Beware the uneasy calm in the markets

Calm markets and low interest rates have persuaded investors to take bigger risks than they once would. But a Vix-induced market slide could shatter that calm and drive stocks down.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In the past five years Seth Golden, a former logistics manager for US retailer Target, has grown his net worth from $500,000 to $12m through trading, reports Landon Thomas Jr in The New York Times. He's now thinking of starting a hedge fund. How did he do it? London property? Bitcoin? Nope. He did it by shorting volatility betting against the Vix index, also popularly known as Wall Street's fear gauge.

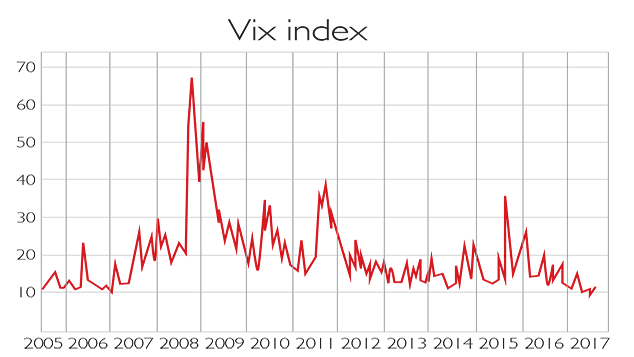

Details of how the Vix works are below. But put simply, it reflects the price of insuring against a slide in the market. When it's low, it means investors are complacent or at least unwilling to pay much to hedge against a big move. One feature of the post-financial crisis era is that the Vix has remained consistently low, as central bank money-printing has propped up asset prices and taught investors to "buy the dip" if the market falls and short the Vix if it spikes.

As the story above demonstrates, shorting the Vix has delivered great returns so far. And as interest has grown, the financial industry has been very happy to provide investors with the means to bet on the index. The amount of money invested in the two main "inverse Vix" exchange-traded products has ballooned. Last month it rose from $1.2bn on 10 August to $2.6bn by the month-end, as investors rushed to bet on the Vix falling after a brief spike.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The danger is that shorting an index like this can also wipe out a lot of money in a very short space of time. For example, says Robin Wigglesworth in the Financial Times, one short Vix product (listed with the ticker XIV) fell in half "in just three torrid days in August 2015". One classic feature of past financial crashes is that large numbers of people have become exposed to significant and sudden losses that they don't fully appreciate. The risk, as Peter Coy says in Bloomberg Businessweek, is that investors caught out by a sudden slump in the market and a surge in the Vix "must quickly find a way to offset their losses". One way to do that is to short the market itself to bet on it continuing to fall. If this happens, "selling could breed more selling", similar to the October 1987 crash.

Another reason for concern is that investors are also "short volatility" in other, less obvious guises. Calm markets and low interest rates have persuaded investors to take bigger risks than they once would partly out of perceived necessity and partly out of complacency. A Vix-induced market slide could shatter that calm and drive stocks even lower. We may not have long to wait. As Dan Galai, a University of Jerusalem professor and Vix pioneer tells Business Insider: "When interest rates start moving up, so will volatility". Be prepared.

I wish I knew what the Vix index was, but I'm too embarrassed to ask

The Chicago Board Options Exchange (CBOE) Volatility index (Vix for short) was created in 1992 by finance professor Robert Whaley, based on the academic work of Menachem Brenner and Dan Galai. The Vix is calculated using the weighted average prices of various options on the S&P 500 index. Options give buyers the right (but not the obligation, hence the name) to buy ("call") or sell ("put") the index at a certain price. So they can be used to bet on the market moving in one direction, or to "hedge" a portfolio against short-term adverse moves.

One factor affecting option prices is the expected level of volatility (the more volatile the market, the more likely it is that the option will end up "in the money" ie, worth something). So the Vix reflects how volatile traders expect the market to be over the coming year broadly speaking, above 30 represents high volatility, while below 20 suggests calm.

Some argue that the Vix works well as a contrarian indicator a low Vix indicates that traders expect calm conditions to continue, and are thus overly complacent, suggesting that stocks should fall (leading to the nickname, "the fear gauge"). However, most studies have shown the Vix to be a coincident indicator (ie, it shows what's happening right now) rather than any use as a forecasting tool, contrarian or otherwise. Equally, the Vix can rise alongside stocks sharp moves can happen to the upside as well as the downside.

One problem with trying to trade the Vix is that exchange-traded products that are "long" the Vix tend to lose money over time, because of the cost of "rolling over" the underlying futures contracts on which they are built. This is one reason why shorting the Vix has become so popular. However, as we note above, this carries its own risks, which will only become ever more important as less experienced traders pile in.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how