A hat-trick of terrible results

Dignity, Carpetright and Bonmarché all saw their shares fall by more than 25% last week. Alice Gråhns reports.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Dignity, Carpetright and Bonmarch all saw their shares fall by more than 25% last week. Alice Grhns reports.

A triple whammy of bad news saw shares in Dignity, Carpetright and Bonmarch crash last week. FTSE 250 member Dignity, Britain's largest listed funeral provider, saw its shares half in value as it issued what was, in effect, a profit warning, warning that aggressive competition had forced it to cut the price of simple funerals by around a quarter. Meanwhile, shares in flooring specialist Carpetright collapsed by 48% after it described its shops as "very, very quiet" and said its profits would all but disappear this year. And Bonmarch, a fashion retailer for the older shopper, sank 28% as it reported dismal Christmas sales.

Dignity's fall could be seen as "a memento mori for stockmarket bulls", says Lex in the Financial Times. Yet it's hard to read across to the wider market "the group's ills look self-inflicted". The firm blames its woes on price-conscious customers and an oversupplied industry, but neither is new. Instead, what has changed is the willingness of customers to pay more than £3,000 for a funeral.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Ageing baby-boomers are demanding better service from the industry the trend now is "less about sending a loved one's ashes into space or becoming part of a coral reef, and more about using online information to clarify funeral pricing". Dignity's decade-long business plan of buying up small, family-run funeral directors and then raising prices by an estimated 5%-6% a year is also coming under pressure. Now that customers have better access to data on rivals' prices, Dignity's strategy "has been dealt a mortal blow".

While Dignity's problems might be unique to the company, the difficulties faced by UK-focused retailers such as Carpetright and Bonmarch "are not particularly surprising", says Peter Stephens in the Motley Fool.

With inflation remaining stubbornly high, biting into the "real" value of UK consumers' income, things could go from bad to worse for Carpetright this year. The retailer's trading during the key Christmas period was significantly worse than expected like-for-like sales in the UK fell by 3.6% in the 11 weeks to mid-January. The firm now expects profit to come in between £2m and £6m for the year, but "it would be unsurprising for this figure to be revised downwards".

Bonmarch blamed the weather for its trading woes, notes fastFT. Sales fell by 5.5% in the 13 weeks to the end of December, which suggests a slump in demand in recent months (sales rose 0.9% in the 39 weeks to end-December). The only bright spot is online shopping, where sales jumped 35.5% over the 39 week period, says Shares.

City talk

"The takeover battle between Melrose and GKN is already shaping up to be one of the feistiest the City has seen for some time," says Ben Marlow in The Daily Telegraph. Michael Turner, chairman of engineer GKN, is a veteran of such battles. After rejecting Melrose's bid, GKN has proposed splitting the group into two separate businesses. But the turnaround specialist could prove a tough opponent.

Chairman Christopher Miller was trained by the late James Hanson, "Britain's original corporate raider". And Melrose has a great track record, having "reinvigorated almost all the firms it has acquired making billions for investors along the way".

James Flude of Accrol, the toilet-roll maker, is off. "And all after the finance chief played such a key role' in its successful initial public offering'," says Alistair Osborne in The Times. Accrol floated at 100p in June 2016. "It proved such a success the shares were suspended for six weeks last October, while Accrol raised an emergency £18m at 50p." The latest half-year figures show £6m in losses.

One can't just blame Flude: the farrago has also cost ex-boss Steve Crossley his job. But "it would be nice if the new one, Gareth Jenkins, stopped calling the IPO a success unless he means at flushing investors' money away".

If The Sunday Times is correct in expecting the culture secretary, Matthew Hancock, to cut maximum stakes on fixed-odds betting terminals (FOBTs) from £100 to £2, "the bookies will take a drubbing" says The Guardian's Nils Pratley. Jim Mullen, CEO of Ladbrokes, said a cut would hurt jobs and tax revenues. But "none of those pleas is persuasive when set against the evidence on the other side of the ledger that bookmakers have been shockingly poor at policing problem gambling and FOBT addiction".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club

