What the pound’s rally can tell us about contrarian investing

The pound gave us a valuable lesson in contrarianism this week, says John Stepek. Plus, MoneyWeek's charts that matter, and what they tell us.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Before I take a look at the charts that matter, I just wanted to note that the pound gave us a valuable lesson in contrarianism this week.

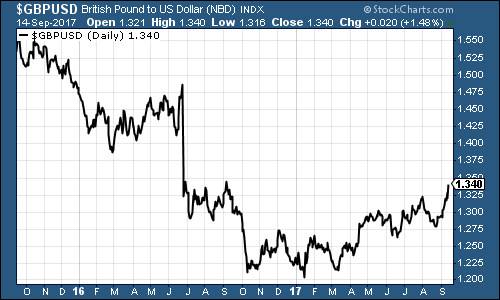

This year the pound has done OK against the US dollar (believe it or not). That's mainly because the US dollar has been getting weaker.

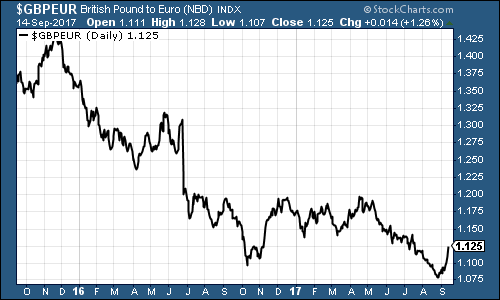

However, it's done badly against the euro.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's mainly because the euro has been getting stronger (it's surged against the dollar, too, this year). Everyone was worried that Marine Le Pen would become French president, so when it didn't happen, the euro rallied. And now, with the eurozone economy perking up, everyone thinks the European Central Bank (ECB) will have to start removing quantitative easing.

All good reasons for a stronger euro, particularly given that the pound was until this week being held back by the threat of lower interest rates into 2018.

However, no trade goes in one direction forever, and the "short pound, long euro" was getting dangerously overstretched.

For a start, we've been seeing a lot of headlines about "parity" recently:

That's a punchy call, given that a pound has never, ever been worth less than a euro. There's a first time for everything, but if you're arguing that a new precedent is going to be set, then you need some good arguments to back it up.

Brexit, of course, is the obvious one that springs to mind.

Problem is, the pound's weakness hasn't really been about Brexit. It's been about diverging monetary policy. And if you weren't watching that, you wouldn't have been ready for what happened this week.

With the ECB getting more dovish, the case for the pound going lower against the euro was already weakening by the time the above headline hit the wires. And this week, we got the turnaround. The Bank of England turned out to be much keener to raise interest rates than markets had been pricing in, and so the pound surged against the single currency.

The surge was all the more aggressive because investors were all positioned on the "wrong" side of the trade.

There were two big things to watch here. Firstly, sentiment. When you hear punchy or even outrageous calls the sorts of calls that generate headlines you should be on your guard for that trend to change.

Secondly, positioning. Figires from the US Commodity Futures Trading Commission (CFTC) showed that the number of investors who were "long" the euro hit a six-year high last week, and one of the highest numbers on record.

If everyone is betting on bad news for the pound, it doesn't take very much good news to turn things around as everyone stampedes to close their one-sided trade.

Sentiment and positioning tend to go hand in hand. But when you see those things dramatic headlines and record levels of overweights in one trade it's a good sign that things are about to change. And that's what we saw this week.

The charts that matter

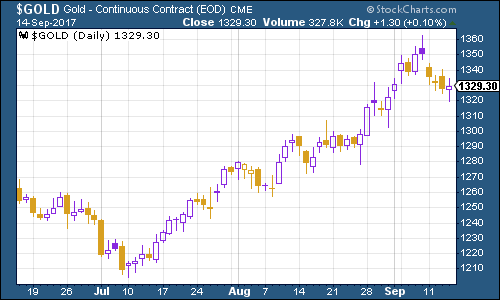

Gold

Gold is taking a breather this week. Investors are starting to wonder if the US dollar is due a rebound (never good for gold) and they are becoming a bit more optimistic on the US economy, and prospects for the Federal Reserve raising interest rates (or at least being more hawkish than expected) next week.

Yet in the fact of this, gold has managed to hold out above $1,300 an ounce. That's probably partly to do with North Korea's habit of lobbing missiles into Japanese airspace just when everyone is relaxing.

(Gold: three months)

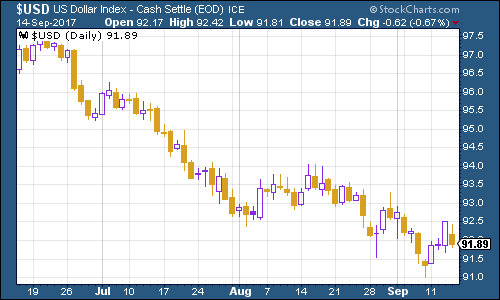

US dollar index

Meanwhile, the US dollar index has perked up a bit this week. It still doesn't look all that healthy, but ahead of the Fed meeting next week, I can't see it plumbing new depths. At the same time, I wouldn't want to bet big on a turnaround either before that happened, I'd really like to see a good old magazine cover decrying the weakness of the US currency as a bad thing. Then we'd have a buy' signal for sure.

(DXY: three months)

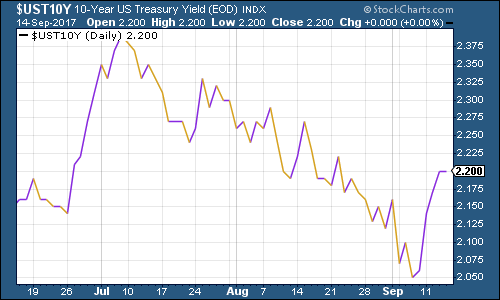

US Treasury bond yields

As investors became a mite more optimistic on the US again, ten-year US Treasury bond yields rose.

(Ten-year US Treasury: three months)

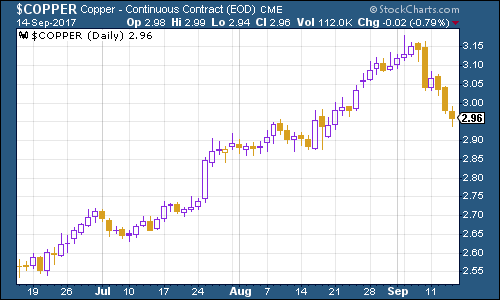

Copper

Despite hopes for better growth in the US, copper's incredible run was knocked right back down to size. As I mentioned, copper was due a breather, but this is quite a big one. It's certainly knocked a bit of steam out of the big miners too, so if you were looking for a buying opportunity on the likes of Rio Tinto, this might be it.

(Copper: three months)

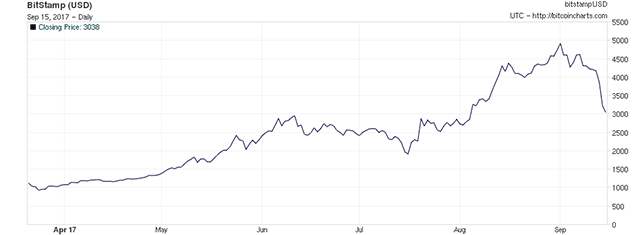

Bitcoin

Gobsmacker of the week for once on the downside was bitcoin. The digital currency crashed from around $4,500 down to $3,000. The cryptocurrency sector may simply have reached peak absurdity (with the likes of "Jesus coin") or it might be that the Chinese are finally deadly serious about taking down bitcoin and its ilk (both seem quite likely). Bitcoin has suffered these sorts of falls before and recovered, and I wouldn't put it past it to do so again. But I won't be using this as a buying opportunity.

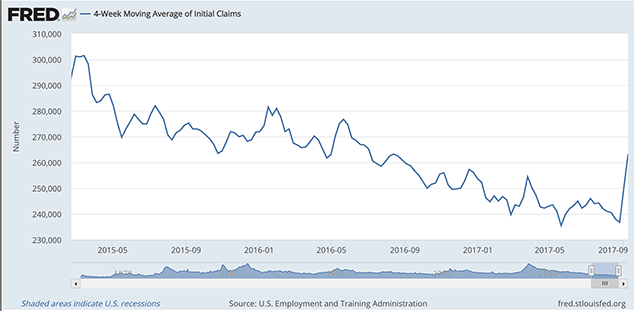

US jobless claims

The weekly US jobless claims data was hit by hurricane disruption again. The four-week average jumped to 263,250 as claims came in at 284,000. That was a good bit lower than the 300,000 expected (claims are being disrupted by the impact of both Hurricane Irma in Florida and Hurricane Harvey in Texas). Overall, claims remain low by historic standards and still not that far off the low of 235,500 set on May 20th.

According to David Rosenberg of Gluskin Sheff, when US jobless claims hit a "cyclical trough" (as measured by the four-week moving average), a stockmarket peak is not far behind (on average 14 weeks), and a recession follows about a year later. We'll see how the data evolves over the coming months. If 20 May holds as the cyclical trough, then if Rosenberg is right (and to be fair, it's a small data set) we might already have seen the stockmarket peak.

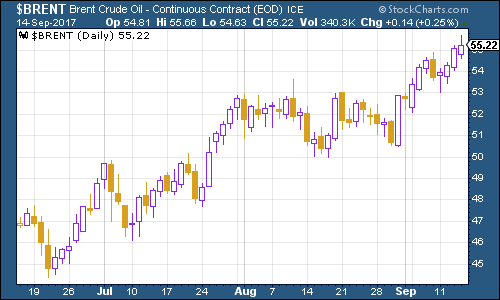

Oil price

Chart number seven is the oil price (as measured by Brent crude, the international/European benchmark). Oil has headed higher again this week, partly due to hurricane disruption easing (which means refiners open and demand for oil goes up) and partly due to forecasts for higher demand for oil in 2018.

(Brent crude oil: three months)

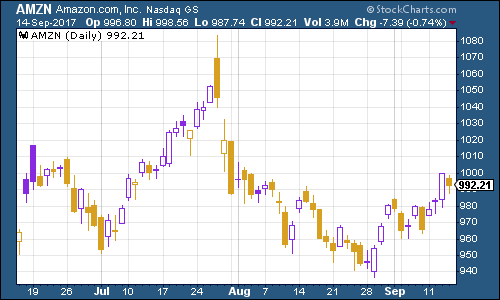

Amazon

Finally there's Amazon. As the wider US markets set fresh record highs, Amazon remained off its August high. It's worth watching this one as attitudes towards Big Tech sour, amid the various cybersecurity scandals erupting.

(Amazon: three months)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King