China’s new helmsman charts his own course

Xi Jinping has consolidated enough power to take China where he wants – whether forwards or backwards. Investors should hope for the best, says Cris Sholto Heaton.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Xi Jinping has consolidated enough power to take China where he wants whether forwards or backwards. Investors should hope for the best, says Cris Sholto Heaton.

The 19th Communist Party Congress ended last week with President Xi Jinping established as China's most powerful paramount leader since Deng Xiaoping in the 1980s and 1990s. In many respects, he's now comparable to Mao Zedong in terms of the public image he's cultivated.

A great deal has been written about where Xi is likely to take China in the next five years and also about whether he is likely to hand over to a new leader in 2022 when his term expires or try to stay on. We can place very little weight on most of these predictions.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

First, forecasting is a largely pointless exercise chance plays a much greater role in the world than we'd like to think. Second, Chinese politics are especially hard to analyse, because insight into what goes on behind the walls of Zhongnanhai is so limited. Still, we can try to draw some broad conclusions about where China stands now and what that may mean for investors.

The crackdown continues

First, the anti-corruption campaign will continue. Wang Qishan, who led the effort for Xi's first term, stood down at this congress, despite speculation that he might stay on past the unofficial retirement age, but Zhao Leji a long-standing ally of Xi has been placed in the same role. The campaign is partly political: investigations into corruption and abuse of power are Xi's main weapon against other factions that may try to loosen his grip on power.

Over the last few years, these have helped him get rid of Bo Xilai, the former party chief in Chongqing, who had also begun establishing a Mao-style personality cult around himself, the former security chief Zhou Yongkang, and other senior individuals, including Sun Zhengcai, Bo's successor in Chongqing, who had been seen as a potential appointee to the Politburo Standing Committee (PSC, the seven-member top leadership) this year.

However, this is not purely a political purge: corruption among officials in China is endemic and senior figures are worried that anger over this is one of the few things that could shake the party's grip on power. Hence the importance of being seen to take tough steps to tackle it. Whether this can genuinely bring graft under control is another matter. What Xi and Wang have conspicuously not done is to introduce more transparency into officialdom, politics and into their investigations something that might have made a big difference to the rule of law in China.

Still, the campaign will undoubtedly be reported as if it has succeeded. The freedom of the press and freedom of speech more generally have been greatly curbed under Xi. Some of this may have been due to the timing of the congress China's leaders are always sensitive about public discussion around big events. But impending efforts to clamp down on the use of virtual private networks (VPNs), which are used to access websites that are blocked in China, imply greater efforts than before to control the internet.

Democracy doesn't matter but ideas may

It's very clear that China will not be shifting towards greater political openness and perhaps ultimately some form of elections for as long as Xi's ideas hold supreme, whereas just a few years ago that was seen as the likely long-term direction. That's not a major issue for now: most Chinese people have no particular desire to see Western-style democracy introduced, there being no tradition of this in China (the country had one broadly contested national election in its history, in 1912, which ended in the leader of the winning party being assassinated).

Recent developments in the West such as the election of Donald Trump have further diminished any appeal democracy held. However, greater curbs on free speech, open debate and the internet risk holding back the growth of a high-tech, innovative economy, which could cause long-term harm.

Some economic reforms should continue (vice-premier Wang Yang, who is seen as a reformist, is on the new PSC). These are likely to be limited in scope. There may be efforts to make the state-owned enterprises (SOEs), which account for around a third of the economy, more efficient, but it's clear that Xi's vision of the economy involves large SOEs playing a major role. So we can't expect sweeping privatisations, moves to increase competition or changes to allow private firms a role in sectors where they are largely excluded: Xi is not a radical reformer in the mould of Deng, and he favours a mixed economy of the kind China now has.

It's impossible to say whether policymakers will continue gradually opening the financial system to foreign investors, as they have done in recent years. Zhou Xiaochuan, the reformist governor of the People's Bank of China, is likely to retire next year and the choice of his replacement may give some clues on this (although ultimately key decisions are made at a higher level).

So, in many ways, it's likely to be business as usual on the economic front. The big concern for many investors is the level of debt in the economy: the debt-to-GDP ratio has grown from around 160% in 2008 to around 260% at the end of last year, due to the credit boom that was unleashed to stimulate the economy after the global financial crisis.

The risk of an immediate crisis is low: the debt is mostly denominated in renminbi and held by a banking system that is ultimately state-controlled, which should make it easier to manage defaults or liquidity crises. The outstanding loans include many that will never be repaid because they have been poorly invested or stolen, but China's no different to many other countries in this respect: much of the world's debt will one day be written off or inflated away.

However, debt levels cannot continue growing so fast indefinitely. The government says it wants to deal with risks in the financial system (where many firms have become the target of anti-corruption investigations this year), bring credit growth under control and continue efforts to cool the property market. These are not new promises and policymakers have a history of loosening up on restrictions when growth starts to slow we'll see if they hold their course this time.

Growth will slow further

The government has also announced plans to fix China's pollution problems, which are appalling (this is common when countries industrialise and often improve as people get wealthier and demand a better environment). Pollution has been touted as a priority for well over a decade with little impact; again, we will see if it's different this time. Recent plans to limit factory emissions over the winter in the Beijing-Tianjin-Hebei area, when air quality gets worse, suggest it might be.

If the government cracks down on lending and pollution, this will inevitably lead to slower growth. China's GDP growth rate has been decelerating ever since the financial crisis, from double-digit rates in the 2000s to probably less than 5% per year at present, regardless of what the official statistics stay. The sustainable medium-term rate is probably around the current level but most of the world can expect slow growth in the years ahead, so if China can deliver slower but better-quality growth, it will still be doing fairly well.

Still a solid investment

In brief, China does not necessarily look any worse than the rest of the world. It has some worrying trends politically and will not be taking all the steps that might make the economy stronger (though not all the reforms that economists urge would be an improvement). However, this is true of many parts of the world.

On the plus side, China also has enormous potential if things go adequately: its GDP per capita is still only around 25% of the level of the US, even allowing for the difference in the price of goods and services between countries (that's the figure overall obviously some areas are wealthier). This means that China is still an important part of a global portfolio: don't bet everything on it coming good, but the odds are no worse than anywhere else.

The market isn't cheap very little is these days but it looks reasonable by global standards. The MSCI China index of stocks listed outside the mainland which is the obvious benchmark for most foreigners trades on a trailing price/earnings ratio of 16.3 and a forward p/e of 13.4. By comparison, the MSCI World index of developed-market stocks trades on 20.8 and 16.7. Dig into the details, though, and that becomes less reassuring.

Many of the biggest stocks in the index are giant state-owned enterprises, including the big banks, telecoms and oil and mining stocks. The banks are a particular problem they are stuffed with bad loans that they will need to roll over, forgive or restructure in whatever way suits the state when the time comes. Other firms such as the telecos, the insurers, and the resources businesses are either badly run, have substantial policy risk or both, though some are arguably better than others.

The two risks of the tech giants

At the other extreme, the two biggest holdings in the index are the internet giants Tencent and Alibaba which combined account for around 30% of the index. The policy risk for these firms is huge: if the government decides that something they do is not compatible with its goals, they can be out of that business or business altogether overnight. If you're worried about the risks for Western tech firms, you should be very worried about them for Chinese ones. In addition, China does not allow foreigners to own businesses in sensitive sectors such as the internet.

When the tech firms listed abroad, they got around this by using a dodge called a variable interest entity (VIE). The underlying assets that make the tech firm valuable are owned by a vehicle (the VIE) that is controlled by the firm's founders or top management. The firm that is incorporated and listed overseas has contracts with the VIE that supposedly guarantees its control of the firm and profits arising from these assets.

How enforceable this dodge is under the Chinese legal system is questionable and there is a risk that shareholders may be ripped off. In my view, the valuations of these firms do not reflect the risks.I'd buy Tencent which I view as the best of the lot in a crash, but for now I prefer firms in sectors that are less politically sensitive but should benefit from rising incomes. I look at a few below.

The firms that make the brands Chinese consumers love

The best Chinese consumer firms trade at higher valuations than other firms in their markets and their developed-market peers. The history of middle-class consumer booms in economies such as the US suggests that the best firms can justify valuations like these. Still, high ratings make them prone to sell-offs if earnings disappoint and investors should be under no illusions about that.

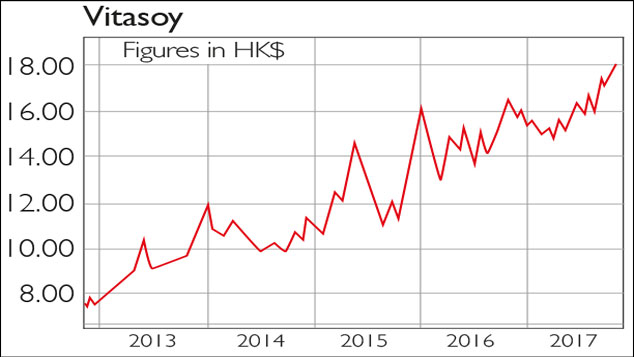

One of my long-term picks is Vitasoy (Hong Kong: 345), an iconic Hong Kong brand of flavoured soy milk and other soft drinks, which has successfully expanded into mainland China. On 34 times estimated earnings, you should only buy now if you have a lot of conviction but I certainly won't be selling yet.

I also hold Want Want (Hong Kong: 151), a Taiwanese-run firm that sells flavoured milk, crackers and other snacks. It's been struggling for growth as consumers shift towards healthy drinks, but has strong brand recognition and should be able to use this to branch out.

Unfortunately, it has rallied in the last month and now trades on 21 times estimated earnings, but is still worth a look. I am less convinced by Tingyi (Hong Kong: 322) and Uni-President China (Hong Kong: 220), two other Taiwanese firms that make noodles and soft drinks. Consumers are moving away from low-end noodles and the two have fought vicious price wars in drinks. Current valuations price in a big turnaround, but I might look to buy in a large sell-off.

I don't hold Foshan Haitian Flavouring and Food (Shanghai: 603288), which makes soy sauce and other condiments, or Dali Foods (Hong Kong: 3799), which makes baked goods and drinks, but have been considering them (regrettably the shares have rallied while I've been deliberating). These are mainland firms (as opposed to those with Hong Kong or Taiwanese management), which often carry greater governance risks, and neither has the history of ten years as a listed firm that I prefer to see. I may yet make a small investment and wait.

I mostly avoid retailers, which risk being undermined by the rapid growth of China's e-commerce sector (I hold cosmetics retailer Sa Sa (Hong Kong: 178) and clothing chain Giordano (Hong Kong: 709) as turnaround plays, but the former remains in my portfolio on sufferance at present and the latter is a wider regional play). I don't find any listed local fashion, luxury goods or cosmetics firms compelling (European, Japanese and South Korean brands tend to dominate the higher end of the market and are worth investigating in their own right).

The same is mostly true of other personal care products Hengan (Hong Kong: 1044), which makes hygiene products, is an established business, but I worry about commoditisation of brands in this sector. Healthcare requires expert knowledge that I don't have, but I occasionally run an eye over Tong Ren Tang Technologies (Hong Kong: 1666), a traditional Chinese medicine firm with a long history and a valuable brand.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Can US small caps survive the software selloff?

Can US small caps survive the software selloff?US stocks have made their worst start to a year since 1995 relative to a global benchmark. But experts think some sectors of the market are still worth buying.

-

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of Kefalonia

Review: Eliamos Villas Hotel & Spa – revel in the quiet madness of KefaloniaTravel Eliamos Villas Hotel & Spa on the Greek island of Kefalonia is a restful sanctuary for the mind, body and soul

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.