Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

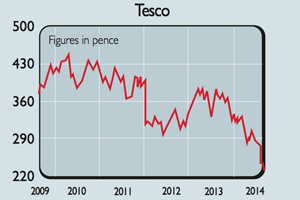

Most investors knew that Tesco (LSE: TSCO)was in a mess and probably weren't surprised when it issued another profit warning last week. However, a 75% cut in the dividend payout was even worse than many expected. Unsurprisingly, Tesco shares have fallen heavily since then.

But is this as bad as it gets for Tesco?I'm not so sure. I think things could still get a lot worse before they get better. Even though Tesco's shares have fallen a long way, they are by no means cheap. Tesco's problems cannot be fixed quickly.

In the UK, it has taken its eye off the ball and faces strong competition. It does not lead the market on price or quality and is stuck in no man's land between the discount supermarkets (Aldi and Lidl) and quality operators such as Sainsbury's, Waitrose and M&S.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

During the last years of Terry Leahy's reign, Tesco didn't spend enough money on its UK stores to keep them looking fresh. Instead, it sold lots of stores to property companies and then rented them back. The resulting cash was then reinvested into foreign ventures most of which have produced very disappointing returns for investors.

For years Tesco has struggled to generate large amounts of surplus or free cash flow certainly not enough to pay its dividend. The size of the proposed dividend cut shows how unsustainable the old dividend was.

Yet how on earth is Tesco going to boost its cash flow in the future? To win back customers it needs to cut prices. If the customers don't come back, sales, profits and cash flow will fall further. With lower sales, Tesco will get less generous terms from suppliers.

When sales were growing, generous credit terms boosted Tesco's trading cash flow. But with falling sales, this process could go into reverse. Tesco also needs to spend more money on its stores to make them more attractive to customers, which will reduce free cash flow further.

Tesco's aggressive sale and leaseback programme in recent years means that it has massive off-balance-sheet rent commitments of £15.9bn, according to its last annual report. Further sale and leaseback deals would be unwise for a business with falling sales, and that means Tesco can't raise any more cash from its property portfolio.

Tesco says that its trading profit will be around £2.4bn this year, and its market cap is currently £18.5bn. So if you add net debt of £6.7bn, you get an enterprise value of £25.2bn and an earnings yield of 9.5%.

However, Sainsbury's,which is arguably a better business right now, offers an earnings yield of 11%. So Sainsbury's is the cheaper share.

If Tesco offered the same yield as Sainsbury's with £2.4bn of profits, it would have an enterprise value of £21.8bn (2.4/0.11). That equates to a market cap of £15.1bn or a share price of 186p.

But what if profits don't bottom at £2.4bn and Tesco shares have to be cheaper than Sainsbury's by offering a yield of 12%?

Well, if Tesco cuts its operating margin to 3.5%, it would generate profit of £2.19bn on sales of £62.5bn. Put that on a 12% yield and you get an enterprise value of £18.2bn, which equates to a share price of only 142p.

But what about net asset value (NAV)? At the end of February, tangible NAV per share was 134p. Given the lower profit outlook, I wouldn't be surprised to see some big writedowns in the value of Tesco's supermarkets, which will reduce NAV further.

So you can't justify a share price anything close to 228p on a NAV basis. In short, now is not the time to buy Tesco.

Verdict: avoid

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

How to profit from rising food prices: which stocks should you invest in?

How to profit from rising food prices: which stocks should you invest in?Tips Food prices are rising – we look at the stocks to avoid and the one to invest in this sector.

-

Tesco looks well-placed to ride out the cost of living crisis – investors take note

Tesco looks well-placed to ride out the cost of living crisis – investors take noteAnalysis Surging inflation is bad news for retailers. But supermarket giant Tesco looks better placed to cope than most, says Rupert Hargreaves.

-

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bn

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bnNews Tesco has agreed to sell its southeast Asian operations to Thai conglomerate Charoen Pokphand for £8.2bn in cash.

-

Tesco should keep its Asian assets

Tesco should keep its Asian assetsOpinion The £7bn that Tesco could get for its Tesco Lotus business in Asia looks enticing. But holding on to it would be smarter, says Matthew Lynn.

-

Tesco cashes out of the mortgage business

Tesco cashes out of the mortgage businessFeatures Tesco Bank has left the mortgage market by selling its £3.7bn loan book. Its 23,000 customers will be moved to the Halifax, a subsidiary of Lloyds.

-

Tesco wields the axe

Tesco wields the axeFeatures Britain’s biggest supermarket is cutting back on staff and fresh food. Will the move prove counterproductive? Matthew Partridge reports.

-

If you'd invested in: Tesco and Associated British Foods

If you'd invested in: Tesco and Associated British FoodsFeatures Tesco has seen its market value rise almost 50% in a year, while AB Foods has seen shares slide despite a rise in profits.

-

What's behind Tesco’s alliance with Carrefour?

What's behind Tesco’s alliance with Carrefour?Features Tesco is clubbing together with French rival Carrefour to bulk buy own-label goods in an effort to cut costs. Will it succeed? Ben Judge reports.