-

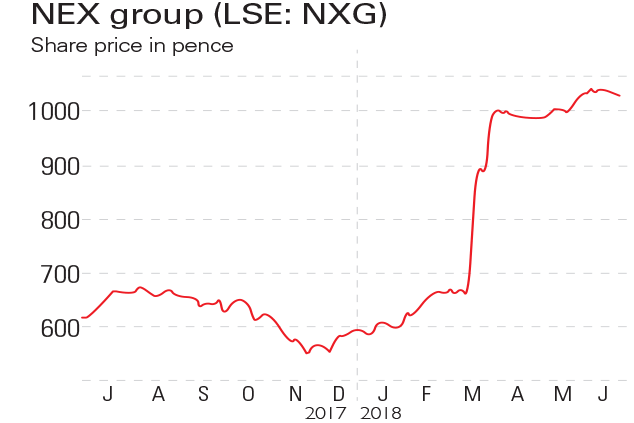

If you'd invested in: NEX Group and Carpetright

If you'd invested in: NEX Group and CarpetrightFeatures London based stock exchange NEX Group saw a 70% rise in it share price, and is to be acquired by US exchange operator CME Group. But things are going wrong for flooring retailer Carpetright.

-

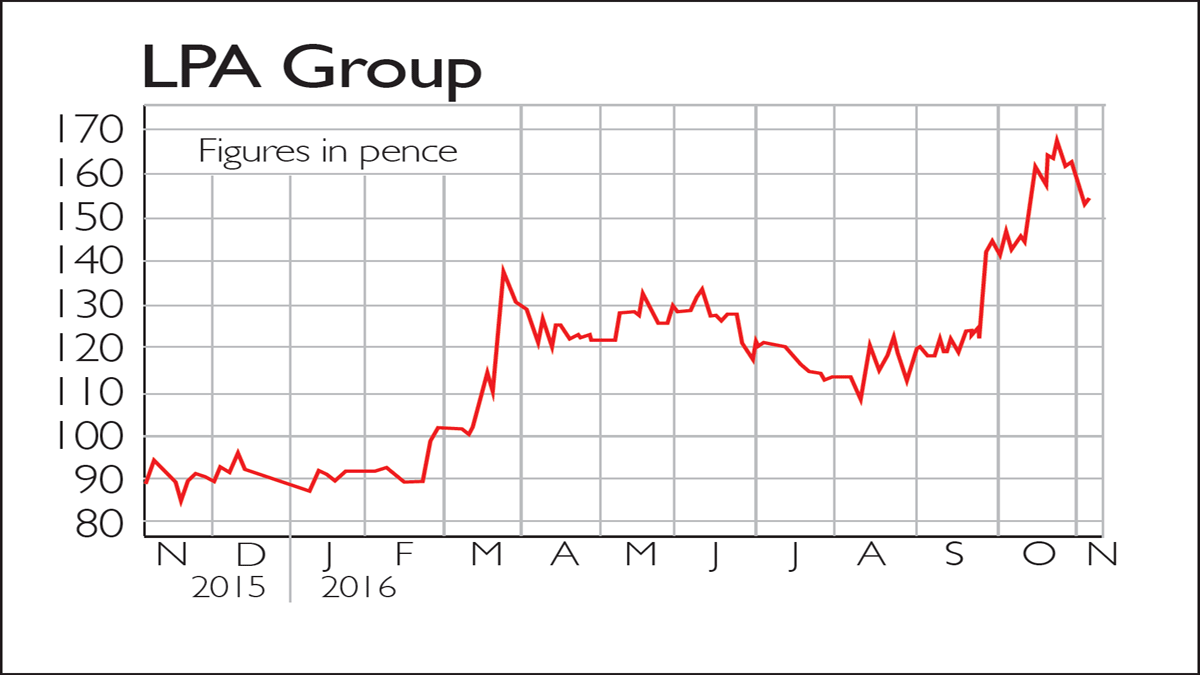

If you'd invested in: LPA Group and Bonmarché

If you'd invested in: LPA Group and BonmarchéFeatures LPA Group designs and manufactures LED lighting systems, while Bonmarché sells clothes and accessories to mature women.

-

If you’d invested in: DP Poland and Carpetright

If you’d invested in: DP Poland and CarpetrightFeatures Pizza sellers DP Poland made a loss of £2.2m last year, after losing £3.6m in 2014 and £3.3m in 2013. But that hasn’t deterred investors.