The five forecasts every investor should heed in 2017

After the political upheavals of 2016, a period of profound social and economic change is upon us. John Stepek looks at the big trends investors must be ready for next year.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

After the political upheavals of 2016, a period of profound social and economic changeis upon us. John Stepek looks at the big trends investors must be ready for next year.

Twenty sixteen was the year that populations around the globe said: "enough is enough". A decade on from the first inklings of the financial crisis, the global economy remains fragile, debt remains high and voters still fear for their jobs, their savings, and their future prosperity. Now they're demanding change and investors need to be ready for it.

As fund manager Gervais Williams puts it in his new book, The Retreat of Globalisation, "we have entered a period of profound social and therefore economic upheaval. We are on the cusp of a period of multi-decade change". How will this change manifest in 2017? Here are our "big picture" views on what's next for the world's most important economies and what it all means for your money.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

1. The US: the end of the bond bull market

The election of Donald Trump as US president-elect was the biggest surprise in a surprising year. We still don't know exactly what his policies will be, but judging from his appointees and actions so far, he's likely to be keen to cut taxes and regulation, and boost government spending (which is all pro-growth), but protectionist and aggressive towards China in particular (which isn't). This will all have any number of side-effects, but the most significant for investors is that it most likely spells the end of the bond bull market of the last 30-odd years.

One factor driving Trump's election and other upsets across the globe this year, including Brexit is disillusionment among electorates. Many voters feel that living standards for many have gone nowhere, as governments have handed responsibility for the economy to unelected central bankers who constantly seem to be threatening their hard-earned savings.

Electing Trump is a cry for the government to "do something!" and that's just what he plans to do. Whether it's by boosting infrastructure spending, cutting taxes to boost consumer demand and corporate investment, or raising protectionist barriers (which will result in higher domestic inflation), Trump's policies will be inflationary, on paper at least hence the rise in bond yields (and corresponding fall in prices) since his election.

Will he succeed? Goldman Sachs alumni Steven Mnuchin, the incoming US treasury secretary, clearly thinks so. He is reportedly keen to issue bonds with ultra-long maturities perhaps as long as 100 years. That would lengthen the average maturity date on America's bonds, allowing it to lock in ultra-low interest rates and reducing "rollover" risk the danger that when existing debt matures, it has to be refinanced at a much higher rate.

Of course, the death of the bond bull has been predicted many times before (sometimes by us) and it hasn't happened yet. And markets may well have run ahead of themselves in the panicky post-Trump euphoria. So how will we know if the trend has really turned? Watch for rising bond yields. As John Authers in the Financial Times puts it: "If the ten-year yield reaches 3% within a matterof weeks, which is perfectly conceivable, the weight of evidence is much stronger that the turn is in and that the trend is upward". We suspect that before 2017 is out, this is exactly what we'll have seen.

Investment implications

Neither bull nor bear markets move in straight lines, and bond yields have risen pretty rapidly since the low in July this year, so don't be surprised if (for example) jitters over Europe early next year send yields back down (bond prices move inversely to yields). But overall, we'd expect to see inflation pick up, yields rise, and the conversation to turn to central bank tightening rather than loosening although how quickly they do so is another matter.

If summer 2016 did indeed mark the low for yields, then this has major implications for investors. Firstly, we'd largely avoid bonds (hardly a new view for us). Rising inflation makes bonds look unappealing on current yields. Secondly, "bond proxies" the sorts of big blue chips that investors have been buying primarily for their high dividend yields are also under threat. We're not necessarily suggesting you dump all your high-yield stocks, but be prepared for cyclical stocks and cheap value plays to do better this year.

The good news for equity investors is that in the early stages, rising inflation is good for stocks. On top of that, a rising yield curve will boost banks' profits and encourage them to lend more money. That should be good for both the banking sector and the wider economy.

It's only when inflation starts to get out of hand persistently above the 4% mark or so and central banks get serious about raising interest rates to combat it, that equities start to struggle. The chances are we won't reach that point in 2017. Central banks have spent nearly a decade trying to spur inflation, so they are unlikely to raise rates aggressively until they are convinced there is no other option.

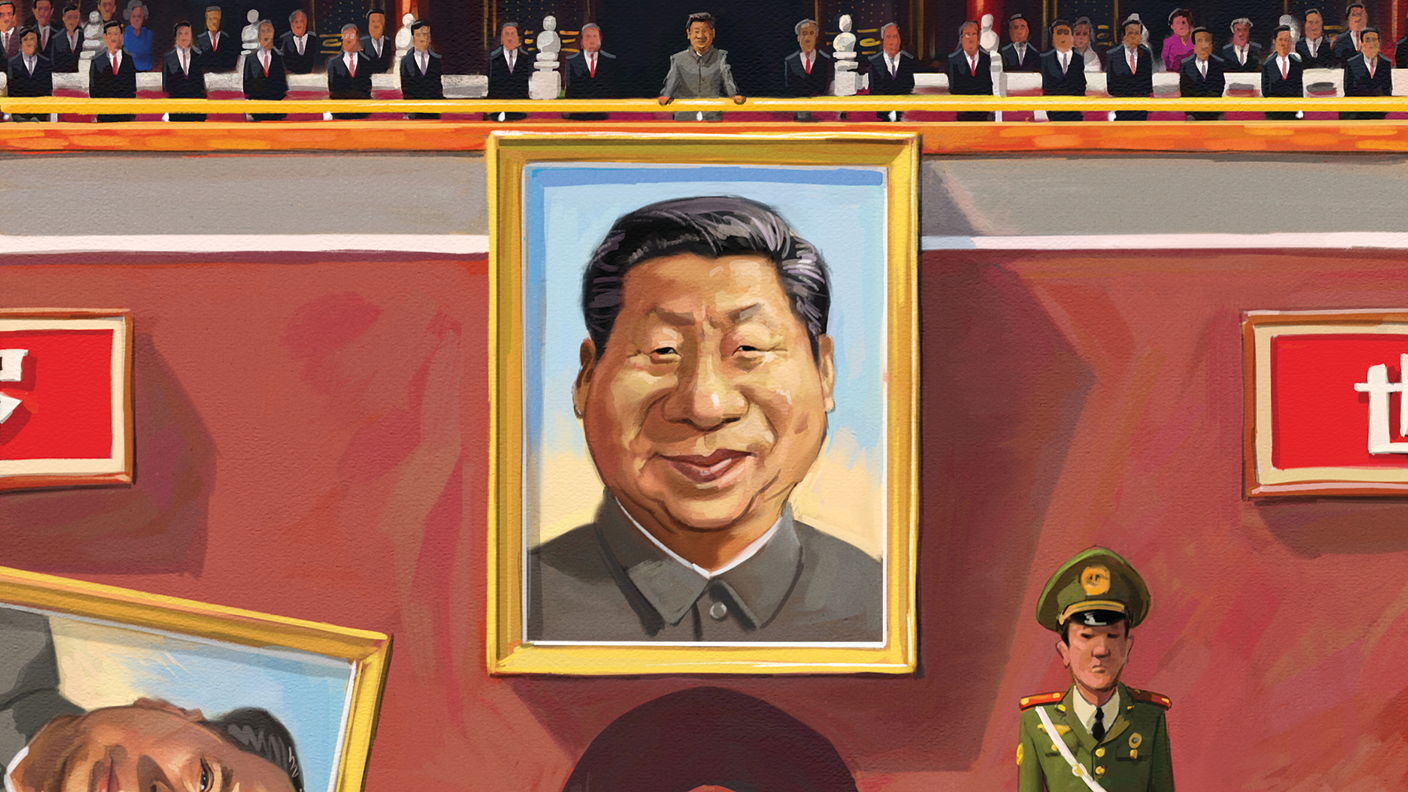

2. China: ending globalisation

Given Trump's constant railing against China on the campaign trail, his relationship with the burgeoning superpower was always likely to be tricky. This week he underlined that fact by having a phone conversation with Taiwanese president Tsai Ing-wen. He's the first US president (or president-elect) to do so since 1979, when formal diplomatic relations with Taiwan were shifted to China, which views Taiwan as a renegade province rather than an independent nation.

While China tried to shrug the move off as a product of Trump's naivety and Taiwan's deviousness, the call was, as David Rosenberg of Gluskin Sheff puts it, "a clear breach of protocol, and only a fool would suggest that this was not aimed at least partially at poking China in the eye".

Particularly as it was followed up with a distinctly unapologetic tweet from Trump: "Did China ask us if it was OK to devalue their currency (making it hard for our companies to compete), heavily tax our products going into their country (the US doesn't tax them), or to build a massive military complex in the middle of the South China Sea? I don't think so!"

The point is, Trump came to power on the back of an "America first", anti-globalisation policy, and the most obvious target of that policy is China. As the vice president-elect Mike Pence put it, the perception is that "we've just been losing to China for far too long economically".

So whether or not Trump imposes a 45% blanket tariff on all imports, or a 35% punishment tariff on US companies that "offshore" production then import products back into the US (which would wreak all kinds of havoc with supply chains), it's pretty clear that the pre-financial crisis deal with China you buy our debt, we'll buy your cheap plastic goods is at an end.

Protectionism is inflationary. So is sabre-rattling, if it eventually leads to conflict or even war, which is a possibility that can't be dismissed out of hand (the last spat over Taiwan, in the 1990s, ended with the US sailing warships through the Taiwan Strait).

However, as Diana Choyleva of Enodo Economics points out, even in the absence of protectionist measures from the US, China is likely to start exporting inflation in 2017 anyway. Why? One reason is that China's woeful demographics mean that the country's workforce is declining. China's cheap exports hinge partly on cheap labour. But the overall labour force shrunk by 1.5% between 2012 and 2015. This has driven up costs producer price inflation (prices at the factory gate) in China finally turned positive in October after five years of declines which squeezes profits for Chinese exporters.

Offsetting this somewhat is a fall in the Chinese currency the yuan has slid almost non-stop against the dollar since Trump's election, partly driven by capital leaving the country, and many economists argue that it is still overvalued. But even though the falling yuan might lower import costs in the short run for US consumers, that trend won't last long.

"It may initially become cheaper for Americans to buy Chinese yellow bath ducks, but they won't stay cheap for long if real consumer demand picks up speed," argues Choyleva. Of course, the sliding yuan also gives Trump the perfect opportunity to attack China as a "currency manipulator". This, according to Capital Economics, "means little in practice", yet it could unnerve markets expecting further tit-for-tat retaliation.

Investment implications

Rising tension between China and the US is inflationary (protectionism and "de-globalisation" increases production costs and reduces supply). It is also likely to be good news for the defence sector, which is already benefiting from hopes for increased government spending, particularly on cybersecurity.

Many of these stocks have done particularly well in the wake of Trump's victory, and this is likely to continue. However, another play on geopolitical uncertainty gold has done rather less well amid the Trump euphoria. This seems short-sighted there are way too many things that could go wrong this year for you not to own some insurance against such geopolitical jitters.

An anti-globalisation backlash would be bad news for many emerging markets, particularly if combined with a stronger US dollar. However, not all emerging markets are in the same boat. As Capital Economics points out, economies that are already fairly closed including India, Indonesia and Brazil should be better-placed to cope with rising protectionism. Economies reliant on outsourcing such as the Philippines could be hit hard, however.

3. Japan: the global reflation play

Japan spent much of 2016 as one of the world's worst-performing major markets. When Bank of Japan (BoJ) boss Haruhiko Kuroda's decision to turn interest rates negative at the start of the year did little more than spark fear over the banking sector's profit margins, it looked as though "Abenomics" had run out of steam. The Topix index fell by nearly 20% in the first half of the year. Yet since Trump's victory, the market has recovered substantially, and Japan is now Morgan Stanley's top pick for 2017.

What's changed? For one, in September, Kuroda promised to keep the ten-year Japanese government bond yield at 0%, until inflation has taken a firm hold. That was good timing this financial repression "is now causing a sharp widening in rates differentials, pushing the yen much lower", notes Societe Generale's Vincent Chaigneau. In other words, Japanese bonds look far less attractive now that bond yields are rising unchecked elsewhere. That has pushed the yen lower, which tends to drive Japanese stocks higher.

The BoJ's move, says Jim Leaviss of M&G, also means that "real" (after-inflation) yields will "drop as inflation picks up", which in turn means that financial conditions will get ever looser "as the recovery progresses". It also gives Japan's government a free rein to spend more if it wishes it has already approved a "stimulus package" worth around 5.5% of GDP.

As to the longer term, in a post-globalisation world, where workers are demanding a bigger share of corporate profits (companies have enjoyed an unusually high profit share for decades now), Japan is one nation where companies can afford to boost employees' salaries without necessarily crushing their earnings.

According to analysts at SMBC Nikko: "Since labour costs account for around 30% of sales, if firms were to hike wages 2%, they could avoid margin erosion by lifting selling prices 0.6% real wages would rise 1.4%, increasing consumption volumes and boosting corporate earnings it would be a win-win situation."

Combine that with the corporate reforms that are encouraging more and more Japanese firms to pay attention to their shareholders, and you have all you need to ignite a sustainable bull market, "fuelled by the prospect of fiscal expansion, rising earnings and a return of true animal spirits", as Morgan Stanley puts it.

Investment implications

Japan has suffered from stop-start deflation for more than two decades, so a genuine shift in the psychology of consumers and savers sparked by the return of inflation should be a huge boost to asset prices, while a more shareholder-friendly culture (dividend payouts and share buybacks are set to hit the highest levels on record this year) will continue to expand as reforming companies see the benefits. And in a world where the US is looking for Asian allies to offset China's strength, Japan is the obvious beneficiary. You can invest via an exchange-traded fund, but Japan is one place where good active managers have added a lot of value in recent years.

As Tim Price notes, Japan has a lot of pockets of deep value, particularly in the small- and mid-cap areas, and it makes sense to employ someone to root those companies out for you. Investment trusts with good five-year track records include Baillie Gifford Japan (LSE: BGFD) (up nearly 200%), Schroder Japan Growth (LSE: SJG) (up 125%), and JP Morgan Smaller Companies (LSE: JPS) (up 113%).

4. Europe: a French surprise

Europe's most immediate problem today is the Italian banks they are a mess. But this is a problem that everyone is aware of, and with a bit of flexibility, they can be saved. In the longer run, of course, Italy is chronically uncompetitive, and eventually it will have to come to terms with the fact that the euro is responsible for that.

We might even see snap elections called next year. But that's a slowburning problem. The eurozone country that has the greatest potential to cause disruption to the global financial system in 2017 is France. Yet it could also spring a huge, positive surprise. Here's why.

It looks likely that Franois Fillon of the Republican party and Marine Le Pen of the Front National will be squaring up to one another in the French presidential elections in May 2017. Fillon is a social conservative and an economic liberal, who admires Margaret Thatcher (quite something for a French politician publicly to admit to), and wants to push through "shock therapy" reforms, including scrapping the 35-hour working week, cutting civil service jobs, reducing taxes and slashing red tape.

Le Pen is a protectionist, pro-big government nationalist who wants to leave the European Union and return France to the franc. Clearly, if Le Pen wins, we'll see panic in the markets. Le Pen has been clear on her plans to hold a referendum on EU membership, and if she wins the vote, she'd presumably have a good chance of winning that too. If France left the EU and the euro, it would seriously damage the eurozone banking system and quite likely lead to at least a couple of sovereign defaults.

But if Fillon wins, notes Charles Gave of Gavekal, he offers "a genuine rethink of the role of the state in the economy". Should his reforms succeed, the French economy "could, after two decades of stagnation, prove itself to be a coiled spring (also, a weak euro exchange rate helps!)". The polls rate Fillon highly: his social conservatism and desire for a "more sovereign France" give him some of Le Pen's appeal without the leap of faith needed to leave the eurozone although mildly eurosceptic, he has no plans to exit the EU. In short, France could finally get its Thatcher moment which could turn out to be the biggest surprise of all.

Investment implications

As this year has amply demonstrated, betting on any specific outcome in any of Europe's myriad elections in 2017 is simply gambling but we can make some educated guesses on the general trend. Many countries are clearly fed up with economic conditions in Europe. However, for most even the French a vote to leave the euro means agreeing to sacrifice an unknown but significant chunk of their own wealth overnight, in exchange for the hope (but not the guarantee) of a brighter economic future for the nation as a whole.

That is a trade-off which we suspect would require even greater levels of anger among voters than we've seen so far. It's also worth noting that the European Central Bank has held the euro down at "southern Med" levels this year, and that growth in many regions is actually improving. So while we expect more vocal resistance to the EU and German "austerity", the euro will probably survive for another year.

If Fillon does win the French elections, expect French stocks to do well. If you're tempted, the Lyxor CAC 40 (LSE: CACX) exchange-traded fund tracks the French index. In the longer run, the resentment of its fellow nations may persuade Germany to quit it's perhaps the only eurozone country where voters have a strong financial incentive to do so, as a reborn deutschmark would likely soar against the euro.

5. Britain: sell London, buy the rest of the UK

Brexit has dominated the headlines in 2016, and it's sure to do so again in 2017. But the precise form it will take is unlikely to be clear for some time. We'll look in more detail at the potential scenarios in MoneyWeek's Christmas issue.

However, in the absence of Brexit itself actually happening highly unlikely next year, given the negotiating timetable we expect Britain to carry on much as it has this year, with employment and growth remaining relatively strong. It's also worth noting that Chancellor Philip Hammond kept his powder dry in the Autumn Statement so when March rolls around and the excitement around Article 50 peaks, it may be his cue to unleash some of the stimulus that many analysts had expected to see last month.

Investment implications

Sterling will likely bounce around with the Brexit headlines (the "softer" Brexit looks, the higher it will climb). But even though inflation is likely to rise sharply, expect the Bank of England to "look through" the data. That's mainly because of the single biggest threat to the UK economy the housing market. Prices in London are now falling according to many measures, as stamp-duty hikes and landlord taxation changes take effect, while mortgage rates may have bottomed out HSBC has just taken its best-selling two-year 0.99% fix-rate loan off the market. That's a further headwind.

However, without a sharp rise in interest rates, the market is likely to stall rather than collapse, and if economic growth continues apace and Hammond decides that a full-blown infrastructure splurge is needed to counteract Brexit we may see other, cheaper parts of the UK play catch up. So we'd be inclined to bet on growth in the regions versus London this year. One trade on this is Real Estate Investors (LSE: RLE), a real estate investment trust that focuses on commercial property in Birmingham and the Midlands.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

Macron has failed France – but there is still plenty to invest in

Macron has failed France – but there is still plenty to invest inCover Story Emmanuel Macron won a convincing victory in France's presidential election, but he has no clear vision for halting the country’s decline. Frédéric Guirinec looks at the state of France and picks 20 French stocks to buy.

-

The best markets in Asia and how to invest in them

The best markets in Asia and how to invest in themCover Story China and Indonesia should do well over the next year, while India and Vietnam have exceptional long-term prospects. From tech giants to banks, there are plenty of cheap stocks, says Rupert Foster

-

The three key risks for investors in China, and how to tackle them

The three key risks for investors in China, and how to tackle themCover Story Xi Jinping’s vision for the future of China is very different to the past. Stricter social control and the slow struggle to tackle problems in the economy may not be good news for markets, says Cris Sholto Heaton.

-

Japanese stocks offer plenty of promise at the right price

Japanese stocks offer plenty of promise at the right priceCover Story After decades of disappointment, Japan is packed with opportunities for investors, says Alex Rankine.

-

The five best ways to invest in India's promising future

The five best ways to invest in India's promising futureCover Story The pandemic has been catastrophic for India, yet the stockmarket is hitting record highs. Investors are right to remain optimistic about the long term, but they are pricing all the good news in, says Cris Sholto Heaton

-

How to invest in Vietnam – an emerging market that shone in a difficult year

How to invest in Vietnam – an emerging market that shone in a difficult yearCover Story Vietnam has been one of Asia’s most promising markets for a long time. Now it is shaking off the global coronavirus crisis and looking better than ever, says Cris Sholto Heaton.

-

China cracks down on its technology giants

China cracks down on its technology giantsCover Story Alibaba, Tencent and their peers grew fast by exploiting gaps in a heavily regulated economy. But with the Chinese government tightening the rules, their prospects are more uncertain. Cris Sholto Heaton looks at the sector and asks if it's worth buying in.