Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

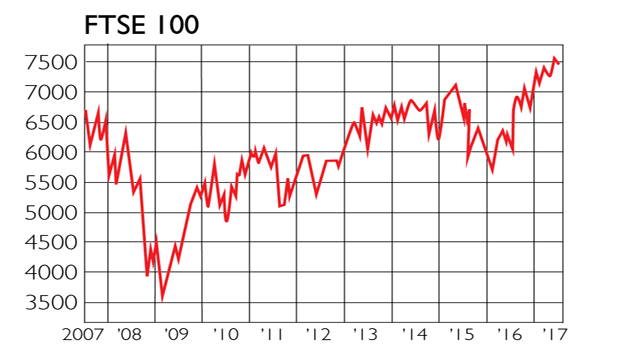

Britain's blue-chip index has hit a series of new record highs in the past few months, gaining 17% since the Brexit referendum. But this could be as good as it gets for a while. One reason to think so is the dwindling boost from sterling. For much of the past year, a weak pound has been good news for blue-chip equities, as many of them are large multinationals whose foreign earnings are boosted by a fall in sterling, says Richard Barley in The Wall Street Journal. Only 26% of FTSE 100 sales are made in the UK.

Now, however, the pound has stabilised, and even risen slightly, so a significant boost from this quarter looks unlikely. Indeed, the last meeting of the Monetary Policy Committee showed that three members now want to raise interest rates. The prospect of higher rates implies a greater return on UK assets, bolstering demand for sterling.

The resilience of the economy has also helped foster a positive view of British stocks in general, but while the economy should stay solid, there is less scope for significant upward revisions to growth now, says Capital Economics. The prospect of higher rates is also a headwind for stocks. Valuations don't look especially cheap and the global backdrop "looks set to become less supportive".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wall Street, which sets the tone for world markets, is very expensive and corporate profit margins will be "squeezed" by the tight labour market. Still, while stocks may not rise much further from here, they are unlikely to slump either. British equities "offer the richest dividend yields among developed countries", as Bloomberg's Blaise Robinson points out. That makes them "very attractive" to global yield-hunters.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now