That’s it – the low for sterling is in this time

The pound has gone as low against the dollar as it’s going to, says Dominic Frisby. We’re at a start of a new, multi-year bull market in sterling.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The low for the pound is in.We're at the start of a new, multi-year bull market in sterling.We're going to see gains of something like 40% over the next three to five years.

Am I talking utter nonsense? Possibly. It wouldn't be the first time.

But here are five reasons I think sterling is set to rally

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Reasons to rally No.1: The pound is cheap

I know I keep saying the pound is cheap, but that's because it is.

On a historical basis, the pound, over these last few months, has been as cheap against the dollar as it's ever been, save for a few months in late 1984, early 1985. In early 1985, it went to $1.04. Apart from then, $1.20-$1.25 is unprecedented. Means revert. Eventually.

It is also cheap against the euro, though not quite so extremely. It is currently €1.15. In 2009 it touched €1.02. But who remembers 2000? Back then it was €1.74.

On a purchasing power parity basis (PPP which values currencies on the idea that £1 should buy you roughly the same quantity of goods, regardless of which country you're in) the value is less clear.

Different analysts have come to different conclusions. Oliver Harvey, macro strategist at Deutsche Bank, for example, argues that the pound is not cheap on a PPP basis. Charles Ekins of Enigma Investments calculates the pound is undervalued by 24% against the dollar, and 6% against the euro (which is itself 21% undervalued versus the dollar). Ekins says PPP fair value is $1.63.

Yours truly compromises. Against the dollar I'd say around 15%. Against the euro I'm with Ekins and I'd say 5%-10%, although I stress that gauging PPP across the eurozone with all its different economies is rather arbitrary.

I'd say something like $1.40-$1.50 and €1.25-€1.30 are "fair value", whatever that is.

Of course, the price is what the market says it is, not what Dominic Frisby thinks is fair value. And as we all know, the market can remain what in one person's view might be irrational for a rather long time.

Reasons to rally No.2: People's worst Brexit fears are now priced in

The pound had a huge sell-off after the Brexit vote, we all know that. It had another huge sell-off after Theresa May's strong words at the Conservative Party conference last October. There was a hysterical selling climax with the flash crash that followed.

But when the prime minister announced on Monday that Article 50 will be triggered on 29 March, the pound was almost indifferent. It was down a few pips on the day, but by nothing unusual in the context of a typical day's trading. Given what has gone on before, one might have expected mayhem.

The inference is that the forex markets have got used to the idea the UK is leaving the European Union (EU).

Sure, there'll be volatility going forward. Every time negotiations reach a stand-off or an inflection point, we can expect volatility. But the biggest bombs have now been dropped.

Who knows, it's even possible that sensible agreements in the interests of all can be reached.

Reasons to rally No.3: Inflation is lurking. Interest rates may have to go up.

Last week it was revealed that one member of the Bank of England monetary policy committee (MPC) US academic Kristin Forbes voted for a rise in interest rates. It was the first split between policy-makers since last July.

It takes five MPC members to secure a rise in rates and, with Mark Carney in charge, the chances of aliens landing in Threadneedle Street looks a more likely occurrence than rate rises, but a vote is a vote all the same.

Then yesterday we discover that inflation (as measured by CPI), jumped to 2.3%. This is above the Bank's stated 2% target. The Bank resolutely ignored the target from 2009 through to 2013, so it could do so again.

But there is such anger now about the wealth inequality that the Bank's policies suppressing rates, not measuring inflation properly, quantitative easing have caused, maybe this time round it won't and rates will rise.

Some of that inflation has been imported. The price of raw materials has gone up as the pound has weakened. So that effect will fade in time if the pound goes up and even if it remains stable.

It's too early to be sure, but for the moment the map is pointing towards a little bit of inflation. Any rise in rates should put more upward pressure on the pound.

Reasons to rally No.4: The economy is not doing so badly

A booming economy and despite what many say, it is possible the post-Brexit economic boom will continue will mean more inflation and more upward pressure on rates. The reverse will mean deflationary pressures.

