A strange North American pre-Christmas custom you can profit from

Just before Christmas, Americans and Canadians sell their losing stocks – meaning canny investors can pick up some bargains. Dominic Frisby explains where you can find some of the best.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

December in Canada and the USA does not just mean the season of goodwill. It also means tax-loss selling.

Every year our cousins across the Atlantic sell their dogs their shares that have done badly to realise a loss, which can then be offset against winning trades elsewhere to minimise tax payable.

It means a lot of selling pressure. Some stocks can get oversold, only to rebound to a fairer value come January. It also means the canny bargain hunter can pick things up on the cheap.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Buying other people's losers

Tax-loss selling tends to hit hardest in the sectors which have performed worst. You're not going to find much tax-loss selling around bitcoin, for example. Very few people have any losses to realise. The same goes for tech stocks, emerging markets, indeed equities in general.

There will, however, be plenty of selling in the sector, which was supposed to do what bitcoin has done: in the precious metals, gold and silver.

Actually, gold hasn't had that bad a year. It began 2017 at $1,150 per ounce. It's currently $1,240, give or take. It's a perfectly respectable performance until you start comparing it to cryptocurrencies or emerging markets.

Silver, on the other hand, is currently sitting in negative territory for the year, albeit only by a few percent.

The miners are more or less flat. The large-caps have, largely speaking, done better than the small-caps. However, they've all been a lot higher at some point this year, and at various points in the past so there are plenty of potential losses to be realised.

Currently in the mining sector there is plenty of selling going on, particularly as gold and silver are falling in what has so far been a miserable winter for precious metals.

In fact, it's not just precious-metals miners. There are plenty of base-metal miners, particularly among the small- and mid-caps, which are being badly beaten up even as we speak. Although, generally speaking, the copper and zinc have done better than gold and silver this year.

Oil and natural gas have also had their ups and downs. So I think natural resources are a good sector to look for tax-selling opportunities.

Where the biggest potential rebounders can be found

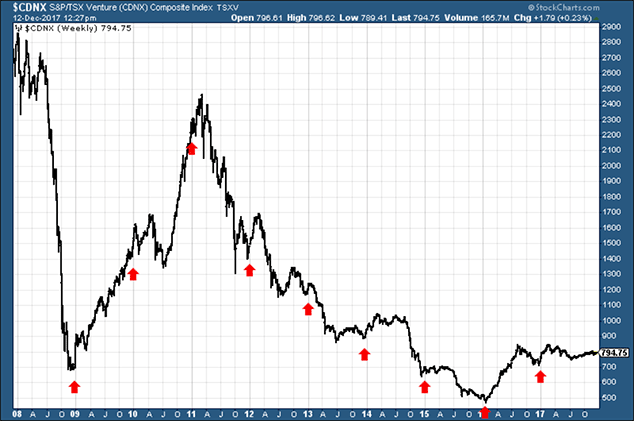

Here's a chart of the TSX and the Venture over the past ten years. I've drawn some red arrows pointing towards the end of year/beginning of new year period.

You can see how there tends to be a sell-off towards the end of every year, followed by a rally, either at the end of the year or shortly after the beginning of the new year. Some years it's bigger than others of course, but it's remarkably consistent nonetheless.

Even in the horrific bear market of 2011 to 2016, we still got little rallies at or around the turn of the year. 2015 was the only real dud. 2009, 2010, 2012, 2014, 2016 and even, to a small extent, 2017 were all belters.

Mining stocks are notoriously volatile, of course, and buying into tax-loss selling as a strategy is by no means 100% guaranteed nothing is. If metals prices keep on falling, the companies will fall with them, except in the most exceptional of circumstances.

It should also be taken into account that in natural resources at the moment there is no runaway bull market in place, so you don't have that margin of error that a bull market gives you.

But given these patterns, I think it's worth a flutter.

Tax loss selling usually peaks two weeks before Christmas. That's right now this week in fact. So now's the time to go digging around Canadian junior mining stocks looking for opportunities. Compliance rules, I'm afraid, prevent me from tipping small caps, so you'll have to get on the investor chat boards to find opportunities in that sector.

However, another way to play this is simply via the VanEck Vectors Junior Gold Miners ETF (US:GDXJ). Listed in the US, this tracks the large junior mining companies and midcaps. It tends to follow the same pattern as the Venture. You won't get the same leverage you might get with a small cap, where a 20% gain might only be a 5% gain in GDXJ. But it's a way to play it nonetheless.

You want to buy now and looking to exit by mid- to late-January. It's for nimble traders not long-term investors. Good luck!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how