What Osborne’s pensions overhaul means for you

Pensions are changing – for the better in the long term. But in the short term, we’ve got a complicated mess. Charlie Corbett looks at the best ways to squirrel away your cash.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Pensions are changing for the better in the long term. But in the short term, we've got acomplicated mess. Charlie Corbett looks at the best ways to squirrel away your cash.

Aside from the resignations, recriminations and U-turns that George Osborne's proposed cuts to disabled benefits sparked, last week's Budget also made it clear that the chancellor is planning the wholesale dismantling of the current pensions system. That sounds dramatic. But his introduction of the Lifetime Isa (Lisa) which gives those aged under 40 £1 for every £4 they save is seen by many as a first step towards some kind of standardised "Pension Isa" for all.

This matters for two reasons: firstly, it makes it even clearer that the days when we could rely on the state, or even a benevolent employer, to fund our old age, are long gone. The onus in the future will be put firmly on the individual to take care of his or her long-term pension pot. The second, more immediate, concern for savers is what should they do now?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Osborne's longer-term aim is clearly to simplify a pensions system that has become off-puttingly complicated for most people to understand. That's a sensible ambition with which MoneyWeek is in wholehearted agreement. A simplified pensions system where people are freed to take responsibility for their own retirement and with tax rates that give people an incentive to save will ultimately reduce reliance on the state, and make us all wealthier.

The trouble with Osborne's pension plan is not the ultimate destination; it's how he plans to get us there. His ultimate aim might be to simplify the system, but British savers could be forgiven for feeling even more bewildered by the dizzying array of options now available to them. Whether you are saving for retirement, a house, children's education, or simply for a rainy day, the number of ways you can squirrel away your cash tax-efficiently has ballooned as has the amount you can save each year.

While all of this choice is undoubtedly positive in particular the chancellor's plan to increase the annual Isa allowance to £20,000 from April 2017 it could also leave even the savviest investor feeling dizzy. The list of tax-wrapper acronyms now reads like a code-breaker's handbook savers can now choose between a Sipp, Jisa, Isa, Lisa, H2BIsa and an If-Isa. The good news is that your options are more straightforward than they might look right now. We'll run through them below.

But first, it's worth understanding Osborne's overall aim. He clearly wants to simplify the current pensions system. He has a very good ulterior motive for that. He'd like to get his hands on the near-£35bn in tax relief that the exchequer foregoes each year. Currently, when you put money into a pension, you get tax relief at your basic rate. So a basic-rate taxpayer would pay in 80p to get £1 of contribution, while a higher-rate taxpayer would pay 60p. On the way out, your pension income is taxed at your marginal rate, except for the first 25%.

Osborne's aim is to get his hands on that tax relief, and prior to the latest Budget, there were plenty of hints that he might just do that, before he balked at the prospect of angering constituents ahead of the key referendum vote in June. One option was to introduce a flat rate of tax relief around the 25%-30% mark that would benefit basic-rate taxpayers but penalise higher-rate ones.

However, with the introduction of the Lisa it looks like he now favours the alternative route to treat pensions more like Isas. In Osborne's own words: "Pensions could be taxed like Isas. You pay in from taxed income and it's tax-free when you take it out. And in-between it receives a top-up from the government." And he can make the country's deficit figures look good by effectively pushing all that tax relief into the future (when people withdraw money from their Isas), when it's some other chancellor's problem.

Putting together a plan of action

So what does this mean for you? The introduction of the Lisa means there is now a very clear delineation between the long-term savings strategy for those who will be over 40 in April 2017, and for those who will be under 40 in April 2017. Let's start with the younger readers. If you are still going to be under 40 in April 2017 (and 18 or over) then the big question is: should I save for the long-term via a Lisa, or should I stick with a pension?

Let's look at the Lisa first. The Lisa is designed to be a slightly more flexible long-term savings vehicle than a pension. You can save up to £4,000 a year in it, and receive a 25% government bonus so up to £1,000 a year (effectively, you're getting basic-rate tax relief on your contributions). This £4,000 comes out of your overall £20,000 Isa allowance so if you put the maximum into your Lisa, you'll have £16,000 leftover to put in an Isa. The bonus will be paid up until your 50th birthday.

You have basically two options for what you do with the money. You can use it to buy your first home, anywhere in the UK, up to a value of £450,000. And it doesn't have to be one Lisa per property a couple can combine their Lisas. Incidentally, this also means that the Help-to-Buy Isa (H2BIsa) has effectively been superseded it will be possible to transfer money from an H2BIsa into the Lisa from next year.

Alternatively, you can hang on to the money until you are 60, and use it to fund your retirement. All withdrawals are tax-free. If you decide to withdraw the money early for any other reason, you'll be penalised. There's a 5% charge, plus the loss of the bonus payments as well as any growth or interest on them. In short, don't put money in a Lisa if it isn't for retirement or your first home.

According to calculations from accountancy firm Deloitte, quoted in the Financial Times by Aime Williams and Josephine Cumbo, a worker who puts the maximum into a Lisa over a 42-year career could build a fund of almost £700,000, assuming average growth of 5% a year. They would have contributed £168,000 and received government top-ups worth £32,000 over that time. How does this compare to saving via a pension?

If you are paying tax at a higher-rate (40% or 45%) but expect to be a lower-rate taxpayer when you retire (it's not always easy to plan for this, but the pensions freedom reforms have certainly made it easier), then the tax relief on a pension is significantly better. Also, you can contribute significantly more to a pension £40,000 a year (at least until you start to earn more than £150,000 a year, at which point the maximum contribution falls until it hits £10,000 a year).

However, the Lisa is a good additional option for pension savers who have maxed out contributions elsewhere. And with the lifetime allowance the amount you can save in your pension pot in total before punitive tax rates kick in set to drop this April to £1m from £1.25m, the Lisa is also a way for higher earners to squirrel away more money for the long run tax-efficiently.

The situation is different for basic-rate taxpayers. Richard Parkin, head of pensions at Fidelity International, argues that those paying basic-rate tax today will be "better off making additional saving in a Lisa rather than saving in a pension".

However, there's a catch. If you're an employee, the chances are that you have a workplace pension, and that your employer contributes to it. If that's the case, stick with the status quo "if your employer pays into a pension then it would be a bit daft to opt out... and lose the employer contribution", as Rebecca Taylor of the Chartered Institute for Securities and Investments tells the FT.

So if you have a pension that your employer contributes to, keep it, and divert any excess long-term savings into a Lisa.

Saving for the over-40s

If you are over 40 in April 2017, then the Lisa will not apply to you. So you can stick with your current plan. You should also probably feel rather gladthat Osborne decided not to target pensions tax relief in this particular Budget.

However, it's almost certainly a temporary reprieve. You might not be able to open a Lisa, but this move by the chancellor makes his plan of action clear. By starting with the under-40s, the chancellor has, "in effect, set up a live experiment for the much-mooted pensions Isa", as Jason Hollands of Tilney Bestinvest tells the Daily Mail. "There remains the possibility of a much more rapid return to a full-frontal assault on upfront tax relief on pensions", particularly now that Osborne is struggling to fill the gap left by his U-turn on disability payments.

Come the Autumn Statement with the Brexit referendum safely out of the way then Osborne (assuming he is still chancellor, of course, by no means guaranteed) may decide to move on tax relief. So between now and then, it's a good idea to continue making sure that you take full advantage of the higher-rate relief still available on pensions.

Of course, if you are in danger of breaching the lifetime allowance, it would make sense to start diverting money to your Isa if you're not already doing so. With the Isa limit now rising to £20,000, a couple can easily build up a very significant savings pot indeed. It also makes sense to have at least some of your long-term savings in an Isa in any case.

While the chancellor's original pension reforms have made pensions far more flexible and attractive, there's no guarantee that Osborne will be able to finish off his process of pension reforms. Politics is a fickle game and it's highly likely that any cash-starved future chancellor (particularly under a Jeremy Corbyn-headed government, say) would still find pension pots a very appealing target.

Of course, Isas could come under fire too, but as we've pointed out in the past, their transparency makes it trickier for governments to play around with them and get away with it. So it makes sense not to have all your eggs in one tax-efficient wrapper, as it were.

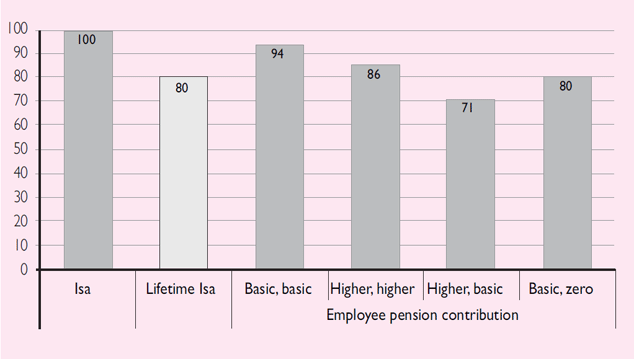

Pensions, Isas and Lisas compared

How much would a person have to contribute to an Isa, Lisa, or pension to reach a £100 contribution after tax relief? Stuart Adam, senior research economist at the Institute for Fiscal Studies, quoted on Citywire, has looked into the answer, summarised in the chart above.

Isa: there is no government top up, so £100 costs £100.

Lisa: saving £100 into a Lisa will only cost you £80.

Pensions: it depends on your tax rate while working, and your rate in retirement. Manypeople will have a 40% (higher) tax rate in work and a 20% (basic) tax rate in retirement. In this scenario, the table shows you need only pay £71 into your pension to get a £100 contribution.

Jargonbuster: what the acronyms mean

Individual savings accounts (Isas)

The original and simplest way to save. From April 2017 you can save £20,000 each year up from £15,240 tax-free in cash or stocks and shares.

Lifetime Isas (Lisas)

The new kid on the Isa block. If you are aged over 18 and under 40 in April 2017, then the government will give you a cash bonus of £1,000 for every £4,000 you save each year up to the age of 50. This can be put towards buying a first home, or withdrawn when you are 60 to fund your retirement. There are penalties for early withdrawal, and any money put towardsthe Lisa comes out of your annual Isa allowance.

Innovative finance Isa (If-Isa)

From April 2016, peer-to-peer lending investments will become eligible to be put in an Isa wrapper. Peer-to-peer lending enables investors to lend money directly to small businesses at higher rates than they could get elsewhere, but they run the risk of default in other words, you might not get your money back.

Help-to-buy Isa (H2BIsa)

For those saving to buy a first home, for every £200 yousave, you will get a government bonus of£50. The maximum government bonusyou can receive is £3,000 a year. It will bepossible for the under-40s to roll this intoa Lisa from next April.

Junior Isa (Jisa)

Just like an Isa, butfor your children. You (or a benevolentrelative) can save up to £4,080 each yearinto this Isa on behalf of your children and not pay tax on interest from cash orstockmarket returns. But beware: theyget access to the money when they are18, so it's quite possible that by then theywill have their own ideas about what todo with the cash.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now

-

How should you save for the long run?

Cover Story Changes to the Lifetime Allowance (LTA) will have to be factored into your pension planning. John Stepek explains.

-

Beware the government's pension grab

Beware the government's pension grabCover Story Relaxed about the pension lifetime allowance and its implications for your retirement planning? Then it’s time for a wake-up call, says James Ferguson.