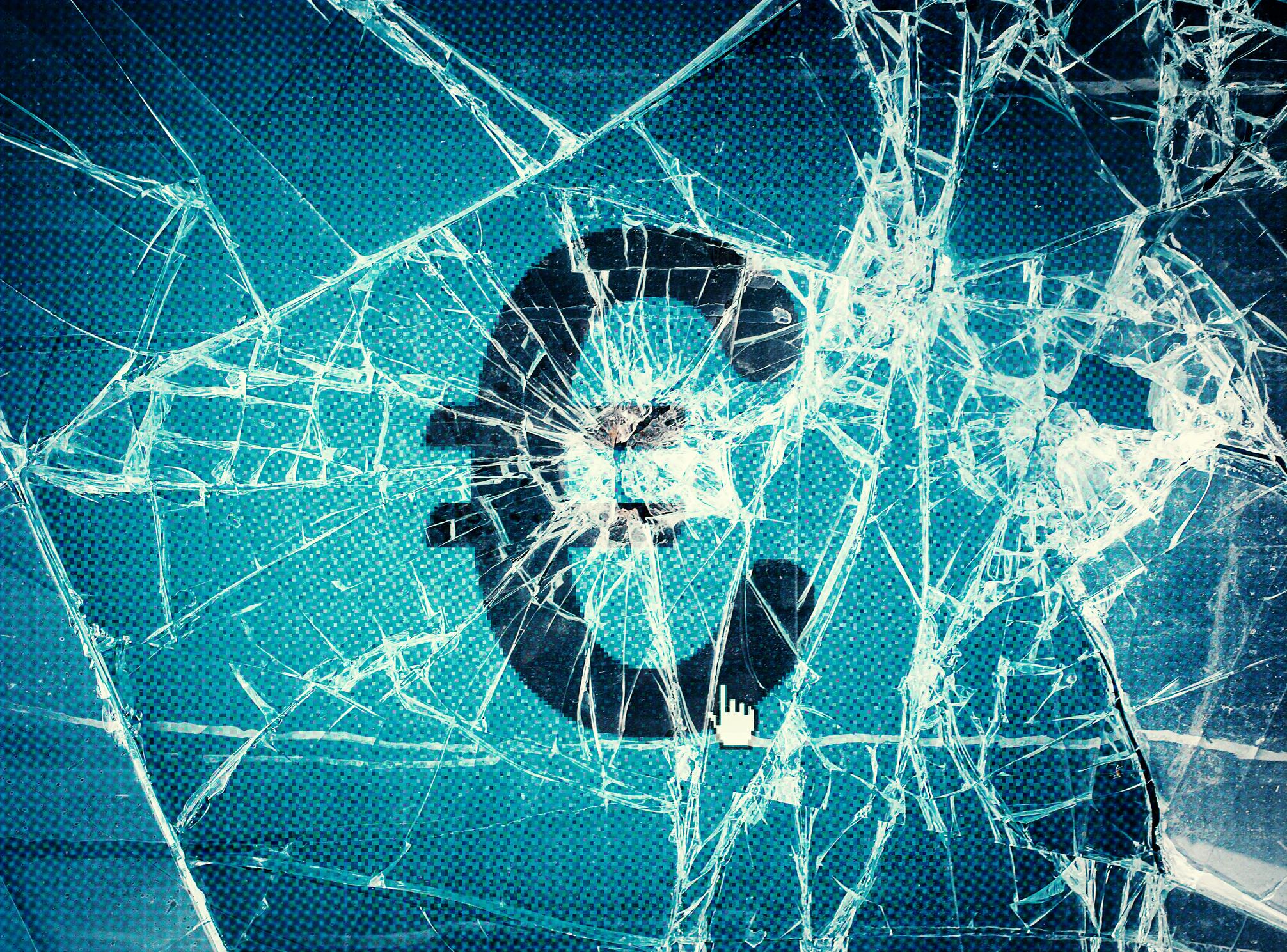

The best ways to profit from the euro crash

With ECB money-printing and low interest rates, the euro is crashing spectacularly. John Stepek looks at what it means for your investments, and how you can profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The currency wars are really heating up.

The euro has absolutely cratered since European Central Bank boss Mario Draghi gave the green light to quantitative easing (QE).

