Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only...

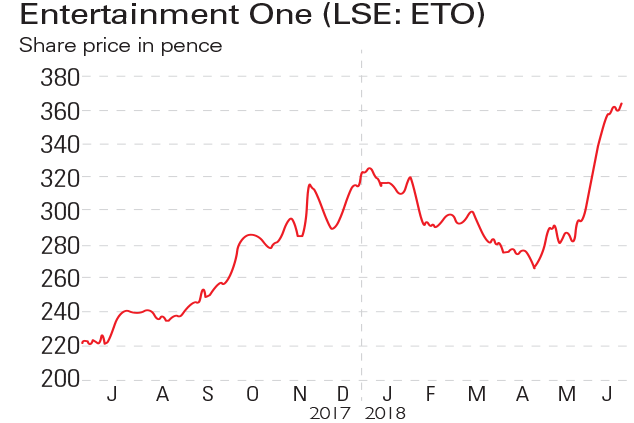

Entertainment One (LSE: ETO) is a Toronto-based entertainment production and distribution company, whose products include the phenomenally successful children's TV series Peppa Pig. This remains the company's most valuable asset, and, along with fellow children's favourite PJ Masks, drove the bulk of the firm's profit growth in the year to the end of March. Revenue fell slightly to £1.05bn after the film division underperformed, but higher margins and cost savings meant profits more than doubled from £35.9m in 2016/2017 to £77.6m this year.

Be glad you didn't buy...

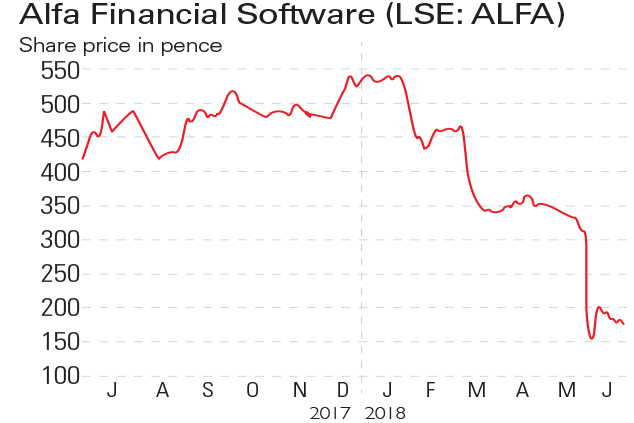

Alfa Financial Software (LSE: ALFA) provides systems software to the motor finance industry and other asset financing businesses. When it floated on the London Stock Exchange in May last year it was the UK's biggest public offering of the year; demand for shares was so great that a third of those who wanted in were unable to buy. However, the company's first post-listing results in March missed expectations, and when delays to major projects led to a profit warning in June, the share price plunged by 40%. It has now fallen by more than 50% in the last 12 months.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Why do experts think emerging markets will outperform?

Why do experts think emerging markets will outperform?Emerging markets were one of the top-performing themes of 2025, but they could have further to run as global investors diversify