Shield your portfolio from the monetary singularity

Quantitative easing has inflated property, share and bond markets alike. The end of this great monetary experiment threatens to blow black holes in balance sheets everywhere, warns Jonathan Compton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For sleepless investors out there, notable cures for insomnia include a bedtime flick through the minutes of America's Federal Open Market Committee. Alternatively, there's always the bestselling book A Brief History of Time, by theoretical physicist Stephen Hawking allegedly fewer than a quarter of the ten million buyers of this actually read it all the way to the end. Yet vigilant investors might want to have a crack at staying awake through both because right now a black hole is opening up in the global financial system whose gravitational effects are sure to suck money from equities, house prices and other asset markets.

A little more than ten years ago the global financial system came perilously close to collapse after years of incompetence, stupidity and greed by banks, governments and the public. In desperation, the Federal Reserve (America's central bank) found a solution that had been used on a limited scale in previous downturns, and aggressively in Japan between 2001 and 2006 with mixed results. This solution was quantitative easing, or QE. Despite vigorous opposition from politicians on both left and right, as well as most economists, it was introduced on a giant scale, then expanded further. Similar measures were adopted by the Bank of England (BoE) and later by the European Central Bank (ECB), while it was also reintroduced in Japan. The result was that financial Armageddon was at least postponed.

Printing money to save the world

The mechanics of QE seem abstruse, but in essence are simple. The banks and many other financial institutions were about to go bust, with bad debts up to their nostrils and no reserves. Thus they were being forced to sell anything not nailed down and to call in loans to customers or each other a classic financial death spiral. QE allowed the central banks to create electronic money. At first this was used to buy government bonds at above market prices from financial institutions, then later to buy corporate bonds and other assets. In extreme cases such as UK high-street bank RBS, or Bank of America in the US, money was pumped in via loans or equity to ensure they could remain in business.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The ECB was even more extreme restrained from acting more transparently by the tricky politics of the eurozone, it went so far as to guarantee a risk-free profit for eurozone banks. It lent them money at almost zero interest to buy eurozone bonds with a much higher yield from the ECB. As a result, interest rates were forced down to record low levels. This means that those who were overborrowed could continue to pay their debts, while financial institutions eventually stopped calling in loans and began to lend more (although the banking systems in the US, and to a lesser extent the UK, remain healthier than that of the eurozone), which helped to encourage investment and create employment, leading to economic growth and higher tax receipts.

The forecasters were once again wrong-footed. Economic dogma said that massive money printing must cause inflation to soar. The reverse happened indeed, the global economy has only just started to edge away from the deflationary abyss. Another accepted fact was that confidence would collapse (instead, it rose) and that economic growth would accelerate (as inflation took off). This latter is the most interesting across countries that engaged in QE, growth did indeed sputter slightly higher for most of the ensuing decade, but only at a great cost. For every dollar or equivalent currency borrowed, there was only about 40 cents of growth. Borrowing 100 to get back 40 is bad maths (and unsustainable to boot).

The silence of the presses

In all, it was an impressive three-card trick. In practice these central banks took truckloads of bad debts out of the system and onto their own books; hence the Bank of England's "balance sheet" (I've used inverted commas here because it doesn't add up in reality) has increased in size by almost fivefold since 2008 to £490bn, and that of the Fed from $825bn to $4.4trn.

All this changes this year. Central banks and their political masters have decided this unique experiment must stop. As a result, the Fed, the ECB and the BoE have announced the end of their buying programmes. In the case of the Fed which ended QE a while ago (see box on the left) it will also start to sell off its vast bond portfolio. There are several reasons behind this attempt to return to "normality". One is a fear that overall debt-to-GDP ratios are still recklessly high: 108% in America and 225% in Japan, for example.

