Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

My thanks to one Right Side reader who, having read last week's issue about contrarian investing, sent me a link with some really interesting information.

You see, last week I noted that contrarians often end up with more than their fair share of ugly ducklings in their portfolios. These are losing stocks and positions, just waiting for that swan moment'.

Moreover, it's quite often the case that a contrarian continues adding to such losing positions (there are caveats here that I won't go into now please refer to the full article for more).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now, here's the really interesting thing that was pointed out to me last week. An academic study undertaken recently into the effectiveness of what's called doubling down' doubling one's exposure to a losing position has found that there's great merit to the tactic.

As with all contrarian investing, the logic behind the idea is impeccable. I mean, if you've decided that something is cheap, and it then becomes cheaper, buying more is an obvious tactic.

Let's look at the outcome of the study, and I'll show you a great way of playing the double-down yourself. Not only that, I'll also mention a couple of traps to look out for when you're doing it.

The 'window dressers' really are bonkers

The work in question called, appropriately enough, Doubling Down was undertaken by Jonathan Rhinesmith, and published by Harvard University. You can read it here [pdf].

The analysis used the performance data of hedge funds from 1990 to 2013. During the period, the average monthly performance was 1% a very decent gain. You can see why many hedge fund managers are filthy rich.

But here's the thing: the average monthly performance for double down trades was a whopping 1.75%. Now, whilst this is past performance and isn't a reliable indicator of future performance, that's really something.

Rhinesmith writes: "By adding to a losing position the opposite of window dressing managers are making their losses particularly salient".

Window dressing' is the practice applied by most conventional fund managers of selling off the losers something I mentioned in that recent Right Side so that clients don't have to look at them.

The hedge fund winners, it would seem, do the opposite. And that makes their losses particularly salient' or, in normal parlance, it makes them stand out like a sore thumb'.

The point is, successful hedge fund managers have the latitude (and the brass neck) to highlight their losers it's all in an effort to turn them into winners. And it works.

However, this is risky business for private investors. We need to be careful.

Practical pointers on doubling down

As we've seen, the window dressers out there often sell the losers. Practically without thinking.

There may be an automatic order in the system to sell a stop-loss order should the stock fall by, say, 20%. The fund manager's thinking "I need to get out before I lose my shirt on this one!"

But only a fund manager that hasn't really done his homework on a stock will be happy to sell without full consideration of the facts. It's more like a gambler's formula than one of a thoughtful investor.

Contrarians do the opposite. So, you could follow a similar, but inverse strategy. That is, buy each time the stock falls a pre-determined amount 20%, or 30% could be appropriate.

Hey, you may even look forward to your stock going into the red so you can top up your holdings on the cheap.

But I strongly urge you not to just put an automatic order that would be very lazy. After all, if the stock's down as a result of some bad news, it's imperative that you reassess. Is the stock really still a buy? How has your fundamental valuation changed?

A tool that I use to help me make this call is one I've mentioned here a few times before the Bollinger band.

A bit of statistical wizardry will help you buy and sell at the right times

A Bollinger band is a volatility indicator you can overlay on a stock chart, or index.

Essentially, these bands are a bit of statistical wizardry that encapsulates the share's trading range at least, the range in which it'll trade 95% of the time, at any given time.

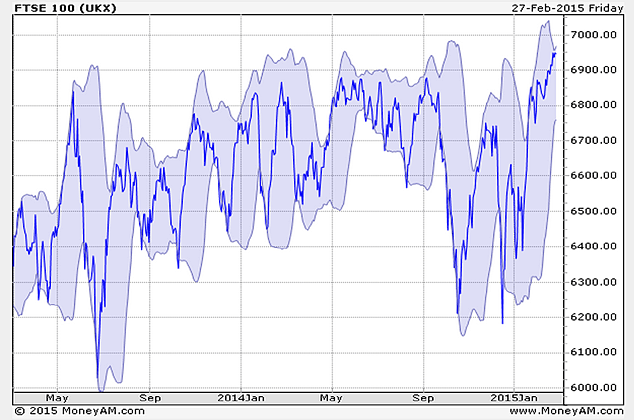

Below I've used the free chart package at MoneyWeek website. Go to the FTSE 100 chart. From there you can put in any stock and choose and hit the overlay Bollinger bands' button.

Here's the FTSE 100 over the last two years:

Two-year FTSE 100, with Bollinger band overlay

The premise of my tactic is simply: as with all shopping, the best time to go out and buy something is when it's offered at a good price, right? And that's as the price trades near its bottom band.

Now, never let it be said that these bands are infallible. You may buy as your stock hits the bottom of the band, only to find that it falls... thereby driving the band itself further down.

Look at the chart and you'll see plenty of examples. And here's the thing: providing that your conviction stands, that's when you double down.

In the case of the FTSE 100, it would have been right to buy the dips. You'll see that we can't help but have made money with this strategy.

Is doubling down for you?

I can't emphasise enough that the double-down strategy must only be used when dealing with quality stocks. Risky punts can go to zero. Doubling down all the way is dangerous.

At The Right Side's sister publication, The Fleet Street Letter, we only do it with quality stocks and in cases that we're convinced there's value. Most of all, if the story changes, then we must, must, must react and reassess.

For more info on FSL, and our strategy in general, just click here.

Anyway, there's absolutely no doubt in my mind that doubling down is an incredibly important factor in successful investing. Turning losers into double winners' is alchemy indeed.

Follow the rules, and always make sure that no specific position becomes too unwieldy. You don't want to skew your portfolio unnecessarily. If you've doubled down, then it's often worth cashing in half the position, should you get back to breakeven.

Refining the strategy is up to you. Be careful, and you should come out on top.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how