000 in the previous year. In April, it entered into a company voluntary agreement to stave off insolvency, closing 92 stores and renegotiating rents on the remainder. The share price has collapsed, sliding by more than 80% in the last six months.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

A hat-trick of terrible results

A hat-trick of terrible resultsFeatures Dignity, Carpetright and Bonmarché all saw their shares fall by more than 25% last week. Alice Gråhns reports.

-

If you’d invested in: DP Poland and Carpetright

If you’d invested in: DP Poland and CarpetrightFeatures Pizza sellers DP Poland made a loss of £2.2m last year, after losing £3.6m in 2014 and £3.3m in 2013. But that hasn’t deterred investors.