What's wrong with Britain's banks?

British banks are still in the post-crisis recovery position. Look at what they do, not what they say, to see which ones are progressing, says James Ferguson.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

British banks are still in the post-crisis recovery position. Look at what they do, not what they say, to see which ones are progressing, says James Ferguson.

When the Bank of England first slashed the base rate to 0.5%, it was seen as an emergency measure, largely to prop up the banks. Five years on, the rate remains at 0.5%, the lowest in the bank's 320-year history. We might have got used to low rates, and the rebound in share prices and house prices they've created. But this is not a normal environment. If these ultra-low rates were down to the banking crisis, the fact we still have them suggests the banks are yet to be fixed. Unfortunately, there's plenty of evidence to back this up.

A banking crisis is simply what happens when the banks' losses are bigger than their capital. They can't admit this upfront, because it would reveal they were insolvent. So instead, they reveal their losses in chunks small enough to be offset against their earnings. Banks generate lots of cash. So even the most catastrophically insolvent bank can eventually earn its way back into solvency, given enough time and support.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And the banks have been given plenty of support. For a start, technically speaking, interest rates may actually be even lower than 0.5%. That's the whole point of that other emergency measure, printing money to buy bonds (quantitative easing QE). US Federal Reserve chief Ben Bernanke described the $600bn size of QE2 as equivalent to a 0.75% rate cut. If you work it out, that means that he reckons QE equivalent to 5% of GDP equals a 1% effective' fall in rates. So the £375bn of QE done in the UK is equivalent to cutting base rates to 4.5%.

This is far from the only assistance provided. The steep yield curve (where long-term interest rates are much higher than short-term ones) in the post-crisis period helped banks make easily-predictable trading profits (by borrowing cheaply over the short-term, then lending at a higher rate over the longer term). Changes to the accounting treatment of securities they owned (bonds and other assets) allowed them to hide losses until they had accumulated enough earnings to offset these. QE sent asset prices soaring, reversing those securities' losses.

Then there are the cheap funding subsidies, such as Funding for Lending', and guarantees on bank debt (making it cheaper for them to borrow), and now on new loans under Help to Buy'. There has been the certainty of low future rates provided by forward guidance'. And, of course, the small matter of the £60bn-odd that the taxpayer injected into RBS and Lloyds. And yet the banks still show the telltale signs of having problems. In short, they just aren't fixed yet.

"History shows getting over a banking crisis takes five to six years"

Of course, history shows that getting over a banking crisis typically takes at least five to six years. It also shows that the smartest thing for a potential bank investor to do is to pay attention to what banks do, not what they say. So the question for anyone thinking of buying British banks is this: how many hidden nasties are still on their balance sheets, and how much of the bad news has finally got out into the open? When the papers report on banks, they focus on headline-grabbing stuff like payment protection insurance (PPI) provisions. But despite the big numbers involved, mis-selling compensation is relatively insignificant in the grand scheme of things.

Far less attention has been paid to chronic loan loss provisioning. This is where banks write off or write down the value of the loans they've made because they're not going to get the money back. To get an idea of how big this is, the big four banks Lloyds Banking Group, RBS, Barclays and HSBC have put aside about £20bn or so for PPI. But since the financial crisis, they have written off about £240bn 12 times as much in total for loan losses. In all, this accounts for about three-quarters of the banks' total losses since the crisis. It also helps to explain why bank lending has shrunk sharply since the crisis broke out (all the money banks have made has gone on writing off losses, rather than writing new loans).

Are any banks in the clear?

That's where we are now. So are any of our big banks in the clear yet? Or is there more to come? Before we take a look, we need to talk a bit about how banks work. Banks have to hold a certain amount of capital against the assets (for a bank, assets include the loans that they write to borrowers) that they hold. Banks don't really like holding too much capital they'd rather be using everything they have to invest in activities that make them money. But the capital plays a vital role it acts as a buffer between them and bankruptcy so that if loans need to be written off, or derivatives trades go wrong, the bank won't get wiped out.

However, certain assets are deemed riskier than others, meaning you need to hold more capital against them, and less or even none against others (this figure is known as the banks' risk-weighted assets' or RWA). So it's very tempting for banks to game' these rules, by holding more assets with a lower risk weighting. And who gets to decide the risk-weighting method? Well, believe it or not, it's up to the banks themselves (they have to seek a nod of approval from the regulator, but it's always given) which is why you can't just take the figures at face value.

