Some thoughts on the bitcoin bubble and when it will burst

Some observers believe bitcoin is a world-changing technology. Others that it’s a speculative mania which won’t end well. Here, Dominic Frisby weighs the pros and cons of the controversial cryptocurrency.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today we consider bitcoin.

I hope my opinion on these pages has been pretty clear.

On the one hand it is a breakthrough technology with world-changing potential. It is that big.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the other, it's a speculative mania. And speculative manias do not end well.

So where does that leave us?

Nocoiners should cover their ears at this point

The problem I have with most "bitcoin is a bubble" arguments, is that most of the people making the arguments are uninformed.

Either they have never used the technology; or they don't understand the difference between cash and money; or they can't see the inherent problems with debt-based fiat currency; or they don't get the value of a deflationary system of money in limited supply; or they can't envisage the colossal power of decentralisation; or they can't see the immense implications of a technology whereby value can be sent anywhere there is internet access, across borders, at low cost, with no middlemen involved.

Usually, it's a bit of everything.

"It's a scam, it'll never work, it'll be regulated out of existence, it'll be shut down, I don't understand it, it's not backed by anything, why do we even need it?, you're not going to ever buy your groceries with it, it's only used for illegal transactions" and so on.

All these arguments are so easily dismantled that they carry very little water, as far as I'm concerned.

In its typically subversive way, someone in the bitcoin community has now come up with a word to describe such people: "nocoiner".

According to Urban Dictionary, a nocoiner is "a person who has no bitcoin. Nocoiners (usually socialists, lawyers or MBA economists) are people who missed their opportunity to buy bitcoin at a low price" and "are now bitter at having missed out".

Urban Dictionary continues: "The nocoiner takes out his or her bitterness on bitcoin hodlers [the misspelling is deliberate], by constantly claiming that bitcoin will crash, is a scam, is a bubble, or other types of easily-refuted FUD [fear, uncertainty and doubt].

"Nocoiners have little to no computer skills or imagination; even when they see the price of bitcoin go up and its adoption spread, they consider all bitcoin users to be in a collective delusion, with only themselves as the ones who can see what is happening."

This definition is bound to wind up anyone who doesn't own bitcoin, because it hits a nerve. Anyone who doesn't own bitcoin has missed out on the greatest money-making opportunity any of us will ever see in our lifetimes.

The longer they've known about it, the more it hurts that they're not super rich. The price has proved them wrong. The easy way out is to dismiss it as a bubble.

And it is a bubble! But at the same time, there has been a bubble of people who don't get it saying that bitcoin is a bubble and that has made me think bitcoin has further to go.

The genuinely decent and troubling arguments against bitcoin

However, over the last few weeks I have stumbled across two or three very well reasoned critiques of bitcoin, which go far beyond nocoiner hot air. To my mind at least, the case for bitcoin is not quite as strong as it was.

The limited supply argument is undermined by the proliferation of "forks", "altcoins" and ICOs (initial coin offerings). The "cash for the internet" and micropayments arguments are undermined by the long transaction times and high costs of transactions. The decentralisation arguments are undermined by infighting among the core developers. The "breakthrough technology" argument is undermined by the inability of the network to handle the growth in volume.

As a disillusioned gold bug, I'm not so sure that fiat money is as doomed as I once thought it was.

The other uses for blockchain technology smart contracts; distributed storage, computing and messaging; authenticity verification; stock issuance; voting are also running into their own challenges. For all the euphoria, a lot of investment, innovation and development is needed before blockchain tech actually usurps existing systems.

It will happen. But not tomorrow. Time, money and a lot of hard work are needed first.

It's like the gold has just been discovered. Everyone has got very excited. Now reality is starting to set in about just how much equipment, investment, manpower and perhaps above all time is needed, before we can actually start pouring the gold.

Even the libertarian arguments are challenged by the argument that users may actually need some protection. When the proliferation of ICO scams are revealed as such, and investors lose their capital; when rookies have their coins stolen; when prices start falling and gains become losses many may not feel quite so strongly about their high libertarian ideals as they once did.

