Oil could be about to take off – but nobody seems to care

Oil is off most investors’ radar. But that could be a mistake, says Dominic Frisby. The price could be about to take off. Here’s how he intends to play it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It might just be me in my little echo chamber, but it seems as though oil is hardly being spoken about.

There was a time in fact, there has been many a time when the subject was on everybody's lips.

Either because supply was about to run out (Peak Oil) or because of its spiralling cost, the West was in panic. Our modern lifestyle looked under threat.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But today it's off the radar and we appear to be asleep at the wheel.

Is that wise?

Yawning our way towards dystopia

There is a common theme to just about every futuristic, dystopian novel: the oil has run out. Cheap energy has gone and mankind is screwed as a result. There never seems to be any wind power or solar energy or lithium ion batteries.

I now know somebody is going to post in the comments a list of dystopian novels that contain all three. (Please do, particularly if they're any good).

But I think you take my point.

It's no surprise that "the oil has run out" is such a common theme. For all the advances that have been made in alternative energies, humankind remains massively dependent on the black stuff for a modern way of living.

Oil and the energy derived from it has made so many wonderful things possible, from planes, trains and automobiles, to heat, power, pharmaceuticals and plastic.

Indeed, given what it has made possible, you'd think we'd be worshipping oil. Instead, it is largely reviled. Not entirely without good reason, the oil industry is accused of malignly influencing political affairs both at home and abroad, of greed and corruption, and of destroying the planet. Small things, really.

We hate ourselves for our dependence on oil, for the fact that, in using it, we are contributing to pollution and worse, and yet we go on using it, because the possibilities opened up to us by travel on a jet plane or a car, or of using a computer or life-saving medical equipment outweigh any dislike we feel.

And so we feel guilty and resentful, and we utter negative statements towards it, even if our actual actions are otherwise.

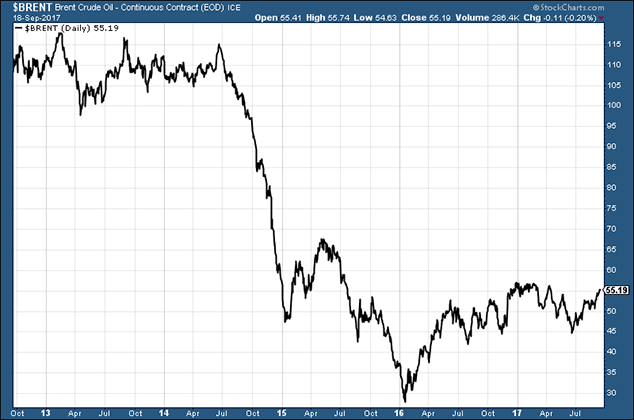

Here's a chart of the price of a barrel of Brent crude oil over the last five years. It's not so long ago it was trading at more than $100.

You can see the incredible collapse, which began in the summer of 2014 from $115, and ended in early 2016 at below $30 a barrel. My keener followers will remember that not long after that, I recommended my trade of the lustrum.

But since mid 2016 for over a year now the world seems to have gone to sleep on oil. Oil is hardly in the news. The commentariat is not arguing about it. It isn't a priority in government policy. Oil stocks barely feature in newsletter write-ups.

As I say, it might just be me in my echo chamber, but it is a long way from being the sujet du jour. And the price has been stuck in a range between around $42 and $56.

It's been moving up steadily since June and is now testing the upper end of that range. From a technical point of view, the next line of resistance, if it can get through $56, is $68. Once past $68, the next stop is $90. $90 oil! That would wake a few people up.

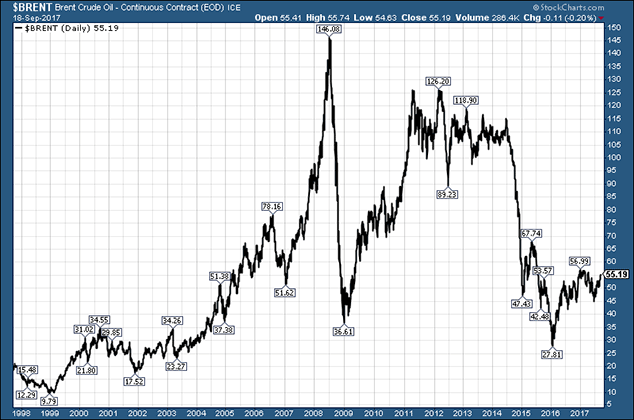

Here's a 20-year chart so you can see the price action since the late 1990s, when we hit the generational low of $10 a low I doubt we will ever see again. In fact, I doubt we'll ever even see $27 again (famous last words).

You can see the epic bull market of the 2000s from $10 to $146. That was quite something. It makes even bitcoin look sober.

But there's now plenty of "room" for the oil price to rise to, say, $120 and, from a technical point of view, to only be at the upper end of its range. (That's not me saying oil is going to $120 by the way).

Here's why I reckon oil could be heading higher

When one reads about investment ideas and market commentary, one often wants hard facts. We want to know what oil demand is, what rates of production are, how big new discoveries are and so on.

If you're a technical guy, you might want to see trend lines, sentiment readings, moving averages and measures of momentum.

The last thing you want to hear is some bloke's got a hunch.

Well, that's it: I've got a hunch.

I can start hunting around for data that "proves" my hunch right to confirm my bias. I could tell you, for example, that global oil demand has, for the third year in a row, risen by more than International Energy Agency predictions.

Chinese oil demand is of particular note. It is growing at double last year's pace, rising by 690,000 barrels per day (bpd) in July, with year-to-date data showing average growth of 550,000bpd, compared to 210,000bpd growth over the same period in 2016.

I can start drawing all over charts, showing that the trend is this, while sentiment is that.

But I don't want to. It would be almost dishonest to say anything more than the truth, which is that I've got this nagging feeling at the back of my mind and I have had it for a while that oil is getting set for a run. I don't think it necessarily starts tomorrow, just that something is brewing.

What's more, I don't think that many in the investment world, the business world or the political world are ready or prepared; and a price surge could take a lot of people by surprise.

You may think me a fool to rely on hunches. But I've found that my instinct that voice at the back of my mind is often a better investor and decision-maker than I am. (I certainly wouldn't recommend relying on other people's hunches, by the way they have to be yours.)

But what do you think? Do we range-trade? Are further falls around the corner? Or is oil getting set for something and the world is asleep at the wheel?

How to play a rising oil price

There are various ways to play oil. I don't like the exchange traded funds (ETFs) that track the oil price, as they don't always end up tracking it as closely as you would hope. There is the spreadbetting option for those with an appetite for such things not recommended unless you know what you're doing, which most don't.

There are the majors, such as BP (LSE: BP) and Shell (LSE: RDSB), which again don't always follow the oil price as closely as you might hope, though Shell's dividend at around 7% is quite compelling and I own it in my self-invested personal pension (SIPP).

BHP Billiton (LSE: BLT), funnily enough, given that it's known for mining, often tracks the oil price very well (oil is its biggest product), but it is not a pure play. And owning specific companies in the oil and gas space is a risky business there is a lot that can go wrong, as owners of Petrofac (LSE: PFC) will vouch.

Myself, I've gone for SPOG (LSE: SPOG) as a way to position myself for this. SPOG is the iShares oil and gas exploration and production ETF, which, as you may expect, gives you exposure to a broad range of companies involved in exploring for and producing oil and gas. If oil goes up, a diversified range of companies operating in the sector should too.

It, along with a few other goodies, is now in the locker with a sign next to it saying "do not touch".

Whenever I write about oil, the hit count on my articles drops by about two thirds. People just aren't interested. That, in itself, is a contrarian indicator. Will this time be any different?

Let's see how my hunch plays out.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how