Will interest rates rise next year?

Inflation is rising, employment is rising, wages are rising. Does that mean interest rates will rise too?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

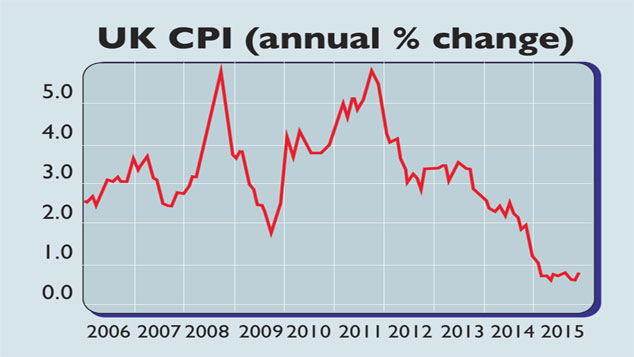

Inflation has edged back above zero. The annual increase in the consumer price index (CPI) climbed to 0.1% in November, from -0.1% the month before. Underlying inflation, stripping out volatile food and energy costs, ticked up to 1.2%. Meanwhile, employment rose further in the three months to September, taking the employment rate to a record high of 73.9%, and lowering the unemployment rate to another post-crisis low of 5.2%. The pre-crisis low was 4.7%, reached in 2005. But the claimant count measure of unemployment ticked up, and annual pay growth eased to 2.4% in October, from 3% in September.

What the commentators said

But perhaps not as long as the market thinks, said Capital Economics: its forward projections of interest rates imply no movement from the Bank until 2017. But overall inflation, even if oil prices stay stable at $40, would be back above 1% by next September as the much bigger falls of 2014 passes out of the annual comparison. Imported goods price inflation should climb too as the impact of sterling's recent strength ebbs. Meanwhile, there are signs that productivity is finally beginning to rise, which implies higher pay.

The weekly wage growth data is stronger than it looks, according to Pantheon Macroeconomics. It has been skewed of late by a slight dip in average weekly hours worked to 32. The Centre for Economics and Business Research, moreover, thinks the national living-wage policy could soon push earningsgrowth back up to an annual 3%.That in turn is set to fuel a 3% real increase in inflation-adjusted household spending, the key driver of growth. So the hawks at the bank "could soon have something to get their teeth into", said FT.com. The upshot? Capital Economics and Pantheon Macroeconomics are both pencilling in the first rate rise for the second quarter of 2016.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

UK interest rates live: rates held at 3.75%

UK interest rates live: rates held at 3.75%The Bank of England’s Monetary Policy Committee (MPC) met today to decide UK interest rates, and voted to hold rates at their current level

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension