Invest with the corporate activists

A new generation of activist investors is cleaning up boardrooms. Matthew Partridge looks at how this can benefit ordinary shareholders – and how to invest alongside them.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A new generation of activists is cleaning up boardrooms. Matthew Partridge looks at how this can benefit ordinary shareholders and how to invest alongside them.

Stratospheric levels of executive pay have become a hot political issue in recent years. Politicians keep promising to bring in new rules to close the gap between boardroom bonuses and shop-floor salaries. But the real problem, as we've noted in MoneyWeek before, is the unwillingness of big shareholders to hold executives to account (partly because to do so would draw attention to their own pay packets). This poor stewardship allows companies to get away with bad habits that ultimately damage returns for shareholders, notes Professor Julian Franks of London Business School.

But things are finally starting to change. Traditional asset managers, under pressure from government and their clients, are rolling up their sleeves and getting more involved with the companies they own. They are increasingly working with activist hedge funds, who deliberately buy big stakes in underperforming companies, with the aim of forcing through major changes or even removing management teams that are not up to scratch. So do the activists do any good and if so, how you can you take advantage?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Fund managers are slowly waking up

This new-found activist streak among fund managers is partly down to pressure from their clients the ultimate owners of the shares who are fed up with witnessing managers being awarded ever-rising compensation packages for questionable performance. Politicians and populist irritation in general are also pushing the issue into the headlines, while regulators are nudging asset managers to get more involved. After the financial crisis, the Financial Reporting Council brought in the Stewardship Code, which requires asset managers to report on how they engage with the companies they own, or explain why they don't.

Nelson Seraci of Institutional Shareholder Services (ISS), which advises around 1,700 institutional investors (mainly in the US) on how to use their voting rights, notes that managers are not just wielding their votes more usefully they're also putting on pressure in other ways. "If companies refuse to take fund managers' suggestions on board, many are prepared to take their disputes public and go to the media", behaviour that was "much rarer even ten years ago". The proportion of institutional shareholders who were not at all involved in the companies they owned more than halved to 19%, from 40% in 2011, according to ISS surveys. Most engagements were just phone calls, but around 40% involved face-to-face meetings, and around 25% ended with managers willing to at least consider proposing motions at the annual general meeting. The majority of investors surveyed felt the success rate of their interventions were rising.

British institutions have also been involved in high-profile battles in recent years. Asset manager Schroeders played a key role in last year's ousting of the chief executive and chairman of credit-card insurer CPP Group in favour of a board backed by the original founder. Even M&G, not typically an activist fund manager, made headlines last month when it sent a letter to the board of Canadian oil and gas infrastructure group Gibson Energy with a list of demands, including a strategic review of the way the company is run. M&G has threatened to vote against the current directors at the annual general meeting next year if its demands are not met.

Enter the activists

Still, when it comes to holding managers to account, Professor Franks (who is also a partner with consultancy Oxera) says ordinary funds will always be limited in what they can achieve alone. The problem is diversification a big asset manager such as BlackRock or Standard Life owns shares in hundreds of firms. That limits the resources it can devote to getting deeply involved with any one investment (and also limits the rewards it can reap from doing so). In contrast, notes Franks, an activist hedge fund, which owns just a handful of companies, can focus more closely on its holdings, and one successful intervention could make a huge difference to its portfolio.

Jeff Gramm, an assistant professor at Columbia University, is the author of Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism, a definitive study of the topic. He is also a founder of Bandera Partners, a value-orientated hedge fund. Bandera's activism is more defensive, in that it buys companies that are cheap, then tries to secure a place on the board to protect its own interests and those of other shareholders. Because the fund's investments are usually going through some form of crisis or restructuring, Gramm has had a ringside seat at many boardroom battles. Activists take two main approaches, he notes. In smaller companies they can build a large enough stake to get a seat on the board, making it much easier to force through change, even against the wishes of management. But when it comes to larger firms, where their relative power is much smaller, Bandera and other activists have found they need to win the support of institutions.

This isn't always easy. Many institutional investors are still distrustful of activists and some, says Gramm especially in the UK, or those dealing with family firms "find it hard to go against the wishes of management". However, the bigger institutions in particular are increasingly keen to go along with the activists "because we're willing to do their work for them by making the changes that they want, but are unable to request". In some cases, says David Hunker, head of shareholder activism defence at JP Morgan, "institutional investors will actually invite activists to get involved". The combination of activist enthusiasm plus institutional firepower has made corporate managements much more willing to compromise with investors, says Hunker. For many, "it makes sense to save time and money by settling with activists rather than fighting a protracted battle that may ultimately be unsuccessful". As a result, activists frequently win without having to go to the trouble and disruption of calling a vote.

Activists aren't always the goodies

Not all activist interventions are beneficial, notes Hunker. Many activist hedge funds hold shares for nine months or less, so they are looking to boost the share price in the short-term, and they are not necessarily interested in the best interests of long-term shareholders. Even hedge funds themselves agree that it's hard to quantify the impact of engagement, with Gramm pointing out that, while some activist funds beat the market, this may be because the companies they invest in were undervalued in the first place, rather than as a direct result of their actions.

However, argues Franks, research shows that overall, activists do make a difference, and can add value beyond simply selecting cheap stocks. With a team of fellow academics, he conducted a study of the Hermes UK Focus Fund between 1998 and 2004. Hermes was owned by telecoms giant BT's pension fund, and at the time, was run by managers who pursued an activist strategy. After examining its internal records to see which interventions succeeded in changing things and which were rejected, Franks and his team found that Hermes' investments in companies where it was able to change things went on to beat the market by a large margin. However, when the fund manager's attempts to shake things up were blocked, the shares failed to outperform.