I'm not saying any of the above arguments are right or wrong, by the way. My point is that I am detecting a slight shift in the narrative. Not your typical, ignorant, nocoiner guff but something much more substantial.

The future for crypto is not the plain sailing the price would have you think it is. There is a lot of grind to get through first before widespread adoption becomes a reality.

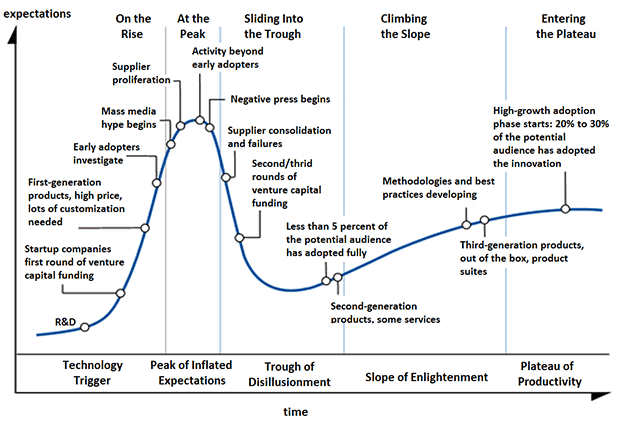

US tech research company Gartner is known for, among other things, its excellent hype cycle chart, which describes the journey a new technology goes through from original inception through to widespread adoption.

Here it is:

This is an idealised cycle. If everything evolved in cycles as precise as this, we would all be a lot richer than we are. It is, however, is a useful guide.

The easiest analogy is dotcom. In simple terms, the 1990s were the "Technology Trigger" phase. Everyone got very excited about the internet though few actually used it.

Then we got the dotcom bubble 2000 saw the "Peak of Inflated Expectations". The bust brought us the "Trough of Disillusionment" from 2001-04. All that money was lost, broadband was still so slow, and adoption was not yet widespread.

Ever since the internet has been marching up the "Slope of Enlightenment" and over the "Plateau of Productivity". Only recently has the Nasdaq passed its 2000 highs.

Where are we now in bitcoin's hype cycle?

I actually argued that bitcoin hit its own "Peak of Inflated Expectations" back in 2013 when it went to $1,200 a coin. Based on this cycle, I said buy bitcoins back in spring 2014. Blockchain tech, however, was still in the "Technology Trigger" phase, I remember saying in talks at the time. Many were saying that blockchain had hit the "Peak of Inflated Expectations" back in 2016 and yet bitcoin's gone ever higher.

Now it looks as though both bitcoin and blockchain tech are somewhere at the "Peak of Inflated Expectations" phase all over again. That's the problem with idealised cycles it's all a bit arbitrary and you can manipulate the cycle to suit whatever narrative it is you want to peddle.

However, my point is this: close to the "Peak of Inflated Expectations" you will see "Negative press begins". Bitcoin has been dogged with negative press ever since the start. The idea of non-government money is inherently political, so bitcoin divides opinion and always will. But it's only now that I'm detecting rather more informed negative press, which would indicate a changing narrative.

I'm not calling the top. It may be that we saw that a fortnight ago at $20,000. It may be that bitcoin wants to go to $100,000. Who knows? I suggested in my own New Year predictions piece last week that bitcoin could go to $50,000 this year.

But I'm aware that it could just as easily crash. We saw in the lead up to Christmas how quickly bitcoin can fall. It went from $20,000 to $11,000 in three or four days. I think that was the fifth correction of 30% or more in the course of a single year. We've also, of course, seen just how quickly it can rally back up again.

I do think it's wise though, as previously outlined, to have an exit strategy in place and to practise selling even if it's only a small amount, so that you know what you're doing and can move quickly in the event you do want to get out of this market.

I have a technical indicator I use based around moving average crosses and it actually has bitcoin on a "sell" signal at the moment.

But dare I short it? No.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how