Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The London Stock Exchange's Alternative Investment Market (Aim) celebrates its 20th anniversary this June, and few people are better placed to reflect on its investment merits or otherwise than star fund manager Giles Hargreave.

Hargreave, co-founder and chairman of investment manager Hargreave Hale, is widely regarded as one of the best if not the best small companies investor around in Britain, with a long-term record of success to back up that view.

At Hargreave Hale, he manages a clutch of funds under the Marlborough banner. They include the company's flagship Marlborough Special Situations, a unit trust that aims to provide investors with capital growth through exposure to a selected portfolio of listed small companies, new issues and firms that may have fallen on hard times but offer good recovery prospects.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

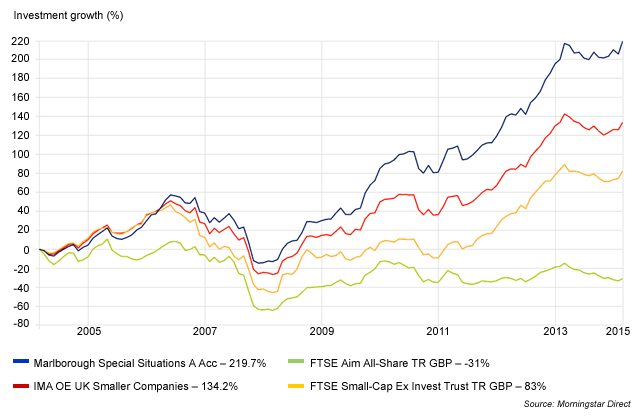

The £830m fund has returned an impressive 224% over ten years, vs 135% for its benchmark, the IMA Smaller Companies sector. Over five years it has delivered 133% vs 96% while its three-year performance stands at 58% vs 56%.

Ten-year performance of Marlborough Special Situations Fund versus benchmark and FTSE indices

Small companies, with a capitalisation of between £250 and £1bn, make up over 40% of the fund's portfolio, with micropcaps' defined as being valued at less the £250m accounting for another 34%. His other unit trust funds include the £935m Marlborough Multi-Cap Income, and the £411m Marlborough UK Micro Cap Growth.

Last October, Hargreave, who has worked in the financial sector since 1969, was ranked number one by investment adviser Tilney Bestinvest. The accolade followed a study by Tilney aimed at identifying the top 100 equity fund managers in the UK on the basis of their performance vs the benchmark, their consistency, and their experience.

And last week, broker Hargreaves Lansdown, to mark the FTSE 100 recovering its high of 15 years ago, published a study showing that Marlborough Special Situations has been the best performing UK fund over the intervening period: £10,000 invested in the fund in December 1999 would now be valued at £71,770. Two other funds focused on small companies are also in the broker's top five: Aberforth UK Small Companies and Investec UK Smaller, would have returned £59,400 and £57,690 respectively on the same basis.

Interviewed at his offices on London's Baker Street, Hargreave is keen to explain his investment strategy for small companies and reflect on the development of the Aim market.

"There are lots of very good companies on Aim boasting all the criteria you want to find in a good company like good management, profitability, and cash flow."

He first stresses that as an investor he does not look upon Aim as any different from any of the other markets: "You use the same analysis and analytic techniques. Obviously, on Aim they tend to be smaller companies and therefore inherently a little bit more speculative than the larger companies. But, I don't think you should look at Aim as something completely different from the rest of the equity market. There are lots of very good companies on Aim boasting all the criteria you want to find in a good company like good management, profitability, and cash flow."

Aim has, of course, got bigger since Hargreave first started probing the market. At launch on 19 June 1995 the index comprised just ten UK companies. Now there are nearly 1,100 companies 217 of them from overseas. Being more lightly regulated than the main market, there have inevitably been sore disappointments: "Sure, some of the overseas companies have turned out to be suspect, but there are lots of very good companies too on Aim."

But despite the bad apples that have cropped up over the years, Hargreave is not in favour of tightening up regulations: "If companies are determined to break the rules, then it doesn't really matter what regulations you've got. People are going to get around it. Obviously, there's the odd company that goes badly wrong. If they're foreign companies, maybe the regulators should just keep a closer eye on them."

Aim offers tax breaks galore

A major attraction of Aim is the "outstanding" tax break regime, says Hargreave. If held through an Isa, for instance, these breaks include no capital gains tax and no tax on dividend income. That means that while basic-rate taxpayers will pay the same inside or outside an Isa, higher rate payers will benefit from tax savings as they would be liable to more tax outside an Isa. And investors don't have to pay stamp duty on Aim share purchases, which immediately saves half a percent.

On top of all that, points out Hargreave, if you keep the portfolio in Aim shares in an Isa for a two-year period, investors can qualify for Business Property Relief and so up to 100% exemption from inheritance tax (IHT).

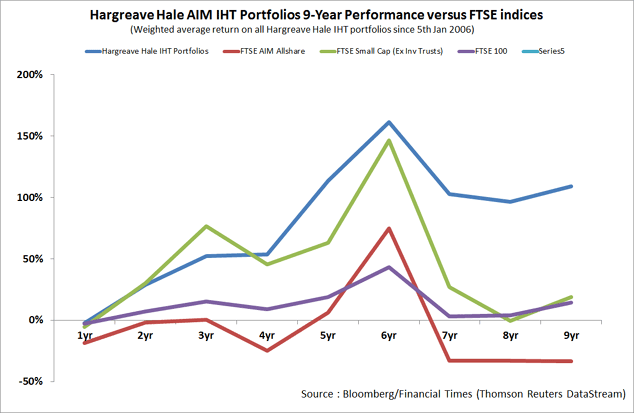

"That all amounts to a very, very strong case in favour of Aim it's a highly attractive collection of tax reliefs. Not surprisingly, we've seen substantial demand for our IHT portfolios. The returns there have been have been highly impressive. There are lots of shares [within these portfolios] which have doubled, tripled, quadrupled some even more."

The IHT portfolios at Hargreave Hales are managed by Richard Hallett. Most have around 20 stocks, and are constructed to be generally defensive in nature and aim to take advantage of market volatility or economic uncertainty: "Provided you stick to quality, simple companies and you avoid the speculative mining shares, the oil exploration shares, and to some extent, biotech which has actually performed well but it is not an area we are great experts in you can do extremely well."

The success of Hargreave Hale investment offerings rests very much on the quality of the assessments carried out by its managers and researchers. Face-to-face meetings with the management of companies of interest or in portfolios are key. "Normally a report will be written by whoever saw a particular company, which will then be circulated to everybody else. As far as Richard Hallett's IHT portfolios are concerned, he'll make up his own mind as fund manager."

Some of the managers run individual client portfolios, but Hargreave himself is now just focused on his Marlborough stable of funds. He stepped down as chief executive of the company last July, handing over the day-to-day running of the firm to long-standing insiders Stuart Brookes and Lee Finlayson. Their appointment to the helm means it's the first time the firm, founded in 1897 by Marsden Hargreave, has someone from outside the Hargreave family running it.

I ask whether he feels his company's success, especially in recent decades, and certainly its remarkable longevity, owes much to family ownership, and perhaps old fashioned' wealth management values and culture. He points out that although a cousin still works at the firm, Hargreave Hale has not been a family business as such for quite a while, as in 2001 Investec acquired a 35% stake in the company.

More important to the firm's success and future prospects, he feels, is the strength of the team: "We are very well resourced, we have a big team, which means we probably see more companies than most other fund managers. A lot of funds are run by one guy but we have many people, which gives us much more scope in terms of meeting companies.

"Provided you stick to quality, simple companies, you can do extremely well."

"There are more than 1,000 companies just on Aim. A lot of fund managers just would not have the time to see most of those companies. That's not true so much with us because we have lots of people and the resources to back them up. There's the senior fund managers, the analysts, and the juniors. Everybody meets companies. There are probably two or three company meetings taking place here right now. That's basically the secret of it. Plus, we've been doing it a long time."

With so many fund managers under pressure to cover the whole market, but lacking the time, resources and bodies to be able to do so, might it not be tempting for them to just copy successful Hargreave Hale portfolios for their own clients? Hargreave is clear on this: "They don't, because we run much more diversified funds than other people. It means we have a lot of stocks, but you can't have a lot of stocks unless you have a lot of people working on them.

"Our aim is to achieve good performance with low volatility: we want a consistent record. If you have too concentrated a portfolio in small caps, you can have terrific performance one year, and the run the danger those stocks have done all they can, become tired'. And so the following year you might have very poor performance. For us it's about diversified portfolios: it's our forte."

He believes another key reason for the firm's success is that it is a private, not a public, company: "Although we like to make profits and pay dividends, it's not the absolute be all and end all. What we really want to do is deliver performance for our clients and let the company prosper over the longer term. That's the idea."

The nimbleness of the private investor

Hargreave Hale serves both institutions and private investors. The one big advantage a private client investor has over the institutional is liquidity: "If you're dealing in units of 10,000 or 20,000 you can get in and out of virtually any stock. Once you start dealing in our size, which is a minimum of 100,000, and quite likely to be several million, you obviously can't. Therefore, if something goes wrong, you're going to get badly damaged."

"It's vital in our case that we do a lot of work before we start buying the shares. We limit the risk as best we can. But private investors can be more nimble when things do happen out of the blue. That's quite an advantage.

"For instance, when you get a profit warning on the company, normally the best thing to do obviously there are exceptions is to sell immediately if you can. If you are holding several million pounds' worth in a stock, you can't possibly do that. You have to live through it and then you have to decide after that how you're going to try and exit. That can be a very painful and very long-winded process. But a private client can ring his broker, sell, and that's it out in flash.

So what is his advice to those retail investors looking to gain exposure to the Aim market, maybe construct their own portfolios? He says: "If they have got some experience reading balance sheets, looking at a company's profitability records and so on then they can draw their own conclusions. All the company information and news is available on the web for the hard working investor."

As for risk factors, there are several that retail investors should be aware of including changes in management, substantial director sales, disappointing profit performance and increases in debt. "The debt position is something to be very wary of: the company might be delivering on profitability but the debt keeps going up, so therefore the profit is not working through fully into cash, so you want to look out for that."

Other issues for investors to keep an eye on include increasing competition for companies in the markets they're operating in. And if it's a very cyclical stock, watch out for changes in the macro conditions that can badly hurt the company.

"Private investors have a big advantage over the institutional investor: they can be more nimble when things happen out of the blue"

For those looking to hand over responsibility for their investments to a fund manager, it's important to have a good look at their record. "I think it's true to say that most good fund managers have good long-term records," says Hargreave. "You should look at their five-year record and the ten-year record and see if it's the same guy. That's important as well.

"If you're going to buy into a unit trust or investment trust, you want to check that the same guy has been running it and he's continuing to run it. Especially in the big firms, you quite often get fund managers changing, whereas in our case, our personnel hasn't changed at all. Indeed we've added to the team as the funds and the management have gotten bigger."

The longevity of the fund managers' careers at the firm suggests considerable time and effort goes into picking the right people in the first place. Indeed, Hargreave cannot recall the last time there was any loss at senior management level: "There's been very, very little change in personnel here, senior personnel. I don't think we've ever lost anybody out of our management side of any significance."

That negligible turnover begs the question of how the firm goes about identifying new people: "It's a good question. Obviously, there's a certain amount of luck in there. We don't have a massive process. We tend to be opportunistic. I think a lot of it has to do with the fact that we've been around for a long time and we know a lot of the characters in the industry.

"If we've got a space, we've a pretty good idea of where we might find the right person for that. I'm not going to name any names, but there is one fund manager in particular who I'd like to join our team at some stage, and I'm hoping he will do."

