Why we can’t copy Warren Buffett

Try as we might, there are just some trades that Warren Buffett makes that we will never be able to copy, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

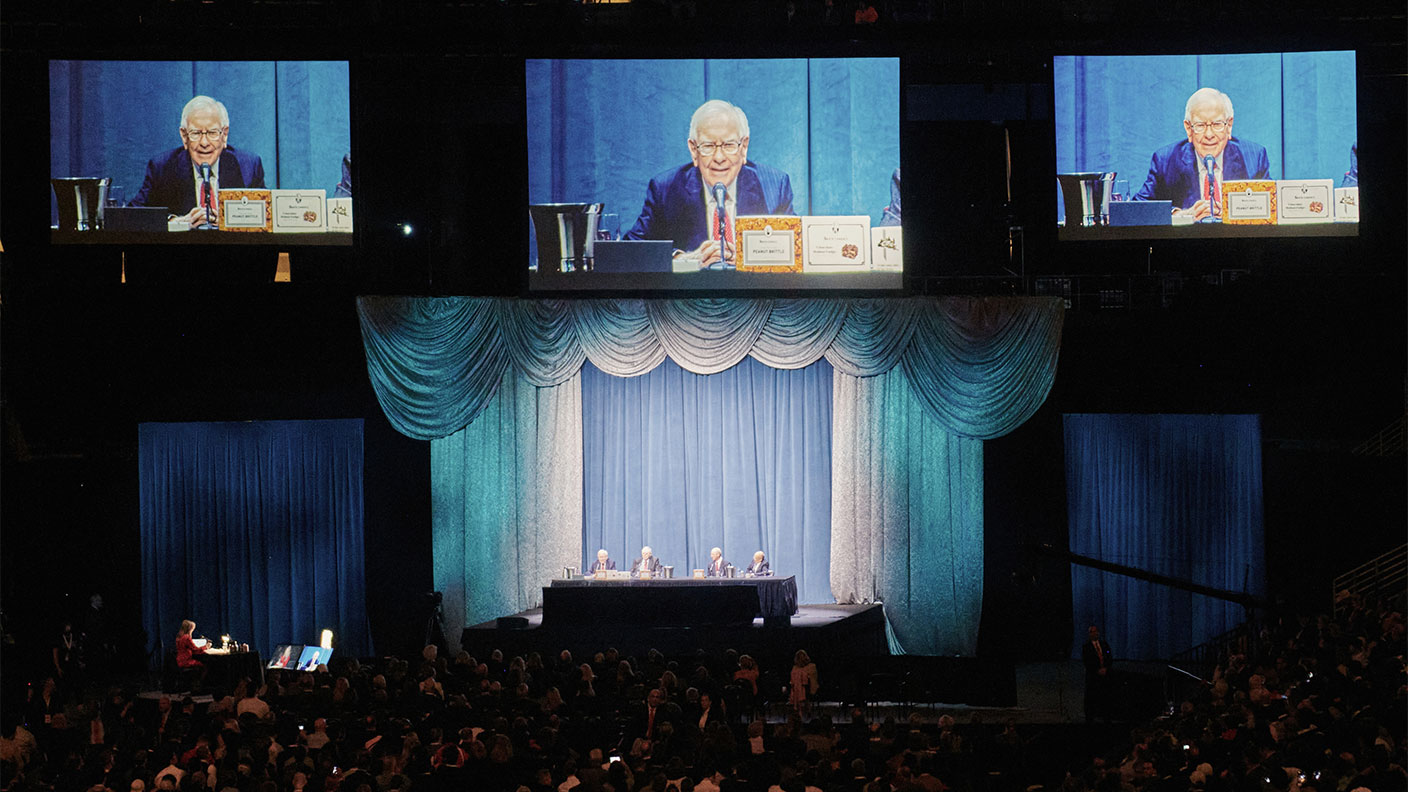

Warren Buffett is the only genuine household name in investment. Even people who've never once glanced at the financial pages know about the genial, folksy, Coke-swilling guru from Omaha, and the countless ordinary Americans who have become multi-millionaires by being early investors in his Berkshire Hathaway investment vehicle. So it's little wonder his every move is pored over.

Now Buffett has invested in Canadian mortgage lender Home Capital Group (HCG). HCG ran into trouble because it uncovered a problem with widespread mortgage fraud but took too long to tell shareholders about it (as far as the regulator is concerned). This in turn almost triggered a Northern Rock-style run on the lender. The share price plunged from more than C$30 to as low as C$6, then recovered to around C$15 after a Canadian pension fund provided a temporary lifeline.

Last week, Buffett stepped in, and the price leaped above C$18. "Ah," you might think. "Buffett has bought a distressed stock. It must be turnaround time. Should I copy him?"

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Sadly not. You can't copy Buffett because only Buffet can get the deal he's getting. In exchange for giving Home Capital a C$2bn overdraft he has the chance to buy C$400m of the shares (almost 40% of the company) at around C$10 a share a 33% discount to the public share price just before the deal was announced. That's on top of the interest he'll make on the loan. That makes it a very different deal to the options open to the ordinary investor. It isn't the first such deal Buffett has done.

A week after Lehman Brothers went bust in September 2008, Buffett invested $5bn in Goldman Sachs. As Stephen Gandel notes on Bloomberg, five years later, an ordinary investor in Goldman had made just 17.5%. Buffett had made 67%, partly because Goldman had given him preferred stock paying 10% a year.

The truth is that Buffett isn't just a value investor, or a quality investor. His real skill lies in grasping what his investment edge is at any point. When you manage millions, you can have an edge in obscure small caps. When you manage billions, you might have an edge in quality large caps instead (similar to Nick Train or Terry Smith in the UK). Buffett's edge is his reputation and his vast pool of liquidity.

When no one else can lend you money, Buffett can bail you out as long as you can pay up for his stamp of approval. You can't copy Buffett's style, but you can work out whether you have some sort of edge. And if you don't, then you can still follow Buffett's advice save regularly into cheap index funds, and put your time to more profitable use than fretting over the market's ups and downs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why we need a little patience

Why we need a little patienceAdvertisement Feature In volatile markets it’s easy to get spooked and sell your investments. But that could cost you many thousands of pounds. A patient approach can be much more rewarding.

-

The dangers of derivatives as the “Goldilocks era” ends

The dangers of derivatives as the “Goldilocks era” endsEditor's letter This is no longer a benign environment for investors, says Andrew Van Sickle. But – as the recent pension-fund derivatives blow-up shows – not everybody seems to have grasped that.

-

How Warren Buffett built his fortune

How Warren Buffett built his fortuneAnalysis Warren Buffett is considered by many to be the best investor of all time. We examine how much Buffett is worth and how he made his fortune.

-

A simple lesson from Warren Buffett that even children can learn

A simple lesson from Warren Buffett that even children can learnAnalysis Warren Buffett has an incredible investment record. And at the core of his strategy there is one very simple principle. Rupert Hargreaves explains what it is and how it can help you.

-

Why investors should beware of corporate waffle

Why investors should beware of corporate waffleAdvice When top executives try to retreat behind impenetrable jargon, investors should be very sceptical, says John Stepek.

-

A lesson for value investors from investor Howard Marks

A lesson for value investors from investor Howard MarksAdvice Value investors need to open their minds, says US investor Howard Marks. But why is he saying it now?

-

Why investment forecasting is futile

Opinion Every year events prove that forecasting is futile and 2020 was no exception, says Bill Miller, chairman and chief investment officer of Miller Value Partners.

-

What is value investing?

What is value investing?Value investing covers a broad range of bases, but the approach hinges on identifying companies that are worth more than their price suggests.