Shares in focus: Can Sainsbury’s defy the doom-mongers?

Tesco has slashed its dividend – can Sainsbury's avoid having to do the same, and should you buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The grocer is struggling, but the shares are a cheap source of income, says Phil Oakley.

Can things get any worse for the big supermarket chains?Their share prices have been hammered as they face up to what seems like a perfect storm.

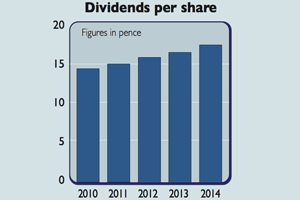

Tesco has slashed its dividend and it's very likely Morrisons will too as both companies' profits tank. The stock market seems to think that Sainsbury's future is almost as bleak.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If you have a look at the supermarket sector as a whole, it's easy to see why investors are so downbeat.

According to the retail experts, discount supermarkets Aldi and Lidl are the new powerhouses of the sector who will kill the big chains with their low prices. I'm not so sure about this, but lots of people believe the theory.

Then there's the fact that more people are buying food and household goods online. This makes it harder for the chains with large stores to cover their costs and make a decent profit.

There's also the latest figures from the Office for National Statistics, which showed that the volume of food sold in the UK has fallen for the first time since records began in 1989.

And for some, the most worrying development of all is the recent departure of Sainsbury's chief executive, Justin King. Has he followed the example of Tesco's Terry Leahy in 2011, and got out just before things turned sour?

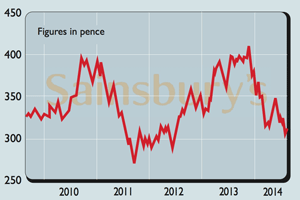

All this doom and gloom has left Sainsbury's shares hovering just above their 52-week low and looking quite cheap on many valuation measures.

So, is Sainsbury's dividend doomed and its shares a value trap? Or have the current woes created a buying opportunity for contrarian investors?

The outlook

No doubt many investors are worried about the Aldi/Lidl issue, but Tesco is also a concern. Tesco's new CEO will start work soon, and many fear that he will cut prices and force Sainsbury's to follow suit. That could inflict serious damage on Sainsbury's profits and make its dividend unaffordable.

This is a simple and very powerful argument and one that could conceivably come true. However, it is heavily dependent on the view that all Tesco's problems are down to the prices in its shops. I don't think that's the case.

There are other issues, such as food quality, the presentation of its stores, the large number of out-of-town hypermarkets and struggling businesses in eastern Europe and parts of Asia.

What's more, despite all the doom-mongering, Sainsbury's has actually coped with the rise of the discount supermarkets very well. Instead, Tesco and Morrisons have been the big losers.

Despite the threat of Aldi and Lidl, Sainsbury's has been increasing its share of the grocery market over the last few years and has been able to hang on to most of those gains recently.

In many ways, Sainsbury's has created a decent niche for itself a halfway house between the cheap end of the market and the perceived quality products on offer from Marks & Spencer and Waitrose. Sainsbury's has done well with sales of its own-brand food and non-food items, such as clothing and cookware.

As well as keeping its prices competitive, Sainsbury's has been in tune with changes in the way that people shop. It has made itself more competitive by building up a very successful online retail business and has invested heavily in convenience stores rather than big out-of-town supermarkets. This has put Sainsbury's in a good position to keep its head above water in the years ahead.

Sainsbury's finances are also in good shape. Its stores seem well looked after and it hasn't got too much debt. It's also encouraging that the chain plans to spend less money on adding new retail selling space.

Capital expenditure could come down by around £100m a year, whichwill give the company's cash flow a nice boost and make it easier to keep paying a decent dividend.

That said, the key reason to buy Sainsbury's shares is not because it's a great business. It isn't. Its return on capital employed (ROCE) is a very modest 11% hardly a hallmark of a great company.

No, the attraction is that the sharesare being bombarded by so muchnegative sentiment. Even the company's own stockbroker turned more downbeat recently. Yet times of pessimism canbe just the right time to buy the sharesof a company. All you have to be is patient enough to wait for things toget better.

I'm not under any illusions that Sainsbury's is going to be a great growth company, nor that trading will be easy. The thing is, though, that Sainsbury's doesn't have to grow for shareholders to make money.

The share price is telling us that the chain probably won't grow its profits again, and that means you can snap up the shares now for less than their net asset value and get a dividend yield of over 5%.

If Sainsbury's manages to keep on defying the naysayers, then all those short-sellers will have to buy back the shares they have sold. At that point, the shares could bounce sharply higher.

Verdict: a contrarian buy

Sainsbury's (LSE: SBRY)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

How to profit from rising food prices: which stocks should you invest in?

How to profit from rising food prices: which stocks should you invest in?Tips Food prices are rising – we look at the stocks to avoid and the one to invest in this sector.

-

What the merger between Sainsbury’s and Asda means for you

What the merger between Sainsbury’s and Asda means for youFeatures Sainsbury’s and Asda have decided to merge. John Stepek looks what it means for the troubled UK supermarket sector and asks: is it a good deal?

-

Britain’s convenience store battle

Features Sainsbury’s has bid £130m to buy Nisa, the mutually owned consortium of more than 1,300 independent retailers, which operates 3,000 small shops.

-

The ten most-hated shares in the FTSE

Features These are London’s ten most-hated shares, judged by the percentage of stock being shorted.

-

Not such a Merry Christmas for supermarkets

News The festive period provided no let up for the beleaguered supermarket sector.

-

Controversy of the day: Will Sainsbury’s fall next in the Great Supermarket Wars?

Controversy of the day: Will Sainsbury’s fall next in the Great Supermarket Wars?Features Sainsbury's saw its first fall in Christmas sales for a decade. Is it about to suffer the same fate as Tesco?

-

FTSE 100 ahead as eurozone succumbs to deflation

FTSE 100 ahead as eurozone succumbs to deflationMarket Reports Falling prices in the eurozone have heaped yet more pressure on central bank boss Mario Draghi to turn on the money taps.

-

Sainsbury's warns of dividend cut

News Sales and profits have fallen at the supermarket as middle-class shoppers head to Lidl and Aldi.