History is a useful guide for investors – but which period are we in today?

When it comes to investing, it pays to know your history. The problem with that, says Dominic Frisby, is that things really could be different this time.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Time magazine ranked him among the 100 most influential people in the world. Bloomberg has him in the top 50.

By 2011, his fund, Bridgewater Capital, had become the world's largest macro hedge fund with over $150bn under management.

He's worth some $16bn.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

I think it's fair to say Ray Dalio knows a thing or two about investing.

When he shares his thoughts, it pays to sit up and listen...

There is nothing new under the sun everything is "another one of those"

"I believe that basically everything is another one of those'", says Ray Dalio in a recent interview with podcaster Tim Ferris. "Almost everything happens over and over and over again through history... the key to success is to identify what one of those' it is, and to look how it's worked in the past".

In other words, it pays to know your history in the case of investing, your financial and economic history. If, for example, a new widget is invented, you should look back and find an example of another, similarly transformative widget. How did markets react then? Chances are they'll react in a similar way now.

"People have a new child", says Dalio, "And they treat it as though that's the first time anybody's had a child." Of course it isn't. People are people, no matter where they are in history, and so behaviour repeats. Cycles repeat. Patterns repeat.

"If you start thinking that way, it's radically beneficial What is this? What one of those' is it? And how do those things work? And what are my principles for dealing with it? Then life is a whole lot easier. If you're not dealing with it that way, everything is a one-off and you'll be in the middle of a blizzard."

Dalio makes the point that it's often good to go back beyond living memory. The political populism which has gripped the world in the last couple of years, for example, is "a bigger phenomenon than we're used to in our lifetimes". But go back to the 1930s and there it was again.

"I use that as an example," he says. "I think, Okay, where were the populists in history? Where were those cases? How does this thing happen? How does it grow? How does it develop? What are the usual linkages, and why?'"

I love it. Know your history, and you'll know how to deal with the present. It's why we have traditions so we don't keep on making the same mistakes. They're a way of dealing with a particular circumstance.

There's just one problem.

In 2017, quite a lot of stuff looks very "different this time"

This is not so much a problem with Dalio's take as it is with the world around us today.

When I survey the financial, economic and investment landscape around us, I can't help but think that in many ways, we really are in uncharted territory. There are so many things going on in the world at the moment that don't seem to have happened before at least not on the current scale.

Much of it boils down to the system of money itself. We have never had a global debt-based system of fiat money before. The price of money interest rates, in other words has never been this low for this long.

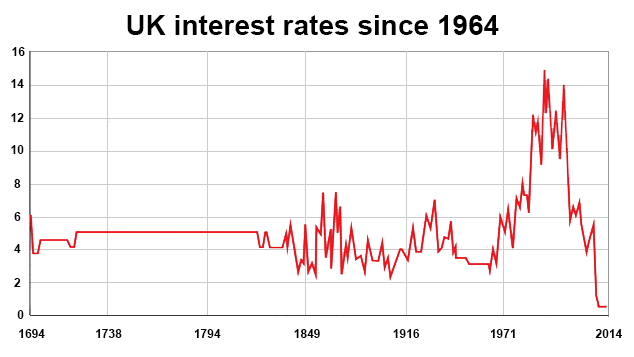

This chart of interest rates in the UK since the formation of the Bank of England in 1694 a chart my colleague Merryn has been known to post demonstrates my point.

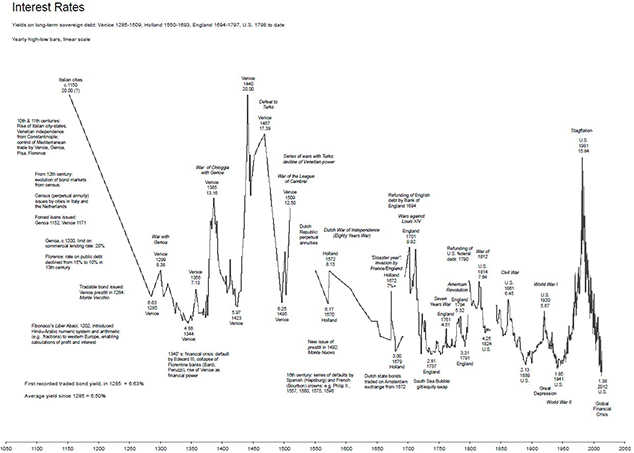

Meanwhile, Nick Laird over at goldchartsrus.com has charted the price of money as far back as Ancient Babylon or thereabouts some 3,000 years BC. There is an enormous amount of information there, and it is worth perusing (click on the chart for a larger version).

The simple fact: money has never been this cheap, for this long, on this scale.

And yet cheap money is not available to all. We think about debt as being something that poor people have. Yet it is in fact more a privilege of government, large corporations, and the very rich and it has created this unholy alliance between the three to prop up asset prices at all costs.

Take mortgages. The average two-year fixed rate home loan for someone with a 5% deposit is now 4.25%. The average rate for the (usually richer) person with a 40% deposit is 1.7%.

There's considerable difference between the two, and with good reason the 5% deposit is the riskier loan. But the person with a 5% deposit pays three times the price for his money!

The Bank of England base rate is 0.25%. The government pays 1.3%, roughly, to borrow money for ten years. Yet who is more prudent with their spending? The individual or the government? The result of cheap money is that government debt levels have never been this high for this sustained a period.

When you start to ask the Dalio question which "one of those" is it? you start to think of previous examples of overly-indebted governments, or of monetary manipulations: coin clipping in ancient Rome; the inflation that destroyed Spain after it brought so much Inca gold back to Europe; France's disastrous monetary experiments of the 18th century; and so on.

It should all have gone pop years ago, I can't help thinking. It nearly did in 2008, but it didn't.

The gold bugs' answer was to buy gold. They were right in that some new monetary alternative must be the way forward. Except gold proved to be an analogue asset in a digital age.

Digital gold was the answer bitcoin. It is doing everything that gold was supposed to have done. But bitcoin is now in a speculative frenzy of its own, on a par with previous transformative technologies, railways in the 19th century, or dotcoms in the 1990s.

Excessive money creation has created the age of bubbles in which we now live. Not just bitcoin, but stocks, bonds, real estate bubbles are everywhere. So much so that now we have this expression: "the everything bubble".

It's hard to find anything cheap platinum or oil maybe, but they're both cheap for a reason. Future demand for both is unclear because of, in the case of platinum, catalytic converters, and, in the case of oil, fracking.

What's the historical parallel for the present day?

So I'd love to ask Dalio a question. Which "one of those" is this? And how does it end?

Though there are many parallels between now and the rise of populism in the 1930s, I don't see a world war as inevitable. More wars by proxy, maybe, but I do not believe our populaces, though agitated, want war. Broadly speaking, I buy the Thomas L Friedman "Golden Arch Theory" that no two countries with a McDonald's will go to war (it has happened occasionally, but on a small scale). We are too comfortably off.

As for the monetary manipulation, Rome is an obvious parallel. For all the coin clipping, it took Rome many hundreds of years to die. It taxed and overspent for centuries, and then it suddenly fizzled out as the Barbarian invaders came. Maybe the "Decline of the West" will be a similarly drawn out process. (I sometimes like to think of Britain as Rome and of the US as Byzantium, which had its own curious evolution, but such parallels are easily debunked.)

It's difficult to know what to do, beyond "going with the flow", which is my current strategy. Trend-following, I believe they call it.

In any case, whether you agree with his specific take or not, Dalio's views are useful food for thought for any investor his new book, Principles, is out now, from Simon and Schuster.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Pension Credit: should the mixed-age couples rule be scrapped?

Pension Credit: should the mixed-age couples rule be scrapped?The mixed-age couples rule was introduced in May 2019 to reserve pension credit for older households but a charity warns it is unfair

-

Average income tax by area: The parts of the UK paying the most tax mapped

Average income tax by area: The parts of the UK paying the most tax mappedThe UK’s total income tax bill was £240.7 billion 2022/23, but the tax burden is not spread equally around the country. We look at the towns and boroughs that have the highest average income tax bill.