A simple lesson from Warren Buffett that even children can learn

Warren Buffett has an incredible investment record. And at the core of his strategy there is one very simple principle. Rupert Hargreaves explains what it is and how it can help you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Warren Buffett is widely considered to be one of the greatest investors of all time, and his record speaks for itself.

Shares in Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), the corporation the investor has managed since 1965, have achieved an average compound annual gain of 20.1% over the past 56 years, nearly double the return of the US-focused S&P 500 index.

Buffett is also a relative rarity in the investment world in that he is a household name (especially in the US) thanks in part to his folksy manner and open-book style of investing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

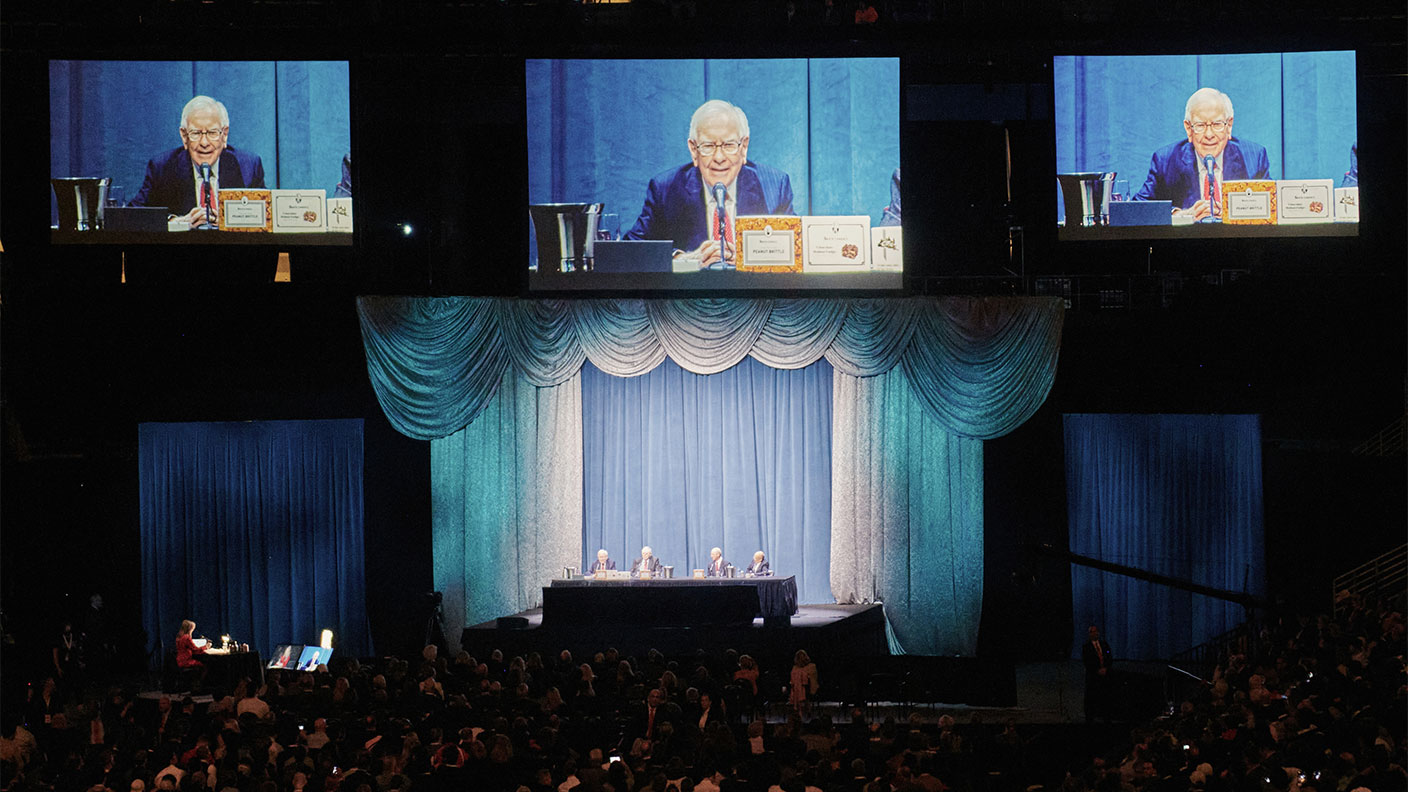

Every year thousands of shareholders attend Berkshire’s annual meeting (AGM) where Buffett and his right-hand man, Charlie Munger, spend hours carefully answering audience questions on everything from politics to business, investing, corporate governance and the environment.

