The ten most-hated shares in the FTSE

These are London’s ten most-hated shares, judged by the percentage of stock being shorted.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

These are London's ten most-hated shares, judged by the percentage of stock being shorted.

Short sellers aim to profit from falling stock prices, so it can be useful to see what they are betting against. The list is also a good indicator of stocks with the potential to bounce strongly on unexpected good news "short squeezes" occur when short sellers are forced out of their positions, which can send share prices surging.

The supermarkets remain unpopular, while investors appear to consider Admiral fully valued. The other new entrant is Drax, representative of wider bearishness on electricity utilities as wholesale electricity prices fall and renewables subsidies are cut.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

| Carillion | Construction/outsourcing | 17.71% | 15.34% |

| Wm Morrison | Supermarkets | 12.65% | 11.92% |

| J Sainsbury | Supermarkets | 11.03% | 10.74% |

| Ashmore Group | Emerging-markets fund mgr | 8.99% | 7.85% |

| Tungsten Corp. | Invoicing services | 8.85% | 6.57% |

| Hansteen Holdings | Real-estate investment trust | 8.62% | 7.94% |

| Admiral Group | Motor insurance | 8.48% | New entry |

| Drax Group | Power generation | 7.69% | New entry |

| WH Smith | Retail | 7.70% | 8.66% |

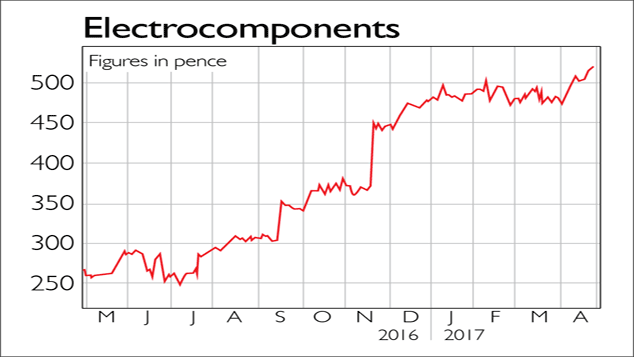

| Electrocomponents | Electronics distribution | 7.48% | 6.77% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How to profit from rising food prices: which stocks should you invest in?

How to profit from rising food prices: which stocks should you invest in?Tips Food prices are rising – we look at the stocks to avoid and the one to invest in this sector.

-

Morrisons takeover bid: supermarket is an attractive target for private-equity buyers

Morrisons takeover bid: supermarket is an attractive target for private-equity buyersNews A private-equity group has made an offer for Morrisons, Britain’s fourth-largest supermarket. Other bids are likely to emerge. Matthew Partridge reports.

-

Morrisons is just the start – get ready for a private equity feeding frenzy

Morrisons is just the start – get ready for a private equity feeding frenzyAnalysis The bid to buy the Morrisons supermarket chain is the latest example of UK listed companies being snapped up by private equity groups. It won’t be the last, says John Stepek – we could well see a feeding frenzy before this is all over.

-

What the merger between Sainsbury’s and Asda means for you

What the merger between Sainsbury’s and Asda means for youFeatures Sainsbury’s and Asda have decided to merge. John Stepek looks what it means for the troubled UK supermarket sector and asks: is it a good deal?

-

Morrisons back from the brink

Morrisons back from the brinkFeatures The supermarket chain has made a strong recovery from a near-death experience. How did CEO David Potts do it? Alice Gråhns reports.

-

Britain’s convenience store battle

Features Sainsbury’s has bid £130m to buy Nisa, the mutually owned consortium of more than 1,300 independent retailers, which operates 3,000 small shops.

-

If you'd invested in: Electrocomponents and International Personal Finance

If you'd invested in: Electrocomponents and International Personal FinanceFeatures Electrical equipment distributor Electrocomponents has seen it share price rise by 93% in the last year.

-

Amazon chews up the grocery market

Amazon chews up the grocery marketFeatures If you hold supermarket shares, watch out, says Alex Williams. Amazon plans to shake up the grocery sector.