Now all the talk is of the euro going to parity' with the dollar. In other words, one euro will buy you just one US dollar. It's not so long ago that a euro would get you $1.40.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

As a side effect, it's also tanked against the pound. Which is cracking news if you're off for a holiday in the eurozone this year.

But what does it mean for your investments?

Will one dollar buy one whole euro soon?

On the one hand, the European Central Bank (ECB) has just started printing money to buy bonds. That's driven interest rates down to record low levels. Money printing plus low interest rates makes for a very undesirable currency.

On the other, the US central bank, the Federal Reserve, is on the verge of raising interest rates (probably). US government bonds also have higher yields than most eurozone government bonds too, which makes the carry trade' (borrowing in a low-yield, weak currency to buy higher-yielding assets in a strong one) attractive.

However, the speed and extent of the euro crashhas been quite spectacular. And now you've got investment banks all over the place predicting parity'. It's the sort of thing that would normally make you think that sentiment had swung a bit far in the too bearish' direction.

And as James Mackintosh rightly points out in the FT, the euro really shouldn't be a one-way bet. The euro has a "record high" trade balance in other words, it exports a lot more than it imports, in terms of value which should be "a small prop" for the currency. (That's because all the people buying goods from the eurozone need to sell their currency and buy euros.)

Also, while everyone tends to focus on the misery in the likes of Greece, the economic picture across Europe is simply not as grim as you might think. Consumer confidence and retail sales growth are at very healthy levels.

So the euro has got more than a few things going for it.

The euro isn't a one-way bet but it might take a while to turn around

And yet it's only really since Mario Draghi started to win the QE fight that the euro began to weaken against the US dollar. So the recent past suggests that the actions of central bankers trump economic reality when it comes to the currency markets.

To be clear, I have no interest in predicting where the euro will go in the short run. As far as I'm concerned, currency trading can be fun, but it's like poker. A very small number of people can make a profit from doing it, but for most of us, it's an entertaining pastime. (And for some people, it's a life-ruining addiction.)

So I'm not saying you should be short or long the euro right now as a trader. But in the longer run, for as long as Draghi is cheering on QE and the US Federal Reserve is thinking about raising interest rates, then I reckon it's going to be hard for the euro to pick itself up off the floor.

Of course, that might change. The Fed may blink and fail to raise rates judging by its lengthy track record of doing just that, I wouldn't want to bet against it.

However, as James Ferguson of the MacroStrategy Partnership pointed out in a recent edition of MoneyWeek magazine, the ECB is likely to have to do a lot more QE than anyone currently expects. So that may well offset any lack of backbone by the US central bank.

The QE trade so far has been to buy the stock markets of those countries whose currencies are being hit hardest. That's why I'm sticking with Europe, rather than the US. If you're not already a MoneyWeek subscriber, you can get a catch-up report to bring you up to speed on our views on Europe (and some of the many ways to play it, including currency-hedged options) and other markets, and also get your first four issues free here.

Of course, Europe's instability could also pose a big threat to markets. We've seen that the Greek situation just isn't going away. My colleague Tim Price has a very gloomy take on the whole story, but it's worth being aware of how bad things could get you can read his views here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

The French economy's Macron bubble is bursting

The French economy's Macron bubble is burstingCheap debt and a luxury boom have flattered the French economy. That streak of luck is running out.

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.

-

Bank of England raises interest rate by 0.5%

Bank of England raises interest rate by 0.5%News The Bank of England has raised interest rates once again, this time by 0.5%. This takes the bank’s base rate to 3.5%, the highest it’s been since 2008.

-

Eurozone inflation hits 10.7% in October

Eurozone inflation hits 10.7% in OctoberNews Inflation across the eurozone hit 10.7% in October. What does it mean for your money?

-

A forgotten lesson on the dangers of energy price caps

A forgotten lesson on the dangers of energy price capsAnalysis Liz Truss’s proposed energy price cap is an ambitious gamble. But a similar programme in Spain ended up being a fiasco, say Max King and Tom Murley. Here, they explain why Truss’s plan could be doomed to failure.

-

Central banks can’t solve our current economic problems

Central banks can’t solve our current economic problemsAnalysis Traditionally, as we hit recessionary times, central banks have lowered interest rates. But that’s not an option this time. If anyone can help dull the economic pain, it’s not the Bank of England, it’s the government. John Stepek explains why.