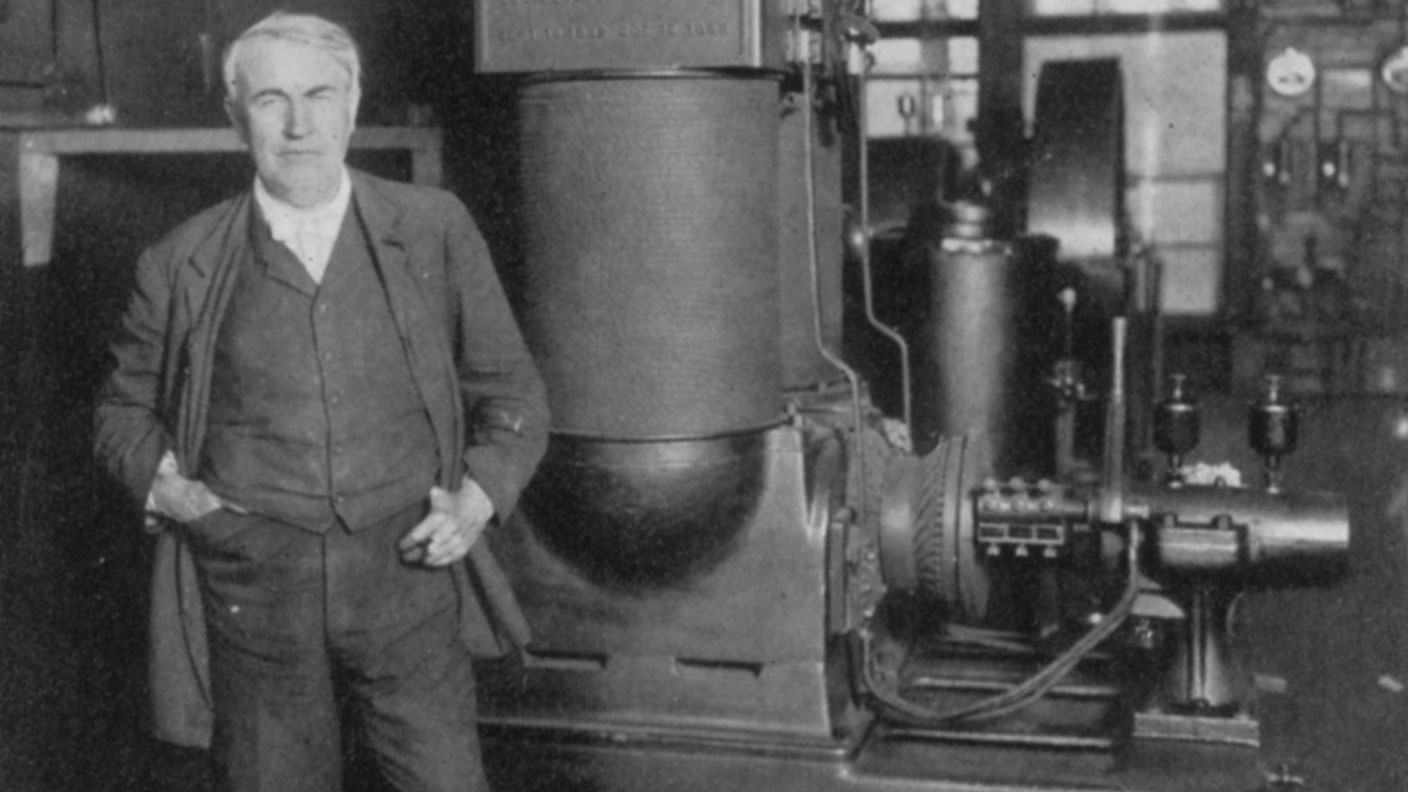

4 September 1882: Edison lights up Wall Street

On this day in 1882, Thomas Edison demonstrated the benefits of electric light to Wall street bankers, ushering in the age of electricity.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In 1879, Thomas Edison created a commercially viable electric light bulb. But a light bulb is useless without the electricity to power it, so a few months later, Edison set up the Edison Electric Illuminating Company.

The following year in 1881, Edison demonstrated in London how surrounding buildings could be lit up from a single location. But it wasn't until 1882, that the first purpose-built power station was constructed in New York City.

The Pearl Street station consisted of six 27-ton steam-driven dynamos, named Jumbo after a celebrity circus elephant. Each dynamo was capable of producing 100 kilowatts of electricity, enough to power around 1,200 lamps.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the real challenge was in hiring the staff. Electrical engineers didn't really exist back then, so Edison set up a training school, run by his lab technicians to train the first generation of sparkies.

On 4 September 1882, everything was in place. Edison strolled down to the offices of JP Morgan, located half a mile away on Wall Street. At 3pm sharp, an engineer at the station cut the circuit breaker, and Edison flipped the switch on Wall Street. The filament of a single light bulb warmed to a glow, and cast a dim light over the faces of the expectant bankers.

For the first time, it was now possible to switch from gas-powered lighting to electrical. By the end of the month, 59 customers were enjoying artificial light. By the end of the year, that number had grown to 513.

In what must be one of the first ever marketing events, Edison's electric company held a procession for the 1884 presidential elections. Several hundred men marched down the road wearing helmets, each topped with a shining light bulb. A horse-drawn generator kept the lights on.

Then in 1890, the Pearl Street station burnt down, but not before it had become the model for the subsequent power stations that began to pop up around the city.

Today, the Edison Electric Illuminating Company survives in the form of Con Edison, which delivers electricity to three million customers in America.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.