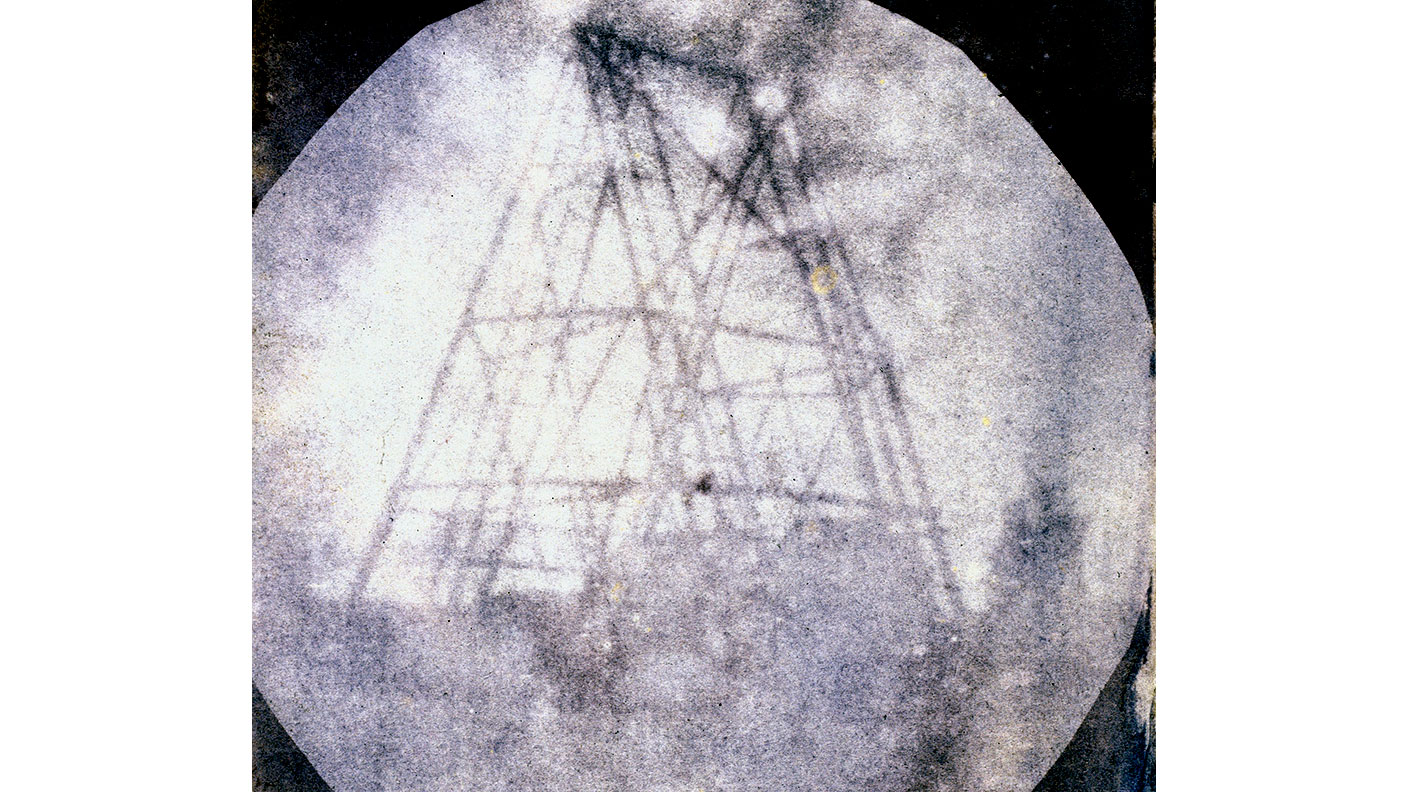

9 September 1839: Sir John Herschel takes the first glass-plate photograph

On this day in 1839, Sir John Herschel created the first glass-plate negative – a photographic technique that would remain in use in astronomy until the 1990s.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Cameras have been around for a very long time. We know the Chinese were playing around with pinhole cameras in the fifth century BC – a pinhole camera is simply a box with a small hole in the front; light enters through the hole and an upside-down image is displayed on the inside back wall of the box. We also know the Chinese were aware that certain chemicals underwent a change when exposed to light. Combine the two and you should have a photograph. Sadly, no ancient selfies have come down to us. But you never know

After that, the ancient Greeks toyed with the technology, then the Arabs and the Europeans after them, and on into the Renaissance. But it wasn't until the early 19th century that photography, as we understand it now, was born.

Frenchman Louis Daguerre is famous for inventing the daguerreotype – an early form of photography that used metal plates – in 1839. But on 9 September of that same year, our own Sir John Herschel created a photographic negative on a glass plate, using silver chloride. It is he who introduced the word “photography” into the English language.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Herschel was one of the great Victorian polymaths, happy to turn his hand at almost anything. Besides his pioneering work in photography, he excelled at botany, maths, chemistry and the family hobby: astronomy. His father was Sir William Herschel, after whom the space observatory, which blasted off in 2009, is named.

But why talk about astronomy? Because the glass-plate method (with a few modifications along the way) was ideal for photographing the skies. So successful in fact, that astronomers continued to use it into the 1990s.

If all that wasn't enough for one man (besides naming a whole bunch of planetary moons), Herschel also invented the “Cyanotype” method. Cyan is the blue colour used in printing, and the process was used to make “blueprints”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.