Another reason is that budget deficits (annual government overspending) remain stubbornly large in many countries and the addiction to all-but free money can only result in economic cold turkeylater. Furthermore, record low interest rates have caused dangerous bubbles in house prices and equity markets. Worse still, perhaps, is the significant deterioration in the "quality" of corporate borrowing that we've also seen. More than 40% of the world's corporate bonds are now rated BBB (only a smidgeon above the grade at which they become aptly named junk bonds). That's three times the proportion seen just five years ago. Elsewhere there has been an explosion in the level of corporate debt in emerging markets, often mismatched ie, borrowing in a foreign currency but funded locally. This formula usually ends in tears (as Turkey and Argentina have just rediscovered).

A major political problem is that there is clear evidence that an unintended consequence of QE has been to make the wealthier considerably better off (by boosting asset prices after all, it's the wealthy who own the most assets), while doing little for lower-income earners. That's ballot-box suicide, and one reason behind the numerous political "surprises" we've seen in recent years. But perhaps the greatest concern for central banks is that continuous QE and ultra-low interest rates mean there is no cushion against the next cyclical downturn.

Sucking money from the system

The end of QE leaves a chasm-wide funding gap (ie, the amount of money the government needs to borrow to bridge the hole between what it spends and what it raises in taxes). Over the past two years central banks have absorbed more than all the government bonds issued by the world's ten richest countries. Now they will only be buying around 40% of those. So who is going to fund the difference? Usually it would come from a combination of domestic savings and countries with excess foreign-exchange reserves.

Yet in most advanced nations savings rates are close to, or at, 20-year lows, while institutional cash levels are also slim, reflecting dangerously bullish expectations that equity and bond prices will rise forever. The two Asian nations that have historically funded a large part of Western lifestyles are less able to do so. China's reserves are down by nearly a trillion dollars from the 2014 peak; Japan's are close to record highs but its budget deficit remains excessive.

The key determinant to what happens is, as usual, America. The new Fed chairman, Jerome Powell, and Congress are not just ending QE, but are also keen to sell off their holdings of US Treasury bills, even while the supply of new bills to fund the government continues to rise. Long ago America ran out of sufficient domestic savings, so had to entice foreigners to fund its deficits and it will do so again. But to attract foreign buyers, interest rates need to be higher than those offered on other major currencies, which indeed they are. Combined with tighter monetary conditions the dollar should strengthen, making funding America's debt even more attractive to overseas investors. But other countries also need to fund their government expenditure and deficits. They in turn must react by raising domestic rates higher than would otherwise be necessary.

Expect lower returns

Monetary policy generally attracts little attention from the wider public and many of its consequences are unforeseeable. Yet we are about to witness the end of the greatest monetary experiment ever devised, at a time when the level of total world debt-to-GDP is the highest in history. QE ended one crisis, but also turbocharged stockmarkets and enabled firms globally and in emerging markets especially to bloat out on cheap, often mismatched debt.

Meanwhile many of us have relished ever-higher property and asset prices. Only an extreme optimist would believe that, given its positive impact on the way up, a reversal of QE will leave markets entirely unscathed. The only question is whether the black hole causes a mild downturn or full-blown recession. The "good" news is that the correlation between growth and index returns is weak, so slower growth is not necessarily a cause for alarm. But stockmarket history does provide a playbook for the probable outcomes, all of which suggest that future returns will be much lower than those we've enjoyed recently. We look at how best to insulate your portfolio below.

Insulate your portfolio as QE ends

Voodoo is slightly more rational than efforts to forecast exchange rates, but that said, I am convinced that the dollar will continue to strengthen. When this happens, along with rising US interest rates and tighter money, there is one sure-fire consequence: the wheels rapidly come off emerging markets. There are a legion of differences between individual emerging markets, of that there is no doubt and yet, even those that have managed their finances prudently are always dragged down inthese circumstances, partly because foreign investors from developed nations pull money out to invest at home. This time will be no different.

Many emerging markets learned their lessons at the government level in the 1997 crash, so the extent of overborrowing externally or foreign debt-to-GDP is much lower. (When Argentina went cap in hand again to the International Monetary Fund earlier this month, foreign debt-to-GDP was close to a 20-year low at 35% of GDP, for example.) Yet emerging-market companies have gorged on cheap foreign debt to an unprecedented extent. Many will be forced to default, creating a downward spiral and cross-country contamination, followed by some panic in Europe whose banks unlike those in America are once again horribly overexposed to this unpayable corporate debt.

Another historic certainty is that every time the Fed has tightened since World War II, the multiple (price/earnings ratio) on the market has contracted. Thus, for indices to continue their merry rise, profits and earnings growth has to rise dramatically. Given that corporate profits as a percentage of GDP are already close to record highs and have been rising for a decade, this is a high hurdle.

Then there is the "zombie problem": those companies in developed markets that in normal conditions (ie, pre-QE) would have expired long ago but continue to stagger on only because rates are low. As rates rise, the zombies die. You can see examples of zombie businesses on every high street in the country.

So should investors simply sell up and head for the hills? No. Timing markets is a mug's game and the downturn may be much less extensive than I fear. Moreover, whatever central banks may say, they too panic when markets fall fast. So any slide may be countered with interest-rate cuts and looser monetary policy a postponement, not a cure. Also, the tight correlations between markets should loosen as monetary policy tightens (ie, they should stop moving in lockstep as "risk-on, risk-off" investing dies out.

One macro winner is likely to be Japan: a stronger dollar means a weaker yen and a higher stockmarket. Here, the Baillie Gifford Shin Nippon (LSE: BGS) investment trust's managers continue to do an outstanding job (full disclosure: MoneyWeek editor-in-chief Merryn Somerset Webb is a non-executive director of this trust). If my view on a strong dollar is correct, then maintaining US exposure seems sensible. Here the JP Morgan US Smaller Companies (LSE: JUSC) trust has continued to deliver, with a five-year annualised return of 20%. In the UK a good place to "hide" is the Finsbury Growth & Income Trust (LSE: FGT). While I am not a big fan of income funds, as too often they sacrifice capital for income, this trust has a terrific consistency and has delivered a 300% return over the last ten years.

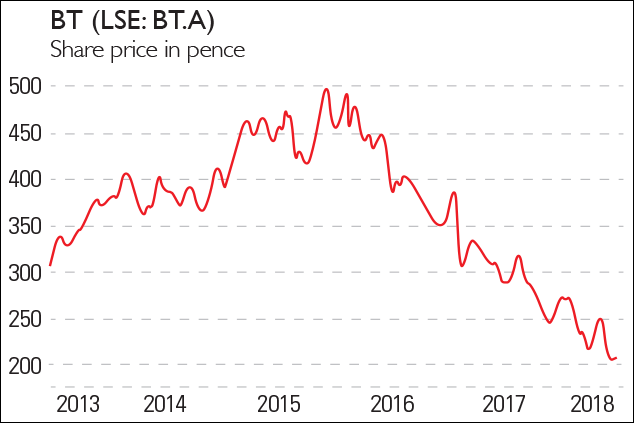

Utilities often perform better in less confident times and I have a hunch that there's an opportunity in one of the least favoured BT Group (LSE: BT.A) which has rightly been excoriated by shareholders and the financial press for poor performance by its recently defenestrated and over-coiffured chief executive. Since the autumn of 2015 the share price has fallen from £4.70 to £2.07, but cost-cutting and rationalisation have commenced. My trigger point to buy will be when its currently unaffordable dividend is cut.

Finally, there's the warfare giant BAE Systems (LSE: BA), which I have recommended before and continue to own. The defence sector tends to be contra-cyclical (it goes up when other stuff goes down); government defence spending in America its largest market is rising; and the 3.7% dividend yield is useful.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Jonathan Compton was MD at Bedlam Asset Management and has spent 30 years in fund management, stockbroking and corporate finance.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.