What sterling’s nosedive means for your money

The pound has collapsed as Theresa May talks tough on Brexit. But is this really a disaster – or a long-overdue rebalancing? John Stepek investigates

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The pound has collapsed as Theresa May talks tough on Brexit. But is this really a disaster or a long-overdue rebalancing? John Stepek investigates.

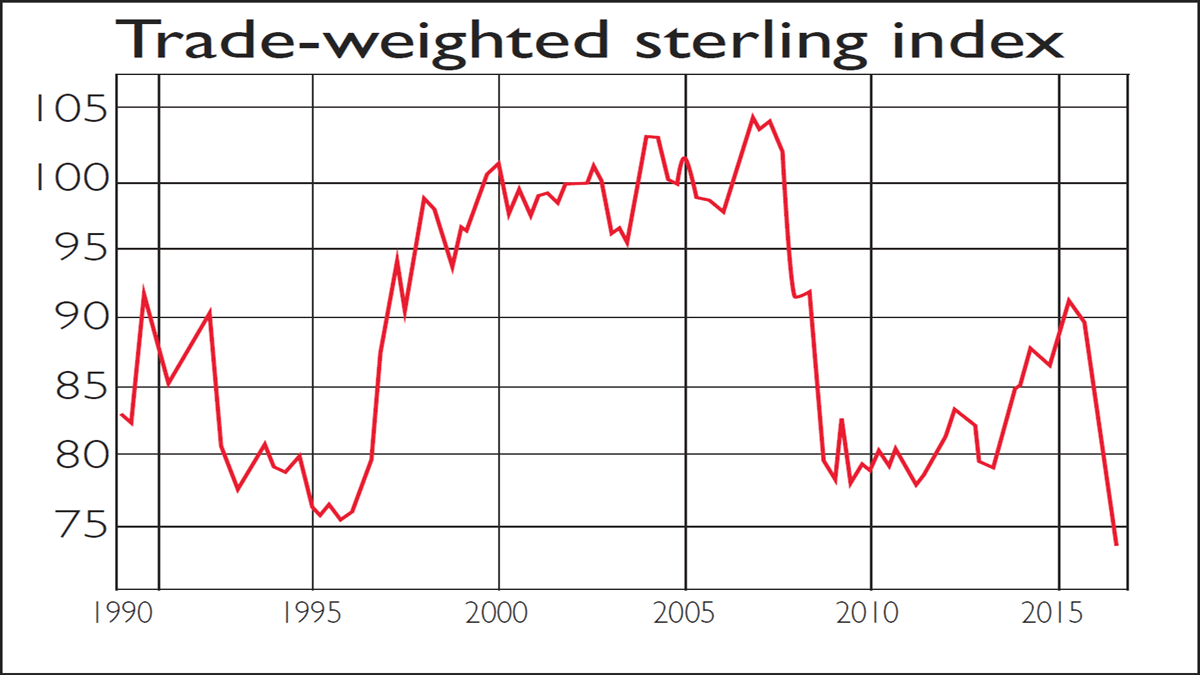

The pound hit a historic milestone this week: measured against a basket of the currencies of its main trading partners, it fell to an all-time low (see the chart below). The reason for the plunge was clear. There was talk of a "flash crash" amid illiquid markets, and a strengthening US dollar didn't help. But ultimately, the pound has crashed because markets are suddenly worried that Brexit really does mean Brexit. At the Conservative party conference, Prime Minister Theresa May not only announced plans to trigger Article 50 by the end of March next year, but also made plenty of noises about tougher immigration policies and taking a firmer hand with big business. As investment bank UniCredit put it: "It is not just about the UK's free access to the single market and trade becoming costlier; investors are now perplexed by the country's vision on immigration, openness and business-friendliness". In short, markets fear that a "hard" Brexit is now much more likely than the "soft" Brexit, or even the non-Brexit some had hoped for.

May's rhetoric is just a starting point for negotiation, of course. May is talking tough now, as are her European counterparts, but the two sides are likely to edge closer as Britain and the European Union (EU) figure out their post-Brexit relationship. Indeed, the pound rebounded a little mid-week after May suggested that parliament would have some say on whatever Brexit deal materialises. But does the crashing pound really prove that Brexit is a dire mistake? Or is it just a necessary step on the path to rebalancing the UK economy painful for some, but equally beneficial for others? More importantly, what does it mean for your money either way?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Rebalancing act

Sterling's collapse has, of course, been manna from heaven for those who still oppose the idea of Britain leaving the EU. In the absence of any other clear sign of economic or market collapse, the slide in the pound is a good way to justify dire warnings issued pre-referendum. As Martin Wolf puts it in the Financial Times with grim relish: "the markets have taught Theresa May a hard lesson on sovereignty". Yet there are two sides to this story. If Britain is genuine in its desire to have a more sustainable economic model that depends less on finance and trading overpriced houses with one another, then many economists believe that a falling pound could be exactly the medicine we need.