While the event is aimed primarily at Berkshire’s shareholders, considering Buffett’s experience and record there’s always something investors can learn from this highly successful individual.

There’s a difference between the stockmarket and the underlying business

If I had to pick out just one lesson from this year’s AGM, I’d have to pick Buffett’s comments on market timing.

Responding to an audience question, he said, “I don’t think we’ve ever made a decision where either one of us has either said or been thinking we should buy or sell based on what the market is going to do, or for that matter, on what the economy’s going to do. We don’t know.”

Timing the market is usually a fool’s errand; most research shows it’s almost impossible to do and any investor who’s been around for a few years will know that all too well.

When investing for the long term, it’s not whether you buy a stock at 100p or 110p that makes the difference, it’s how long you hold that stock for and how much value the business creates in the meantime (this applies to funds as well).

Over the past 70 years, (Buffett first started investing money for others in the mid-1950s) Buffett has seen recessions, depressions, wars, periods of inflation, central bank tightening cycles, monetary easing cycles, market crashes, market bubbles and civil unrest.

You name it, he’s been through it. Yet he’s never moved away from his basic strategy of buying high-quality companies when they look cheap, and avoiding them when they look expensive.

Since the beginning of his career Buffett has invested following the principle that a share is a piece of a business, not a gambling chip in a casino. He looks through the market and focuses on a company’s fundamentals to determine how much the underlying business is worth. He’s not bothered by what the rest of the market is doing.

The simple principle at the core of Buffett’s strategy

It might seem simple, but this differentiator lies at the heart of Buffett’s strategy: he buys businesses, not stocks. He is looking to buy businesses on the cheap when the market offers him the chance. He is not trying to outsmart the market and predict the future.

This is a strategy any investor can follow. In fact, Buffett believes it’s something even children can pick up.

“We’ve been reasonably good at figuring out when we were getting enough for our money. And we had no idea when we bought anything, but we always hoped it would be down for a while so we could buy more. ... I mean, that stuff, you could learn in fourth grade,” he told his audience last weekend.

The approach has cost him some opportunities, but it has also saved Buffett from making plenty of mistakes, and that’s far more important.

It’s very easy to lose money. It’s far harder to make it, a fact Buffett knows all too well. So rather than trying to guess what the future holds for the market, he sticks to what he knows – buying businesses at attractive prices.

Considering his record, it’s hard to argue against this approach.

Disclosure: Rupert Hargreaves owns shares in Berkshire Hathaway.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

The outlook for stocks is improving

The outlook for stocks is improvingThis is the best of times for investors, says Max King. Global risks are receding, but few have noticed.

-

The building blocks for an income strategy: resilience, growth and diversification

The building blocks for an income strategy: resilience, growth and diversificationAdvertisement Feature Iain Pyle, Investment Manager, Shires Income plc

-

Investment platforms offering measly interest rates on cash holdings – is your cash working hard enough?

Investment platforms offering measly interest rates on cash holdings – is your cash working hard enough?The interest rate on cash you hold within an investment account can be as low as 0.75%. We look at the worst cash rates on the market, and what you should do with your cash instead.

-

Rethinking ESG investing

Rethinking ESG investingAnalysis Sustainable ESG funds are coming under attack for a lack of focus. Investors need to be selective

-

Can a woman deliver you better returns?

Can a woman deliver you better returns?Tips Women often make better stock pickers than men, delivering stronger returns for investors - but with fewer females managing funds, how can you make sure you take advantage of the feminist touch when picking funds? Kalpana Fitzpatrick on how to filter funds run by women and why it matters.

-

Flat fees vs percentage fees - are you paying too much for your investments?

Flat fees vs percentage fees - are you paying too much for your investments?We investigate whether it’s better to choose an investment platform with flat fees, or whether percentage charges could work out cheaper.

-

What is a dividend yield?

What is a dividend yield?Videos Learn what a dividend yield is and what it can tell investors about a company's plans to return profits to its investors.

-

Fund platform launches low cost £4.99 a month service for small investors - we see how it compares

Fund platform launches low cost £4.99 a month service for small investors - we see how it comparesAdvice Aimed at investors with small investment pots of £30k or less, fund platform interactive investors has launched a low costs service - but is it any good and how does it compare to rivals?