A rosy outlook for equities

Commenting on the current climate for investment and outlook, he says things are looking "very favourable for equities". He adds: We're starting to see money coming out of the bond market. There's nowhere else for it to go other than the equity market, which is why equity income is in demand. We have an equity income fund which is extremely popular because it yields 3.5%, a bit more than that. That's an obvious place for people to put money, I would say. Obviously you can't get that sort of return on deposit. So I think equity income funds will continue to do well.The big fall in oil price is a key development currently informing decision making at Hargreave Hale. The fall is clearly very good for consumers, meaning as it does that they will have more disposable income. And that implies a rosy outlook for consumer stocks. "Things we own include Greggs, Patisserie, Restaurant Group and Ted Baker. I'm not saying you should buy them, because some of them have had very good rises, but they are all quality consumer stocks which have done very well in the short and medium term. We think they will probably go on doing well."

"Money is coming out of the bond market. There's nowhere else for it to go other than the equity market."

Downside risks ahead include the upcoming general election in May: "It is a source of uncertainty and will no doubt have an effect on the market [as we get closer to it]. I don't think markets will take a socialist victory very well. It would be a pity, I think, if the Conservatives didn't win because I think they've done a good job. Particularly with cleaning up the mess which Labour left behind, which people seem to forget.

"We now have thriving economy. If you had said to me 15 years ago that we were going to have the situation whereby you had half the standard interest rates, or zero interest rates and negligible inflation which is amazing and a growth rate of around 3% well, it's quite extraordinary. It's as good as you can get, I would say. But that, of course, is the risk that things can't get much better than they are."

Even though he continues to manage his Marlborough funds, his stepping down from day to day management last year might have caused some of his investors' concern. It is clear, however, that he feels at the top of his game and is focused on continuing to deliver for them for some considerable time yet: "I've worked here a long time, I've been in the business of fund management a long time. One of the good things about fund management is that age isn't necessarily a bad thing. Witness Mister Buffett. He's 82. I'm only a very young 66. Plenty of time yet."

Related links

- How to invest in the UK's fastest-growing shares [FREE REPORT]

- Invest in Aim shares: Everything you need to know

- Aim shares- find more related articles

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kam is a former deputy editor at Hemscott Invest and online editor, City A.M and he was also previously the Digital Editor at IFA Magazine. Kam is currently a senior journalist at The Global Treasurer and contributes to MoneyWeek. Kam shares expertise on the FTSE 100, investing and global stocks.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Somero: trading this overlooked bargain

Somero: trading this overlooked bargainFeatures Mechanical-screed maker Somero dominates its niche and is attractively valued. Matthew Partridge picks the best way to trade it.

-

How to find big profits in small companies

How to find big profits in small companiesCover Story The small- and micro-cap sectors are risky and volatile. But with careful research and patience, investors could make huge gains. Matthew Partridge explains how to find the market’s top tiddlers.

-

The hidden gems on Aim, London's junior market

The hidden gems on Aim, London's junior marketFeatures Aim, London’s junior market, is risky – but you can find solid stocks at low prices. Scott Longley reports.

-

Three Aim-listed firms that will thrive in a post-Brexit world

Opinion Matt Tonge and Victoria Stevens of the Liontrust UK Smaller Companies Fund pick three Aim-listed firms that will survive Brexit turmoil.

-

Fetch! The Chinese small-cap stocks to buy in the Year of the Dog

Opinion Each week, a professional investor tells us where she’d put her money. This week: Tiffany Hsiao of Matthews Asia selects three Chinese small-cap stocks with exciting potential.

-

Small and mid-cap stocks with big potential

Opinion Professional investor Guy Anderson of the Mercantile Investment Trust selects three small and medium-sized firms with promising prospects that the market has missed.

-

Get cheap, reliable growth from smaller companies

Get cheap, reliable growth from smaller companiesFeatures One of the most reliable long-term investment trends is the long-term outperformance of smaller companies over blue chips. Max King picks some of the best ways to buy into this growth.

-

Now the bitcoin bubble’s burst, what’s the next big thing?

Now the bitcoin bubble’s burst, what’s the next big thing?Features Forget bitcoin, if you want to increase your wealth faster than most other people, you need to find the next big thing. Merryn Somerset Webb suggests some places to look.