Shares in focus: Marston’s - time to get another round in?

Shares in pub brewer Marston's have been making steady progress. Phil Oakley looks to see if the shares are still worth buying.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

A building spree and in-pub dining should grow profits at the chain, says Phil Oakley.

Investing in pub companies is not for the nervous. Their profits are very sensitive to the ups and downs of the economy and consumers' willingness to spend. On top of that, the pub companies themselves have had an unhelpful tendency to push the self-destruct button from time to time.

Back in the late 1990s, they spent too much money on city centre pubs and trendy bars. The 2000s saw tenanted pubs become all the rage and the supposed path to riches. That ended in tears for many.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

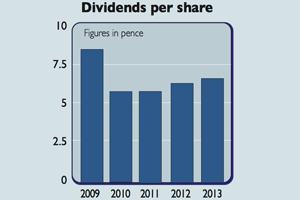

After a rough few years, it seems that things are looking up. The sector was clobbered by the smoking ban, rising beer taxes and a horrible recession during the last decade.Marston's did not escape the turmoil and had to slash its dividend, but has recovered well.

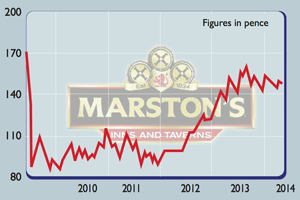

I tipped the shares as a "buy" at 111p back in August 2012, and they have made steady progress. So, is it now time to call last orders?

The outlook

The good news for investors is that the management team knows this and has set about putting things right. If it succeeds, then profits and dividends can keep growing nicely in the years ahead.

Marston's is doing the right thing by targeting the eating-out market. You may be forgiven for thinking that this marketis saturated with lots of competition.

In some ways it is, but Marston's seems to be focusing on an area with lots of potential to flourish. The trend of people eating out has been steadily growing for years. The informal settings of pubs make them a good option for families wanting to eat out without breaking the bank.

Since 2009, Marston's has built more than one hundred pub restaurants. It is looking to spend £80m-£90m per year building another 25-30 for the next three years. It will pay for this by selling poorer performing pubs.

What this should do over time is vastly improve the quality of its pub portfolio by replacing bad ones with good ones. Over 50% of the sales in these family pubs come from food, which produces higher profit margins and better returns on investment.

Another potential source of future profit could come from adding lodges to some of its pubs. Marston's currently has rooms in 50 of its pubs and recent investments are performing well. It is not looking to take on budget hotel operators, such as Whitbread, but a careful roll out in better locations could do well.

More improvements will come from converting tenanted pubs to pub franchises. Marston's wants 800 franchised pubs by 2015. Instead of running the pub on their own without any help, a franchisee gets lots of support from Marston's and benefits from its buying power. In return Marston's gets tocontrol what is sold to the customer.So far this has led to happier, more motivated managers and more profitsfor Marston's.

Marston's is also the market leader in brewing premium beers. It has beendoing well with its Pedigree ales,along with its local and bottled beers. Nearly three quarters of its beer sales come from premium beers, compared to 60% four years ago, and this has boosted profit margins.

Is Marston's carrying too much debt?

A potential concern is an ongoing review into the tenanted pub trade and the tie between tenants and pub companies such as Marston's. The government is looking into how tenant rents are set and any restrictions on where they buy their beer from. Stricter rules would not be welcomed by the pub companies.

On the downside, Marston's still has too much debt for my liking and looks to be financed like a water company which can cope with lots of borrowing rather than a company where profits can go down a lot when times are tough.

That said, debt has been coming down and a slice of expensive borrowings has been paid off. Compared with when we last looked at the company, its profits can now cover the interest bill four times instead of just two times, which is more reassuring.

On a positive note, the company has secured long-term financing at a fixed interest rate against the value of its pubs. Investors should not worry too much if interest rates rise.

At 154p, the shares trade on 12.9 times forecast earnings and offer a prospective dividend yield of 4.3%. That's not as cheap as they were back in 2012, but is hardly expensive either. With profits well placed to grow over the next few years, the shares are still worth buying.

Verdict: buy

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?