But a successful economy often enjoys an appreciating currency. You know me, I'm massively pro-Brexit. I think our economy will do better out of the EU than in. The EU fringe economies Switzerland, Norway, etc are all performing well and their currencies have done just fine. There's no reason the pound and the UK can't match or even surpass their performances, as far as I'm concerned.

Meanwhile, we have various elections coming up in Europe. It's possible that some of the victors and I'm specifically thinking of Marine Le Pen might be minded to cut the UK a good deal.

And there are the problems in southern Europe. I'm not entirely clear how this is going to pan out, but, structurally, I'd say it's the euro, not the pound you want to be worrying about.

Reasons to rally No.5: The pound's eight-year cycle

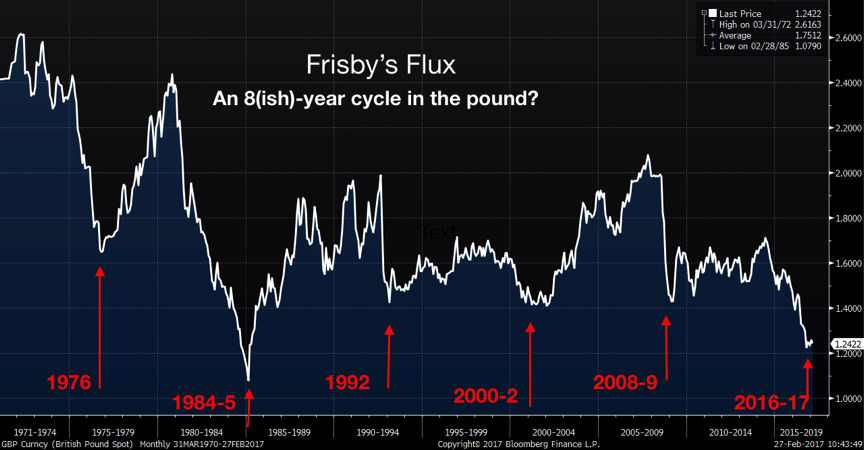

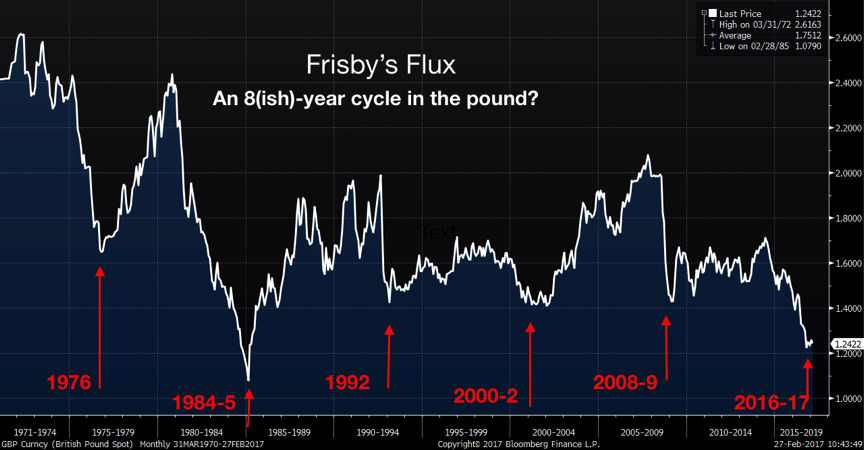

This is something I've written about before. I'm fully aware that when one starts talking about cycles, hocus pocus abounds. But every eight years or so, the pound does seem to experience an almighty sell-off.

It happened in 2008; in the dotcom crash after 2000; with Black Wednesday in 1992; with the miners' strike in 1984; and when Dennis Healey went cap in hand to the International Monetary Fund in 1976.

I believe I was the first to write about this, so I've dubbed the cycle "Frisby's Flux". I hope, for my sake, it catches on. I've illustrated it in the chart below.

After each of those sell-offs, the rallies over the next few years were, roughly: 50%, 80%, 25%, 50% and 20%. The mean rebound is around 45%. I'm not saying that's what we'll see now. But if we were to, we'd be up around $1.70. It's not impossible. We touched $1.70 in 2014.

But it's that mean rebound that led me to my wild claim in the introduction that sterling is going to see a 40% rally.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets