It’s only a matter of time before this hated metal makes a comeback

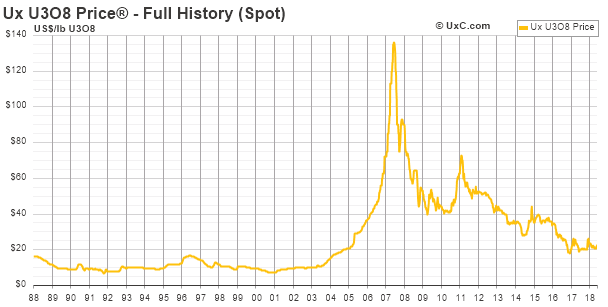

Having hit an all-time high in 2007, the price of uranium has fallen every year since. But it’s time will come again, says Dominic Frisby, Here’s how to play it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In 2007, uranium was the bitcoin of its day.

Penny stocks turned into billion-dollar companies as the world rushed to invest in what seemed to be the only solution to a looming energy crisis.

Then, in 2007, the bubble burst. The uranium price has fallen every year since. Most of the companies that sprung up no longer exist. Uranium became loathed by almost all and sundry.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But I see that a new uranium investment vehicle, Yellow Cake, is listing on AIM next month with plans to raise $160m at IPO (initial public offering).

Does this mean the uranium game is back on?

The rise and fall of the nuclear metal

Uranium is deeply cyclical. We think of the 2007 high at $137 per pound as the all-time high. Yet, adjusted for inflation, the highs of the late 1970s-to-early 80s weren't very far off that level.

There were many parallels between the two periods the 2000s and the 1970s not least soaring oil and commodity price inflation alongside a strong narrative that investment was needed in other energy sources if we were to maintain our current lifestyles. In the 1970s, the nuclear arms race also added significantly to the buying.

The narrative changed in the 1980s. Hydroelectric dams meant there were alternative power sources and that dampened demand. Numerous environmental and safety concerns over nuclear power plants emerged.

Shifting geopolitics meant that demand in weaponry disappeared indeed, Russia began selling off its holdings. What was seen as a solution became loathed, and so we got an extraordinary bear market that lasted 20 years or more.

The bear market led to a considerable supply deficit. Nobody invested. The stage was set for the bubble of 2007. Although the spot price of uranium went from $10 a pound in 2003 to $137 in 2007, it was the exploration companies that made investors fortunes (well, some investors).

I know of one company that went from 5c a share to over $15. And such extraordinary gains were not uncommon. Many companies multi-bagged simply by changing their name and making sure the word "uranium" was in there.

The investment world could not get enough. Hundreds of new companies started up to meet this new "need". I remember joking with friends at the time that I was going to stake Wandsworth Common's uranium rights (small traces of the metal can be found almost anywhere, though they are a million miles from being economically viable deposits) and form Wandsworth Uranium Corp.

Stupid though the idea is, the insanity around uranium was such that it almost seemed vaguely plausible.

Accompanying the bubble was a strong narrative. Just as bitcoin is deemed the solution to the world's financial problems, so uranium was the solution to energy: "Oil is running out, coal is too dirty, alternative energy is bogus uranium is the silver bullet."

Then the bubble popped. By the time the Fukushima disaster struck in 2011, the "peak oil" narrative had disappeared. Thanks to fracking and other new technologies, North American production of oil and gas was surging and the uranium price was already in freefall.

But the Japanese disaster really did for uranium. It changed public attitudes drastically. Germany went as far as to phase it out completely as a power source. Uranium as it has been in previous decades became loathed once again.

Today, ten years later, the price of uranium is still falling. We are not quite back at the deeply oversold levels of the 1990s, when uranium sank beneath $10 (although, adjusted for inflation, we are). Today, uranium sits just above $20. You can almost count the number of operating uranium companies on the fingers of two hands. Investment has dried up.

The cycle will turn once more for uranium but when?

So I was interested to read that a new uranium investment vehicle is to list on AIM next month. It goes by the name of Yellow Cake and it is planning to raise $160m at IPO. It will make its money by stockpiling the metal and waiting for its price to appreciate. It also plans commodity streaming and royalty deals.

Kazakhstan is one of the world's largest and lowest-cost uranium producers and Yellow Cake has managed to secure a supply contract with Kazakh miner Kazatomprom, to acquire somewhere around $170m worth at around $21 a pound, which is about 8% lower than the current spot price of $23.

To put that number into some perspective, $170m worth of uranium is about 25% of Kazatomprom's annual production, and is 5% of 2016 global marketed production.

Yellow Cake has also made a deal with the Canadian firm Uranium Royalty Corporation, which operates a similar model. URC has agreed to buy $25m of stock in the IPO, and to help Yellowcake identify new sources of supply in exchange for royalty and streaming deals.

Investment boutique Bacchus Capital, led by Peter Bacchus, is behind Yellow Cake.I don't know Bacchus, but his CV suggests he is no mug when it comes to commodities: global head of mining and metals at Morgan Stanley and European head of investment banking at Jefferies; head of industrials and natural resources investment banking at Citigroup; adviser to numerous mining giants, including Rio Tinto, First Quantum, MinMetals and Fortesque; 25 years in natural resources.

The bet makes sense. Uranium is "structurally mispriced" he says, and I tend to agree. Put simply, most uranium companies cannot get it out of the ground at current prices.

Indeed, late last year, the world's largest publicly-traded producer, Cameco, suspended operations at its flagship McArthur River mine in northern Saskatchewan, while Kazatomprom itself announced three-year cuts of around 20%. Supply is falling, in other words.

Uranium spot prices tend to be rather slow to react, but while they remain in the the low $20 area, there is going to be very little incentive to increase production or open up new mines. Higher prices are inevitable, eventually. There's the key word "eventually". What we all want to know is, "when?"

I have to say, I rather suspect this is a case of next year rather than tomorrow. Perceptions need to change, and that takes time. For investors, the memory of everything that was lost post-2007 still lingers. Bubbles take years to unwind.

For the broader public, there is still the issue of whether it is ready and willing to accept nuclear power as an option. Higher energy costs will make the public more amenable, but we are not there yet.

That said, money invested in uranium now with a five- or even ten-year investment horizon will, I'm confident, pay off. That's why it makes great sense for Yellow Cake to be doing what it is doing. It is positioning itself for the inevitable change in sentiment. It is giving itself what will be a first-mover advantage. Fortune favours the prepared, as they say.

Uranium may or may not be quite ready to take off, but it will. It makes sense to book your place on the plane before the rush. And not only will you be on board, you'll be able to think more clearly about when to get off.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets