Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Three days a week, Irving Kahn takesa taxi from his Manhattan flat to theoffices of his investment firm, KahnBrothers. "Nothing surprising aboutthat, you might think," says The DailyTelegraph. Except that Kahn is 108 yearsold, and the world's oldest investmentmanager.

To say he has seen it all, as TheWall Street Journal notes, "feels like anunderstatement". Kahn's career beganbefore the 1929 crash.

He has tradedthrough the Great Depression, World WarII, the Cold War and, recently, the 2008crash as well as numerous less severecrises. He has also seen two of his sonsretire from the family firm in their mid-70s. He, of course, keeps on going.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Kahn vividly remembers his first trade, in"the feverish summer of 1929", says TheDaily Telegraph. Convinced that priceshad hit "unreasonable levels", he decidedto short sell a miner, Magma Copper (ie,he bet the price would fall).

"I borrowedmoney from an in-law who was certain Iwould lose it, but was still kind enoughto lend it. He said only a fool would betagainst the bull market."

By the time thecrash took hold in the autumn, Kahnhad nearly doubled his money. Yet hesubsequently changed tack, replacingspeculation with a conservative, analyticalapproach (see below). The catalyst?His collaboration in the 1930s withBenjamin Graham, the father of "valueinvesting".

Graham was teaching atColumbia University in New York andKahn became his first teaching assistant,helping him with his 1934 classic, SecurityAnalysis. "They'd take the subwaytogether to Columbia," says third sonTom Kahn, who also works for the familyfirm. Among their later disciples was ayoung Warren Buffett.

"Small and gnomish", Kahn counselspatience in hard times, said The DailyBeast in 2011. "The depths of theDepression turned out to be a useful timeto learn that lesson": life for a banker was"markedly frugal by current standards".

Kahn and his wife, Ruth, lived in publichousing on the Lower East Side. He'dwalk home for lunch to save money onrestaurants. But he considered himselfremarkably fortunate, given the breadlinesand homeless families surrounding themin New York, says Der Spiegel. "Mysalary was reduced to $60 a week. Iremember my boss asking me: Whydo you look so happy?' And I replied:I thought you were going to fire me.'"

He later prospered, but his habits haveremained modest. For years he ate thesame dish chopped steak, rare at thesame time-worn French restaurant.

In recent years, Kahn's longevity hasbeen the subject of scientific inquiry.It might be just be a "genetic gift", saysThe Daily Beast: all three of his siblingslived to over 100, though he is nowthe last one surviving.

But Kahnhimself seems convinced that watchingthe gyrations of markets might havesomething to do with it. "I get a kick outof seeing who's going to come out aheadin this race."

'A value investor must be willing to wait'

"This is not new to me," he told Financial Week's Hilary Johnson. "It's like the same play, or plot, with different characters." He was confident that Kahn Brothers' value-investing principles would see it through.

"Wall Street has always been a very poor judge of value," Kahn told The Daily Beast. Making a priority of finding it was "an investment strategy born of the beating that Ben Graham had taken in 1929".

Said Kahn: "I stopped wasting time on what other people claimed a stock was worth and started looking at the numbers... There were a large number of valuable buys during the Depression."

Then, as in the recent crisis, the smart money was on companies with sound fundamentals what Kahn calls "legitimate businesses", producing food, clothes and other essentials. "Everybody still wanted a clean shirt."

One key lesson Kahn learned from Graham was to "studyfinancial statements to find stocks that were a dollar selling for50 cents'", says Richard Evans in The Daily Telegraph. He usesthe same approach now.

"There are always good companiesthat are overpriced," he says. A "value investor must be willingto wait".

Like Buffett, he reads constantly. But with the S&P500 hitting record highs, bargains are hard to find. "That isusually a sign of widespread speculation." No one knows whenthe tide will turn. But when it does, "those who are leveraged,trade short term and have bought at high prices will be exposedto permanent loss of capital".

Value-seekers like Kahn seemto have "remarkable" staying power, says Spencer Jakab inthe FT. Philip Carret and Philip Fisher (two of Buffett's otherinfluences) died at 101 and 96 respectively, and legendaryinvestor Sir John Templeton remained active until his deathaged 95.

Shareholders of Berkshire Hathaway, contemplatingthat relative stripling Buffett, "have cause for cheer".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

What is Bernard Arnault's net worth?

What is Bernard Arnault's net worth?We look into Bernard Arnault's net worth – how did he make his billions?

-

What is Warren Buffett’s net worth?

