The charts that matter: Yellen bows out with neither bang nor whimper

Janet Yellen ended her reign at the Fed with an interest-rate rise that set no pulses racing, but disappointed nobody either.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Welcome to your weekend edition, where we take a look through the charts that matter and catch up on anything else that we missed during the week.

This week, Federal Reserve chair Janet Yellen marked her last time in the hot seat with an interest rate hike.

Everyone had expected the US central bank to raise rates, so it didn't faze them at all. Indeed, the Fed was ever-so-slightly more dovish-sounding than most people expected. So the US dollar slipped after the meeting.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It was a pretty good metaphor for Yellen's time at the helm overall. She managed to keep the market on its toes by occasionally looking as if she'd raise rates more rapidly than expected. But in the end, she always kept spirits up by continually putting the fateful day off.

And her timing has been fantastic. She got into the job just as the nastiest bit of the financial crisis was over. The "taper tantrum" of early 2013 probably marked the last big panic that the Fed had to ride out.

There was a brief China crisis in 2015, but that passed by pretty quickly by application of the usual Fed solution of making sure that monetary policy was even more dovish than the market expected. And now she's leaving before things start to get sticky.

This is not a criticism of Yellen. I am positive that if things had been rougher during her time at the top, she'd have handled them in the same way as Ben Bernanke or Alan Greenspan would have.

It's more just an observation about the role of luck in public office.

Yellen herself pointed out that "correlation was not causation". She was talking about the yield curve (more on that here). But she could well have been talking about the tenures of Fed chairs.

The strategy for running the Fed has been set in motion. It's all about the "Greenspan put". That strategy has worked since the 1980s. Bernanke and Yellen have just been continuations of the strategy.

Inflation taking off is the only thing that would remove the Greenspan put as an option. But now that's something for Jerome Powell to worry about.

Getting in at the right time, and leaving at the right time. It's only when you look at all of the people who didn't that you realise that this in itself is a more impressive feat than it sounds.

Time for our regular charts

Now we'll turn to our charts, but first, if you missed any of this week's Money Mornings, here are the links to catch-up.

Monday: What's holding back wages in the US? Probably nothing but time

Tuesday: A sneaky oil boom is getting underway

Wednesday: A strange North American pre-Christmas custom you can profit from

Thursday: This trade has been disappointing so far but hang on for now

Friday: How Britain avoided the worst of the Great Depression

I've at least temporarily added the Topix index, Japan's key stockmarket, to our list. (In Japan, the Nikkei is analogous to the Dow Jones; the Topix is the S&P 500). Here's why.

The Topix index hasn't managed to claw back above the 1,800 level since the collapse of the Japanese bubble at the beginning of the 1990s. Jonathan Allum at broker SMBC Nikko describes the level as "the iron coffin lid". As the chart below shows, the last time it was challenging this level, was in 2007.

The Topix started the week with its head just above 1,800. It managed to move a good bit higher - almost to 1,820 - but ended up closing back below 1,800 by the end of the week.

So for now, the battle continues. If the market can break above this mark convincingly, it would be a very bullish sign. If not - it would be a very good point at which to mark a top, or at least a breather, for the wider global markets.

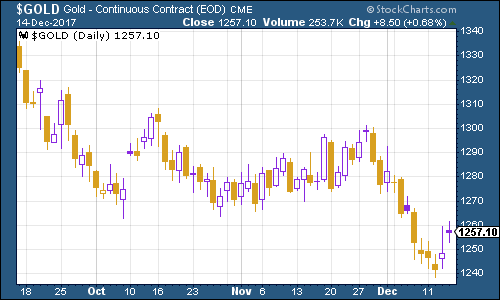

Gold recovered a little this week after its big slip last week.

(Gold: three months)

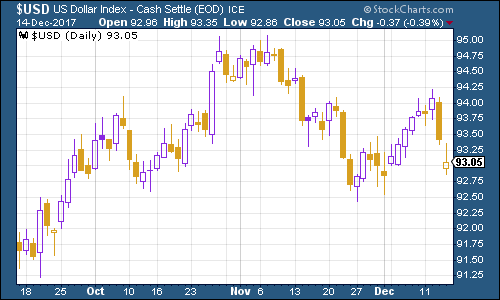

The US dollar index a measure of the strength of the dollar against a basket of the currencies of its major trading partners dipped this week, partly as a result of the Fed being less aggressive than expected and partly down to renewed uncertainties over Trump's tax bill.

