A perfect storm for Tesco

The supermarket faces tough challenges – so should you wait for a better time to buy? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

For years it seemed that Tesco could do no wrong. Loved by its customers and the City, it dominated British food retailing and set its sights on becoming a global giant.

Under the leadership of Sir Terry Leahy, Tesco built up a huge land bank and set about smothering the country with supermarkets and local convenience stores. It also launched a substantial online grocery business and branched out into areas such as banking and mobile phones. The company led the way with keen pricing and its innovative Clubcard loyalty scheme.

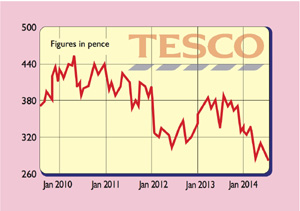

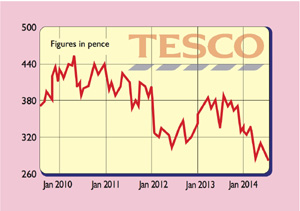

So why have things gone so terribly wrong for Tesco since Sir Terry decided to bow out just over three years ago? Philip Clarke, his successor, has had a horrible time as profits have fallen and the company has lost market share. Now Clarke has stepped down and Tesco is turning to a man called Dave Lewis. Lewis comes from consumer goods company Unilever and has a reputation for doing good things. Investors will be hoping that he can restore Tesco to its former glories.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Can Tesco be fixed?

Management from rival retailers believed that Tesco's perceived success was largely down to its huge building schedules.A steady stream of new supermarkets getting up to speed gave the impression of strong underlying sales growth,when in reality it probably wasn'tthat impressive.

How times have changed. Tesco's pursuit of size may have sown the seeds of its current woes. It was lucky that it did not have many strong competitors to stand in its way in the past. Ten years ago, Sainsbury's and Morrisons were in a mess, while Waitrose and the German discount stores didn't really have a meaningful presence. With the exception of Morrisons, that's not true now.

A lot has been said about the damage that cheap supermarkets such as Aldi and Lidl are doing to the likes of Tesco. Their lower prices are certainly wooing shoppers, but Tesco's problems are more deeply rooted than this.

Tesco's chief problem in the UK is that it is too big. It has also lost touch with its core customers and is no longer giving them what they want. This is not going to be fixed by clever marketing spin, it needs something a lot more radical.

Britain has too many supermarkets.The industry is subject to the basic rules of demand and supply. Over the last ten years we have seen a big increase in supply, which, unsurprisingly, has ended up with too many stores chasing too few customers. That's meant lower profits for most of the big players. Tesco has more to lose than most, having splurged on big out-of-town stores to sell the stuff that people now buy on the internet.

Getting out of this mess will not be easy. Tesco has effectively remortgaged a lot of its big stores and is renting them back from property companies meaning that it has around £11bn of hidden debt. Tesco has break clauses on some of these leases, but any such break will incur a penalty fee. According to the annual report, ending all those breakable leases would cost £5.4bn money Tesco probably doesn't need to spend just now.

Arguably the best strategy for Tesco is to break itself up. It could slash prices and take on the competition with a core network of stores and then focus on creating a big online retail business.It seriously needs to consider getting out of a lot of its overseas markets such as eastern Europe where profits havefallen sharply. This would create havoc with its finances in the short term and would probably lead to much lower profits, huge write-downs on the value of its properties and a dividend cut. However, the strategy might pay off in the long run as it could make life very difficult for competitors.

The trouble for existing and potential investors in Tesco is that it's difficult to work out how far profits can fall and at what level they become sustainable again. My guess is that profits could fall a long way from where they are now, even after analysts have slashed their forecasts.

At the moment, analysts are expecting Tesco's trading profits to stay flat at around £2.9bn for the next three years. This looks optimistic. Last year its UK supermarkets had profit margins of 5% on sales of £43.6bn. It's obvious that Tesco needs to cut prices, so we might see a 4% profit margin soon. That would imply a 15% fall in profits if sales don't respond to the price cuts. That means the prospective price/earnings ratio of 10.8 and dividend yield of 5% need to be taken with a big pinch of salt.

Lewis may bring some much needed fresh thinking to Tesco, but he has taken on a very hard and painful job. Tesco could recover, but things may have to get worse before they get better. Now is not the time to buy the shares. Patient investors may get a better entry point.

Verdict: one for the watch list

The numbers

Directors' shareholdings

What the analysts say

Key facts

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

How to profit from rising food prices: which stocks should you invest in?

How to profit from rising food prices: which stocks should you invest in?Tips Food prices are rising – we look at the stocks to avoid and the one to invest in this sector.

-

Tesco looks well-placed to ride out the cost of living crisis – investors take note

Tesco looks well-placed to ride out the cost of living crisis – investors take noteAnalysis Surging inflation is bad news for retailers. But supermarket giant Tesco looks better placed to cope than most, says Rupert Hargreaves.

-

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bn

Tesco sells its retail subsidiary in Thailand and Malaysia for £8bnNews Tesco has agreed to sell its southeast Asian operations to Thai conglomerate Charoen Pokphand for £8.2bn in cash.

-

Tesco should keep its Asian assets

Tesco should keep its Asian assetsOpinion The £7bn that Tesco could get for its Tesco Lotus business in Asia looks enticing. But holding on to it would be smarter, says Matthew Lynn.

-

Tesco wields the axe

Tesco wields the axeFeatures Britain’s biggest supermarket is cutting back on staff and fresh food. Will the move prove counterproductive? Matthew Partridge reports.

-

If you'd invested in: Tesco and Associated British Foods

If you'd invested in: Tesco and Associated British FoodsFeatures Tesco has seen its market value rise almost 50% in a year, while AB Foods has seen shares slide despite a rise in profits.

-

What's behind Tesco’s alliance with Carrefour?

What's behind Tesco’s alliance with Carrefour?Features Tesco is clubbing together with French rival Carrefour to bulk buy own-label goods in an effort to cut costs. Will it succeed? Ben Judge reports.

-

Lessons from Tesco’s turnaround

Lessons from Tesco’s turnaroundOpinion Retailers have it tough, but Tesco has shown that it’s still possible to thrive, says Matthew Lynn.