What is Warren Buffett’s net worth?Warren Buffett, sometimes referred to as the “Oracle of Omaha”, is considered one of the most successful investors of all time. How did he make his billions?

-

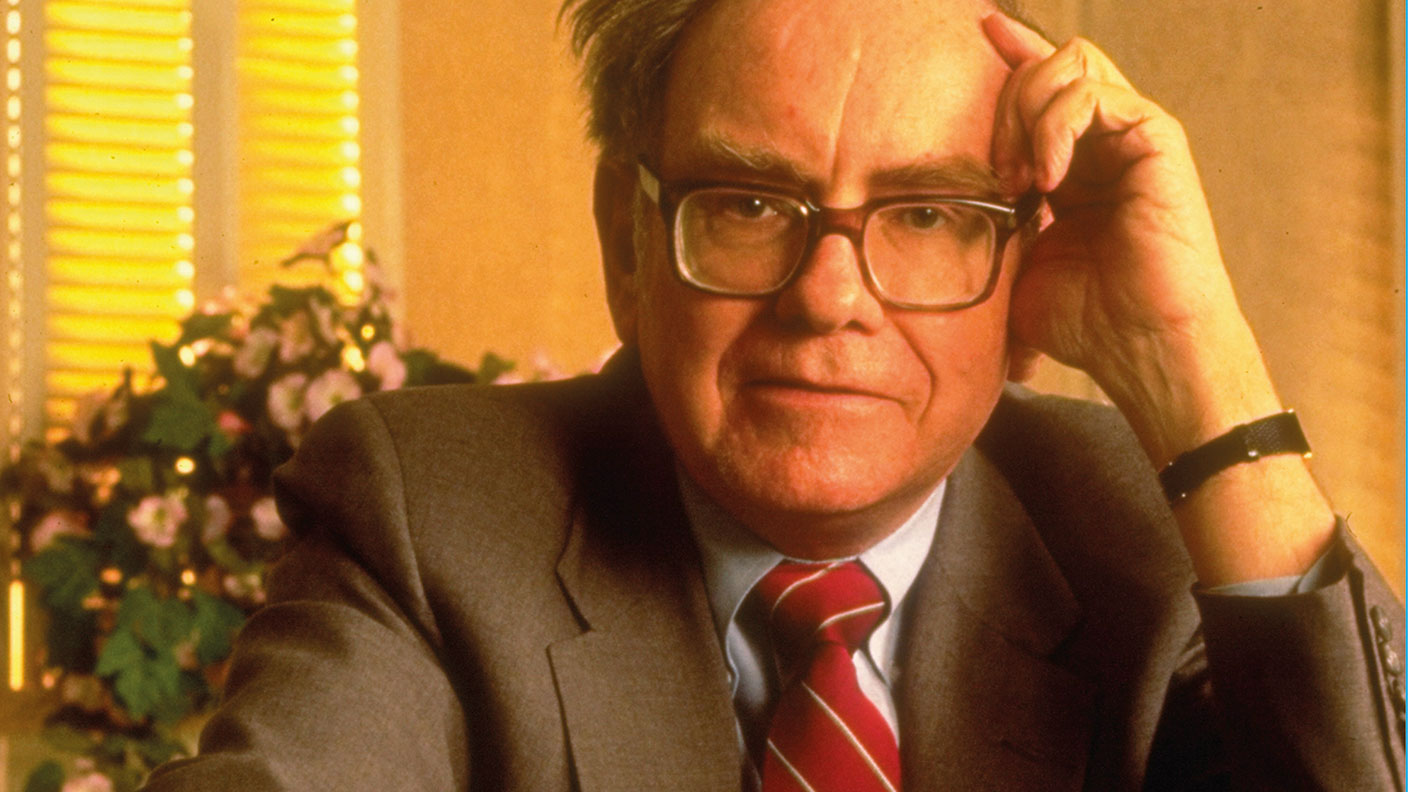

The making of Warren Buffett

The making of Warren BuffettProfiles The man who “triumphed in the long game by practising a simpler, purer version of capitalism” is widely hailed as the world’s greatest living investor. How did he get to where he is today?

-

Atul Gawande: the writer shaking up US medicine

Atul Gawande: the writer shaking up US medicineProfiles Atul Gawande doesn’t have the sort of CV you’d expect for someone running a healthcare joint venture between Amazon, Berkshire Hathaway and JPMorgan. That’s exactly why he was chosen. Jane Lewis reports.