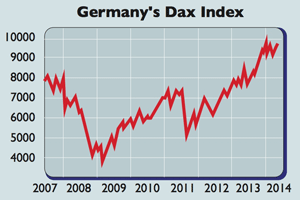

Can the Dax rally last?

Germany's benchmark index, the Dax, is at record-high levels. But the headwinds are getting stronger.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

German blue chips have almost tripled since the bear market bottomed in March 2009, with the Dax index now at a new record peak around 10,000. But the air is getting thinner, as Wirtschaftswoche puts it.

Technical analysts have noted that market momentum has ebbed in recent weeks and stocks have become more vulnerable to pullbacks. Things look worrying from a fundamental perspective too.

Like its major global counterparts, the Dax is less a domestic than a global barometer. Most of the 30 firms in the index are large exporters and around 75% of all the firms' sales are made outside Germany.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While 69% of goods went to European countries last year, emerging markets, especially China, are becoming increasingly important. China is Germany's fifth-biggest export destination and about 15% of earnings are China-related.

That means the DAX would be vulnerable if there was a financialcrisis in China something that many pundits expect.

The Ukraine crisis is another concern. Germany will suffer if the West imposes tighter sanctions on Russia andRussia retaliates. A sanctions spiralcould cause German exports to Russiato slump by 50% by 2015, reckon analysts at DW Bank.

What's more, the German stock market is one of the world's more cyclical markets, and that makes it more vulnerable than most to a bout of global or European risk-aversion.

All this could easily be shrugged offif valuations were cheap but they aren't. The index looks pricey on 18 times2013 earnings. The forward price-to-earnings ratio is 13, but this figureis based on unrealistically highearnings estimates that ignore the unspectacular growth in the world economy.

Investors who have enjoyed some or all of the Dax's roaring bullrun should take some profits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.