Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The price of gold has slid to around $1,050 an ounce, its lowest level since February 2010. Gold pays no interest, and so tends to fall if interest rates on other assets are expected to rise.

The US Federal Reserve could start raising US rates as early as next month, making US securities more appealing. Gold is also priced in US dollars, and so struggles when the dollar is strong; the prospect of higher rates is also fuelling the dollar bull market.

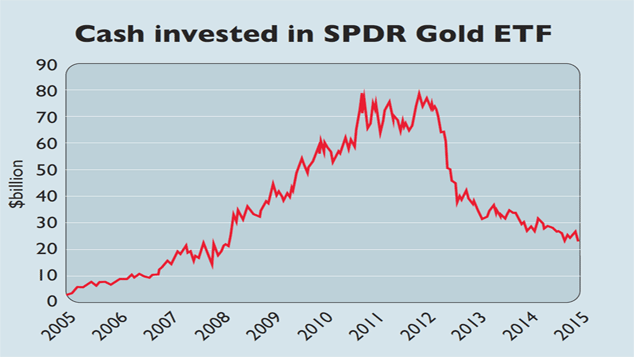

The slide in the amount of cash invested in America's biggest gold-backed exchange-traded find (ETF), SPDR Gold ETF, is a stark illustration of investors' growing disenchantment with gold. On the other hand, with gold this out of favour, there should be scope for a decent bounce if sentiment changes and people rush back in.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In light of ongoing concerns about financial markets, we'd still suggest owning some gold as portfolio insurance.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The challenge with currency hedging

The challenge with currency hedgingA weaker dollar will make currency hedges more appealing, but volatile rates may complicate the results

-

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?

Can Donald Trump fire Jay Powell – and what do his threats mean for investors?Donald Trump has been vocal in his criticism of Jerome "Jay" Powell, chairman of the Federal Reserve. What do his threats to fire him mean for markets and investors?

-

Freetrade’s new easy-access funds aim to beat top savings rates

Freetrade’s new easy-access funds aim to beat top savings ratesFreetrade has launched an easy-access exchange traded fund (ETF) range - here’s how the ETFs work and how they compare to the savings market

-

Go for value stocks to insure your portfolio against shocks, says James Montier

Go for value stocks to insure your portfolio against shocks, says James MontierInterview James Montier, at investment management group GMO, discusses value stocks and slow-burn Minsky moments with MoneyWeek.

-

Where do we go from here?

Where do we go from here?Features A new series of interviews from MoneyWeek

-

As China reopens, why pick an income strategy?

As China reopens, why pick an income strategy?Advertisement Feature Yoojeong Oh, Investment Manager, abrdn Asian Income Fund Limited