Where to look for property bargains

New tax rules will make residential property in the UK less attractive to buy-to-let investors. But certain areas of the country have more potential than others, says John Stepek.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

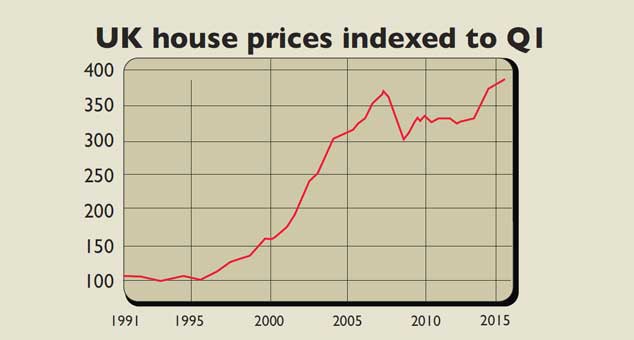

George Osborne's new tax rules will almost certainly make residential property in the UK less attractive to investors. But do certain areas have more potential than others? The UK housing market is often referred to as a bubble market, and affordability is certainly not improving, with average wages lagging house-price growth. However, if you take a step back from the UK-wide averages, then there's a very clear divide between north and south or more explicitly, between London and everywhere else.

If you look at Nationwide's price data, for example, then even in nominal terms (ie, ignoring inflation, which would make the figures look even worse), house prices in many areas are still lower than they were at the peak of the last bubble. In Northern Ireland, average house prices are still more than 40% down on the peak. The region has been battered by the fallout from Ireland's bubble, so it arguably should be excluded for these purposes. But prices in Scotland, Wales and the north of England are 5%-8% lower than in mid-2007 (a prettygrim return over eight years). In the Midlands, prices are flat. In the South West, prices are up about 5%, whilein East Anglia they are 7% higher.

Of course, certain towns and cities will have done better or worse than others it's hard to generalise across whole nations, as for Scotland and Wales. But for "mania" conditions, there's no question that London and its commuter belt in the South East are the only regions where we're genuinely back to post-crash bubble territory. London prices are roughly 40% higher than at the 2007 peak, with a 20% rise in the "outer metropolitan" area (the bits that are within commuting distance of London) and a 13% rise in the rest of the South East.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And according to an analysis of Land Registry data by The Guardian, London is by far the least-affordable area, with the average property price now 12 times the regional average income compared to 4.4 times in 1995 (which was also high by UK standards at the time). We're not suggesting you pile into buy-to-let now that the government has landlords in its sights, the latest tax raid is unlikely to be the last. But if you do, the figures suggest you should look beyond London.

Now's not the time to start up as a landlord

Make of all that what you will. The truth is that if you want to invest sensibly in buy-to-let property, what matters as with any sensible investment is the income that it'll produce for you over time. You can't bet on capital growth materialising (as many investors, happy with miniscule yields in the likes of London, seem to be doing right now), particularly given that as James notes above it's hard to see interest rates going lower from current levels, even if it takes a while for them to rise again. And therefore, the key point about the chancellor's changes to the buy-to-let tax regime is that they will make it harder to get a decent yield on buy-to-let, across the board. That has to make it less attractive as an asset class overall.

If you're still dead keen, remember that again, as with any other asset class your yield should reflect your risk. LendInvest's buy-to-let index might indicate double-digit yields in less salubrious areas of Glasgow, but that's because they're riskier bets than a waterfront flat in central London. And if, on the other hand, you can only muster up a single-digit yield, are you really better with a single buy-to-let property than a portfolio of blue-chip dividend-paying stocks? In all, given the alternatives, it's hard to make the case for buy-to-let right now now is not the time to start a career as an amateur landlord.

See also:

The death knell for buy-to-let?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.