Amid the hand-wringing over the impact of Brexit on the City, many appear to have forgotten that it was Britain's overreliance on the financial sector that landed us in the mess we got into in 2007 and 2008 in the first place. "Britain within the EU became a magnet for speculative international financial capital," notes Ashoka Mody of the International Monetary Fund (IMF). This created "a property-buying frenzy in London and neighbouring districts. British banks channelled foreign speculative capital, and the finance-property bubble became a central feature of the British economy". This also drove up the value of the pound, and as a result, "British producers lost competitiveness at home and abroad. Producers' incentives to invest were weakened, leading to Britain's poor productivity performance". This also helped create our huge current-account deficit worth 7% of GDP as imports outstripped exports. This, as Larry Elliott notes in The Guardian, came at a huge cost. Big deficits "are financed either by Britons selling off their overseas assets or by investors from other countries buying up assets in the UK". In short, as Mody puts it: "The people of Britain were not richer before Brexit. On the contrary, they were living beyond their means".

Paul Krugman sums it up well in The New York Times. Krugman isn't MoneyWeek's usual economist of choice he has a fondness for advocating monetary extremism that we're not really on board with. But he was among the few "mainstream" economists who was clear-headed enough to remain sanguine about the short-term economic impact of Brexit before the EU referendum. Krugman argues that Britain's dependence on financial services is a form of Dutch disease but rather than commodities crowding out investment in other sectors, the dominant financial industry has squeezed out manufacturing investment. As Roger Bootle of Capital Economics and entrepreneur and Labour party donorJohn Mills argue in their book, The Real Sterling Crisis, this is a problem because the weakness of manufacturing "diminishes our prospective rate of productivity growth (since productivity growth is stronger in manufacturing than services), intensifies the problems associated with employing lower-skilled workers, increases inequality, and accentuates the regional divide".

So how do we resolve this? Put simply, "the correction for an excessive current-account deficit is a fall in the value of the currency", argues the US-based Center for Economic and Policy Research. "As the UK loses part of its financial industry in the fallout from Brexit, it will need increased output in other areas to fill the gap created A lower valued pound will make a wide range of UK-produced goods and services more competitive internationally, reducing the size of the country's trade deficit." In short, if the "march of the makers" and the "Northern powerhouse" are ever to be anything more than empty slogans, then Britain needs something more radical than a half-hearted reshuffling of regulatory responsibilities backed up by endless quantitative easing and the weaker pound can help with that. "If we were able to increase our net exports this would not only boost incomes and employment, but it would do so in parts of the economy that have recently done relatively badly the parts that have been heavily dependent upon manufacturing, thereby helping to address some of our country's problems with inequality," note Bootle and Mills. As Krugman puts it, "a weaker pound shouldn't be viewed as an additional cost from Brexit, it's just part of the adjustment".

Soft or hard, Brexit is Brexit

But won't a hard Brexit be bad news for trade? Not necessarily. As Bootle notes in The Daily Telegraph, splitting Brexit into "soft" and "hard" options just confuses the issue. The key point is whether or not Britain remains part of the single market, and this is by no means an unalloyed good membership prevents us from negotiating our own trade deals, and as a study by Adam Slater from Oxford Economics shows, our trade with the EU actually grew more slowly after we joined the single market than before. And, as Mody points out, even in a worst-case scenario where Brexit results in extra barriers to trade, "if the pound is about 20% overvalued, then the fuss about the laughably trivial few percentage points increase in tariffs after leaving the EU is really beside the point".

The good news is that the weakening pound is already having an impact on reducing our current-account deficit. Germany's DIHK Chambers of Industry and Commerce has warned that German exports to the UK are set to fall this year, rather than rising by 5% as previously estimated. Meanwhile, as Liam Halligan notes in The Sunday Telegraph: "British factories registered their best month in almost three years during September as export orders surged".

The return of inflation

Of course, it isn't all upside. A weaker currency will drive up the price of imported goods. The market now expects UK inflation to average more than 3% a year over the next ten years (hence the price of index-linked gilts has soared). Inflation has the potential to squeeze wage growth (assuming companies actually feel able to pass on price rises to consumers in such a competitive environment, which is by no means certain). Fear of inflation could also drive up borrowing costs investors don't want to buy assets that pay a fixed income if inflation is rising, as this erodes the "real" value of the income stream. That could make any planned "fiscal" stimulus spending from the government somewhat more costly to fund. Already, this week, the yield on the ten-year gilt (the UK government bond) has risen above 1% for the first time since the day of the EU referendum result. That's almost double the record low of 0.52% it hit on 12 August. In turn, that means government bond prices have fallen the ten-year has lost nearly 4% of its value since then, the 20-year is down 6.6%, and the 30-year has lost 9%. As Hargreaves Lansdown's Laith Khalaf notes, that's "pretty negative price action for a safe' asset".

It's good news for the nation's pension deficits. But "this sell-off hints at the damage that could be done to bond portfolios if interest rates were to rise to more normal levels". That said, for now, there's no need to worry. Britain's borrowing costs are still lower than the Treasury had budgeted for at the start of the year, so as Jonathan Loynes at Capital Economics notes, "the Chancellor will still save... on interest payments versus the expectations in the Budget".

It's also possible that the crash in sterling will prevent the Bank of England from cutting interest rates any further, as many analysts expect. In fact, it could even raise them. However, we wouldn't bet on it. If the Bank seriously believes that we're heading for a Brexit-driven recession, then the last thing it will want to do is raise rates. The Bank is only likely to step in if the fall in the pound turns into a full-blown collapse. That's certainly not impossible it happens regularly in emerging markets but it does remain unlikely. Perhaps more to the point, as Lord King, former governor of the Bank of England, put it: "Someone said the real danger of Brexit is you'll end up with higher interest rates, lower house prices and a lower exchange rate, and I thought: dream on. Because that's what we've been trying to achieve for the past three years now we have a chance of getting it".

In short, as David Bloom, head of FX strategy at HSBC, tells The Daily Telegraph, sterling "is a flexible currency and in a time like this, it needs to flex. It will help rebalance the economy if we want to enter into this new brave world". We look at how to position your portfolio for a weaker pound, and at the sectors best placed to profit from this shift below.

The best ways to benefit from a weaker pound

Let's make one thing clear. Trying to make money based purely on currency movements is a mug's game. You can figure out what a currency should do in theory, based on expectations for interest rates, inflation and economic growth. But turning that into a consistently profitable investment strategy is nigh-on impossible. It only takes one unexpected event Brexit, say to upturn everyone's forecasts and systems. So there's no guarantee that the pound will get weaker from here, or even remain weak.

Indeed, on a purchasing power parity basis, Charles Gave of Gavekal reckons the pound is about 10% undervalued versus the euro, and 17.5% versus the US dollar. When that scale of undervaluation has happened in the past, "within two years" the pound had returned to fair value. "Based on that pattern, the next two years should see the pound return 15%... not too shabby."

So from a big-picture perspective, the best way to protect your portfolio from any sterling shock is to diversify. Investors globally tend to suffer from a phenomenon known as "home country bias" they have too much money tied up in their own domestic markets. Don't be one of those investors. Own some gold (it's dollar-denominated and essentially a form of currency in its own right). Get exposure to overseas markets: we've regularly recommended Japan here; we also think it's worth having some money in the eurozone; and several emerging markets look attractive right now. Regardless of which way sterling goes next, it makes sense to avoid having your portfolio entirely focused on the UK.

However, for now it seems clear that even if the pound is near a bottom, it may take some time to regain its previous heights. That means that at least some of the rebalancing discussed above may come through and there are certainly some companies that will benefit from even a relatively short bout of sterling weakness. One nice thing about the London market and the FTSE 100 in particular is that it gives you lots of exposure to US dollar earnings (hence the FTSE hitting an all-time this week). Financial data firm Markit expects dividend payouts from the FTSE 350 to rise in value by 16% this quarter compared with last year, as blue chips like pharma giant GlaxoSmithKline (LSE: GSK), mining giant Rio Tinto (LSE: RIO), and oil majors BP (LSE: BP/) and Royal Dutch Shell (LSE: RDSB) make more in sterling terms.

As for promising exporters to back in March (while Brexit was still deemed unlikely) we tipped four UK exporters that looked set to profit from a weak pound: valve specialist Rotork (LSE: ROR), plastics manufacturer Victrex (LSE: VCT), aerospace giant Rolls-Royce (LSE: RR) and steam engineer Spirax-Sarco (LSE: SPX). All four companies have made solid gains since then, but with the pound far weaker than it was six months ago, they should continue to benefit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.