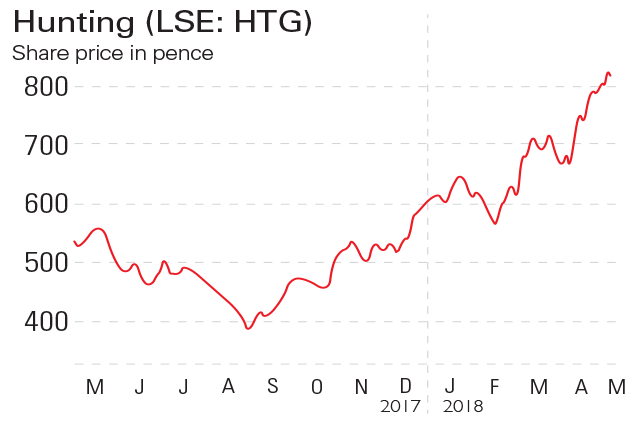

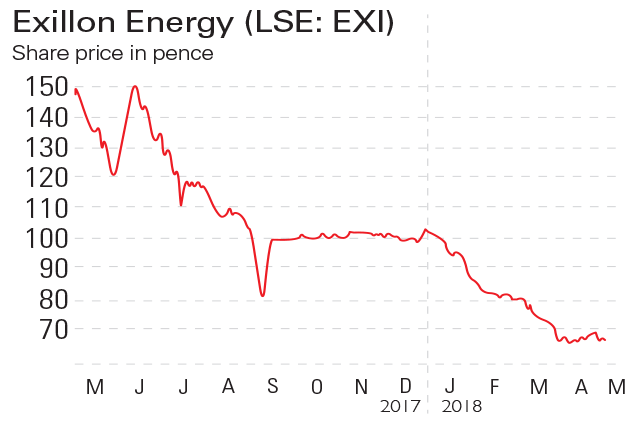

If you'd invested in: Hunting and Exillon Energy

Energy services provider Hunting is growing revenues, while oil explorer Exillon continues to struggle.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Hunting (LSE: HTG) is an energy services provider to upstream oil and gas firms. It has benefited from the increasing oil price following a three-year downturn. Revenues increased by 59% to $722.9m in 2017, compared with $455.8m in 2016. This led to an underlying profit before tax of $10.9m, compared with a loss of $93.2m in 2016. In April, Hunting said revenues in the first three months of the year had been growing at a similarly strong monthly rate to that enjoyed in the fourth quarter of last year, while activity levels in North America remained strong.

Be glad you didn't buy...

Exillon Energy (LSE: EXI) is an oil exploration and production firm with assets in two regions of northern Russia. The firm struggled during the oil-price downturn, but reported increasing revenues for 2017 to $136.8m from $127m in 2016 thanks to the increasing oil price. Earnings before interest, tax, depreciation and amortisation rose by 14% from $70.8m to $80.5m, with a net profit of $47.6m, compared with $40.5m in 2016. This was offset by a drop in production, which decreased by 23% from five million in 2016 to 3.9 million barrels.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now