Franks has just completed a much larger study (with Marco Becht of Solvay Brussels School, Jeremy Grant of Berenberg Bank, and Hannes Wagner of Bocconi University) covering 1,740 engagements in 23 countries. The results confirm the earlier study, finding that successful interventions boost returns, independent of other factors. Franks adds that other studies have found that, at the very least, activist intervention doesn't reduce the amount of money spent on research and development (which you might expect to see if activism was pursuing short-term gain), and may even increase these investments.

Overall, stronger shareholder activism is generally a force for good, and could even, Franks believes, "play a key role in reversing the death of the public company', which has seen the number of firms listed decline in both Britain and America".

Activist hedge funds are reluctant to disclose their returns, and unless you have a spare million lying around it's hard to invest in them. However, they are required to list their investments each quarter, and also when they take a significant stake in a company. German index provider Solactive has used this data to build an index of companies that noted activist investors have bought into. Using back-tested data from February 2010, this index (the Solactive Guru Activist Index) has returned 165% (equivalent to around 14% a year), greatly beating the stockmarket. We look at how you can join the activists in the box below.

Passives are getting more active

At the other end of the scale from activist funds are passive funds. These hugely popular (and growing) funds simply track the major stockmarket indices. As a result, they are effectively a captive shareholder base they can't sell if they don't like a company's policies, which some argue weakens any influence they may have with management. Competition to keep costs low also limits the resources they can devote to monitoring companies.

However, there is evidence amid growing pressure from their own investors that passive funds are getting more involved with the companies they own, especially on matters of long-term strategy, and ESG (environmental, social and governance) issues, notes Barron's. Fund Votes, an organisation that monitors how asset managers vote on shareholder resolutions, notes that in 2016, BlackRock voted against management 74% of the time when it came to director elections, while State Street voted against every attempt to restrict shareholder rights or make it more difficult for someone to take over a company (BlackRock did so two-thirds of the time). That said, there is plenty of room for improvement when you look at all resolutions in the year to June 2016, State Street voted against management only 12% of the time, while Vanguard and BlackRock were even more conservative, backing management in 92% of votes.

Ride the coat-tails of the activist hedge funds

One way to trade on the back of activist hedge funds is to buy the Global X Guru Activist Index ETF (Nasdaq: ACTX). This exchange-traded fund (ETF) tries to follow the Solactive Guru Activist Index, which, as noted above, comprises the top 50 holdings of activist hedge fund investors, as culled from their regulatory filings. The ETF doesn't reveal who it is copying, but it seems to be influenced by big names such as Carl Icahn. The management fee of 0.75% isn't bad for a specialist ETF, let alone the underlying hedge funds. Top holdings include refinery and fertiliser group CVR Energy, truck maker Navistar International and Chinese internet giant Alibaba.

But one problem with following activists is that news of their involvement usually affects a company's share price quite quickly, so the risk is that the biggest profits have already been made. The Gabelli Value Plus+ Trust (LSE: GVP) takes a different approach. It is run by activist hedge fund Gamco Investors, and aims to locate undervalued companies that are ripe for intervention but haven't as yet been targeted, as well as those going through major changes, such as takeovers or restructurings. It charges 1.33% a year and trades at a discount of 5.3% to its net asset value (NAV).

Another activist investment trust is the Crystal Amber Fund (Aim: CRS), run by Richard Bernstein. The trust aims to intervene where it thinks it can boost a company's profitability and make it more appealing as a takeover target. Fund manager Neil Woodford helped to start up the trust in 2008, and bought a large stake two years ago. Despite relatively high fees (2% of assets and 20% of return above 10%) it has a strong track record, producing an average annual return of 8.1% since launch, against 6.6% for the FTSE 100. It is on a 2% discount to NAV.

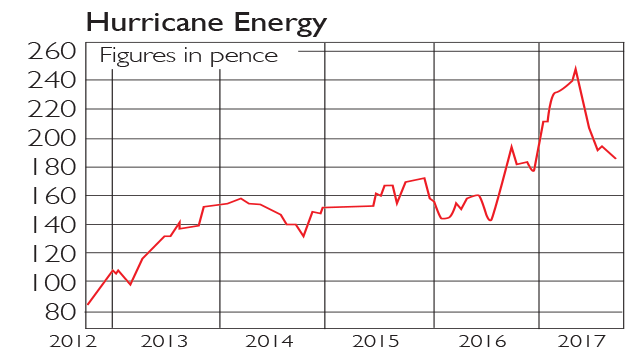

So what about individual companies that are being targeted by activists? Crystal's largest investment is oil explorer Hurricane Energy (LSE: HUR). Low oil prices, and a decision to raise extra funds through a share placing to pay for long-term investment in its main oil field, have battered its share price. Bernstein, however, argues that the market is greatly undervaluing the company's reserves, and is pushing for asset sales to unlock this "hidden" value.

A big battle between activists and management is currently taking place at BHP Billiton (LSE: BLT). Activist fund Elliott Management wants the mining giant to return money to investors, while BHP's management would rather re-invest it. But the latter recently made a major concession by agreeing to sell BHP's shale oil holding, which has consumed a lot of money with little to show for it. Meanwhile the company has made substantial progress in reducing its debt levels. This should help it continue to fund its more-than-comfortable dividend yield of 4.6%.

In the US, veteran activist Bill Ackman of Pershing Square Capital is trying to persuade the management at ADP Payroll Processing (Nasdaq: ADP) to move away from what he sees as an "obsession" with short-term targets. He thinks the company can drastically improve profitability by investing in technology, rather than spending money on buying rivals. For now, management has rebuffed his overtures, but since he now owns around 8% of the company, it will be hard for them to put him off forever. ADP trades at a relatively expensive 25 times 2018 earnings, but if Ackman can deliver on his plans, this could end up being cheap.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.