(DXY: three months)

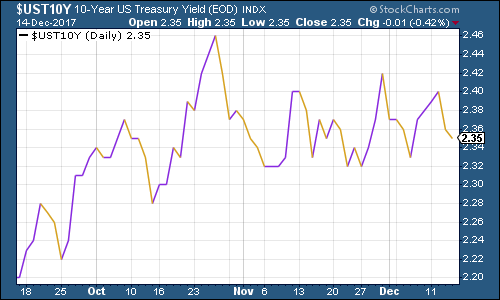

Meanwhile, the yield on ten-year US Treasury bonds continues to hover below the 2.4% mark that's seen as a major line in the sand by many analysts.

(Ten-year US Treasury: three months)

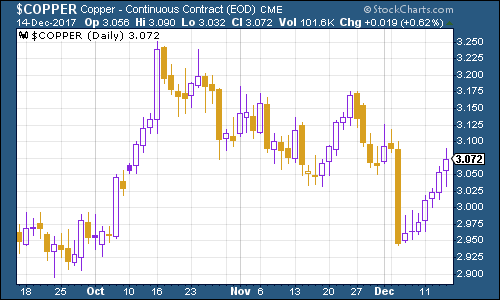

Copper enjoyed a rapid recovery this week, after falling too far, too fast last week. Upbeat manufacturing data from China also helped matters.

(Copper: three months)

And back bitcoin. The digital currency, asset, whatever continues to fascinate. One thing about bitcoin is that I think we're going to have to change the jargon we use as finance writers.

For example, a bear market is generally viewed as a fall of 20% or more from a previous high. On that basis, bitcoin nearly entered a bear market last Saturday, falling by about 18% in the day.

It then recovered on Sunday (insert obligatory hangover joke here) and spent the rest of the week working its way up to a new high. Fastest near-bear-market ever? Quite possibly.

Of course, part of the resilience of bitcoin might be down to the difficulties that some people report in selling the stuff. So as my colleague Dominic warned last week, if you own bitcoin, then make sure you have a plan mapped out for your exit.

(Bitcoin: 10 days)

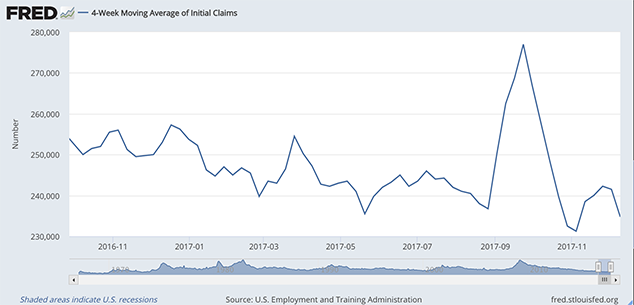

This week, the US employment figures remained strong the four-week moving average of weekly US jobless claims fell to 234,750, while weekly claims fell to 225,000. According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), a recession follows about a year later.

As the chart below shows, the most recent cyclical trough was just a few weeks ago, at 231,250. So we could still be some way from the peak.

(Four-week moving average, US jobless claims, past 18 months)

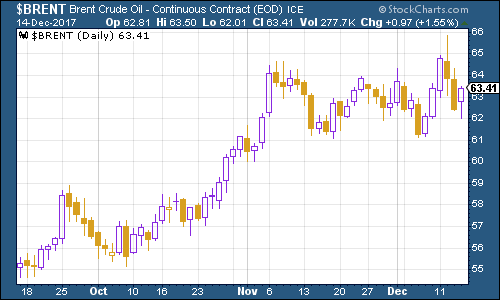

The oil price (as measured by Brent crude, the international/European benchmark) rallied sharply at the start of the week as a key North Sea oil pipe network was shut down for repairs (I wrote about this on Tuesday).

(Brent crude oil: three months)

Finally, internet giant Amazon had an uneventful week price-wise, despite reports from Morgan Stanley that it might be reaching saturation point in the US in terms of prime' subscriber numbers.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King