Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

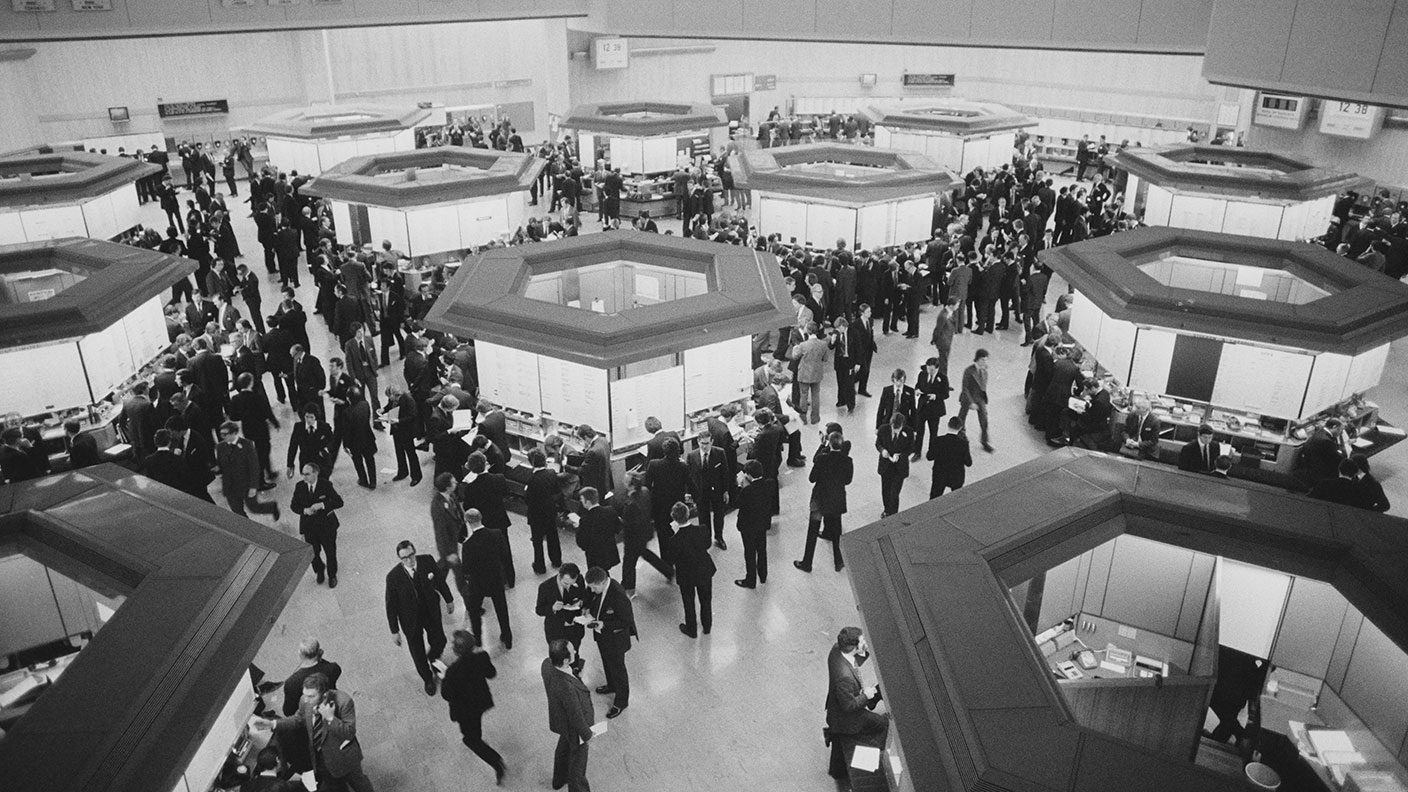

Before 1986, the City worked rather differently to the way it does today. Old Etonians would roll in from the shires mid-morning, depart shortly after for a civilised lunch and a bottle of very nice Bordeaux at a discreet restaurant somewhere, then hop in a cab to the club for a few snifters of single malt, before being whisked back first-class to London's leafy fringes.

If you wanted to buy a stock, you approached your broker, who placed the order with a “jobber” – cockney barrow-boy types who made the trade on behalf of the public schoolboys. It was all terribly, terribly cosy.

Unfortunately, it wasn't very competitive. London was being left behind as a financial centre by upstarts like New York – Wall Street was making ten times the number of trades that London was, while Frankfurt and Paris were starting to threaten London's position as the main financial centre in Europe.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Things were due a shake-up. And who better to shake things up than Mrs Thatcher? The old boys' network had to go, with regulation slashed to allow competition to flourish.

And so in 1986, the Financial Services Act deregulated the London Stock Exchange. The split between brokers and jobbers was abolished. Overseas firms were allowed to compete, and the rules governing ownership of exchange members were relaxed. Foreign firms rushed to London to set up shop, and there was a flurry of mergers and acquisitions as banks and financial houses vied for supremacy.

The deregulation coincided with the arrival of new technology, which made many of the old practices obsolete. Electronic trading was introduced. Exotic instruments such as derivatives were devised. The days of jobbers shouting and gesticulating across the trading floor were over, as trading was done over the phone or by computer.

London transformed itself into the world's most important financial centre, and its centre of gravity moved east to the brash new glass skyscrapers of Canary Wharf.

But was it all good? There is still much debate about the legacy of the Big Bang. And some claim the relaxed rules directly contributed to the financial crisis of 2008.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how