So what we're looking for in a bank is one that has made sufficient progress in recognising the losses the crisis has inflicted, and is presenting a realistic view of its capital versus its RWAs, to give us confidence that we won't face either nasty surprises in the future, or years more of earnings being demolished by loan losses.

RBS: regulatory gamesmanship

Ross McEwan, the new man at the helm at RBS, has understandably decided to cram as much bad news as he can into his first year in charge, in the hope of being able to present a better story in future. But shareholders (whether involuntary or not) have a right to ask why this news comes after "seven straight quarters of profits", and more than five years after the crisis. Clearly RBS under former boss Stephen Hester was not profitable if it was sitting on known but undeclared losses.

However, as McEwan himself explained at the third-quarter figures in November, about 50%-60% of the £5bn-£5.5bn losses recognised this quarter "were expected in the original plan to be incurred in 2017 or later". In other words, he brought forward losses that were scheduled for recognition further into the future. So even after five years of writing down losses on assets held before the crisis, at a rate of about £10bn a year, RBS expects to write off more over the next five years that's a ten-year (2008-2018) resolution plan. As of the end of 2013, cumulative loan losses amount to £55bn, and there's more to come. But can we at least assume that this latest kitchen sink' move will constitute the entirety of RBS's crisis-related loan losses? Sadly not.

This is where RWA comes in again. McEwan expects RBS's core Tier 1 capital ratio to rise from 9.1% in the third quarter to about 12% by the end of 2016. But he's not doing this by raising more capital. The plan instead is to dispose of the assets with the highest risk weighting, through an internal bad bank'. Trouble is, if you look at the figures, just 3.4% of RBS's total assets (£38.3bn) account for 28% of the total assets by risk weighting. If you get rid of these specific assets, then sure, you'll dramatically improve the ratio of capital to RWA but are you going to reduce the actual risk as sharply?

Let's have a look. As of the third quarter, RBS had £1,129bn in assets. Of this £133bn were securities, £324bn were derivatives and £469bn were loans to customers. Even if we generously assume all derivatives are 100% liquid, hedged and devoid of counterparty risk, that still leaves over £600bn of loan and securities risk assets. Yet if RBS follows its plan, its RWA figure will drop from £410bn to as low as £294bn. That's half of the sum of its total loans and securities.

Compare that to US banks, which don't subscribe to Basel, and so have no incentive to game the regulations. RWA over there is consistently higher than loan assets alone. Take JP Morgan. Loans are$0.73trn, while RWA is almost twice as much at $1.37trn and total assets are $2.4trn. Based on £294bn RWA, then having a target capital ratio of 12%, would mean that RBS was in fact holding only a 6% capital buffer against its loans and securities, and nothing against its derivatives. That seems optimistic. In a banking crisis like the one we've just been through, total loan losses historically hit about 15%-20% of all loans made. In RBS's case, peak loans hit £886bn. Even just writing off 10% suggests we'll eventually see £89bn of cumulative losses.

"Loan losses at Lloyds are likely to rise further"

But that's the best-case scenario. The major four US commercial banks have already written off 14%-19% of their loans on this basis. A more realistic 15% assumption for RBS suggests a further £62bn or so of losses to come on top of what it's already recognised. That's enough to wipe out the existing common equity Tier 1 capital of £41bn one and a half times over. Financial engineering and regulatory gamesmanship got us into this mess in the first place. RBS seems to be planning to use the exact same regulatory capital ratio tricks to hide how far away from resolution it still is.

Lloyds: overly optimistic

Lloyds which the government hopesto return to private hands this year isan even more politicised bank than RBS, in many ways. There's a lot of pressure on the bank to look good. This shows. By its own measures of RWA, Lloyds considers itself a lot less risky than its peers consider themselves. But so far it has only set enough earnings aside to write down 8.8% of its peak loans (of £673bn). That's well below the typical 15%-20% loss rate I've already mentioned, and also less than what peers such as HSBC (at 11.2%) and in the US, Citigroup (19%) have already achieved.

Given Lloyds' disproportionate exposure to mortgage lending, and the likelihood of another housing slump if interest rates get anywhere near more normal levels, it doesn't seem unfair to assume that loan losses at Lloyds are likely to rise further before we leave the shadow of this crisis.

The bank would have to count itself lucky if cumulative loan losses stop at 10%. But even that would mean we should expect a further £8bn-£10bn in provisions in the quarters ahead. And a more realistic 15% final loan loss rate could see Lloyds have to take another £40bn or more in losses, which would absorb the best part of the next five years' earnings, as well as the last five. I'd say this is a problem. The bank is already taking a pretty lenient view of the riskiness of its own assets, which gives it a capital ratio of 13.7%.

However, for the most robustly capitalised UK banks similarly tothe US banks their RWAs are higher than their loan assets. HSBC's RWAsare 6.4% higher than loans and Standard Chartered's RWAs are 13.7% higher. Not so Lloyds however. Lloyds has the dubious distinction of marking its RWAs down to just half the level of its loan assets. The only other major banks I'm aware of that share such a rose-tinted opinion of their own assets are Bank of Ireland, Nordea, ING, Banca Monte dei Paschi di Siena, Deutsche Postbank, Hypo Real Estate and Dexia. This is not, frankly, a great list to be associated with.

If we viewed Lloyds' assets more as its peers do, then its capital ratio wouldfall to about 5.8%. That means it would need to raise about £25-£30bn to make up for the shortfall. So you can see why it has taken this particular view of its RWA, but you could well argue that it's an overly-optimistic one. The team at MoneyWeek give their verdict on which banks might be worth considering instead, below.

James Ferguson is a founding partner of the MacroStrategy Partnership LLP.

The banks to invest in now

James has made it pretty clear why he'd still avoid RBS, and also why you shouldn't chase the rally in the Lloyds Banking Group share price. The new RBS CEO, Ross McEwan, has a plan to improve RBS's capital ratio over the next three years. The problem is that he won't be doing this by increasing capital but rather by shrinking risk-weighted assets (RWA). Since RWA is a bank's own internal measure of how risky its assets are, this is where any manipulation will occur.

At the end of 2009, both Lloyds and RBS measured their RWA as equivalent to 77% of total loans. Since then, Antonio Horta-Osorio at Lloyds has managed Lloyds' RWA down to just 57% of loans, but under Stephen Hester, RWA at RBS rose to 97%. McEwan's plan is to get rid of his highest RWAs. This is arguably a cynical exercise to make RBS look better capitalised, but which won't necessarily make the bank any safer in reality. Avoid.

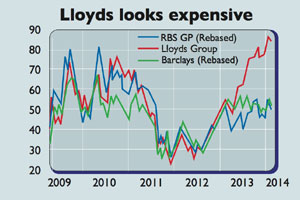

James also argues that Lloyds, despite the planned resumption of dividend payouts and the government share sale in 2014, is open to significant risk. Most people believe things can only get better at Lloyds. But as the relative share price chart (above) shows, a lot of this optimism is now in the price. Over the last year, Lloyds is up 62% to a prospective price/earnings (p/e) ratio, assuming all goes well, of 12.5 times. However, the shares now trade on 1.5 times book value. Banks tend to trade below book value when the market believes that hidden losses are artificially padding out the reported book value. RBS, for example, still trades on 0.6 times. Lloyds has far too much good news already baked into the share price, despite the clear incentive for the government to make sure it does well this year. Take profits.

As for recovery candidates, Barclays (LSE: BARC) is the best option. Its shares are down more than 15% over the last year. The dividend yield is only 2.7%, but has been rising steadily since 2009, so should improve from here. Unlike Lloyds, Barclays trades on a heavily discounted price-to-book ratio of just 0.7 times, only marginally above RBS a bank in arguably much worse straits. Weak results at its FICC (fixed income, commodities and currencies) division have hit sentiment. But such earnings are always volatile. With Barclays, investors get all the upside potential that Lloyds offers, but without as much risk and at half the price to book. Meanwhile, last summer the Bank of England's Prudential Regulation Authority (PRA)demanded that Barclays increase its capital by £12bn which resulted in a £6bn rights issue. But it leaves Barclays with a much stronger capital base than it had before. It offers the most exciting risk/reward outlook in the sector. Buy.

HSBC (LSE: HSBA), on the other hand, offers the best balance of risk and reward for the more long-term investor. HSBC has always been the best capitalised of the big UK banks. Although the share price halved during the initial stage of the crisis, it quickly rebounded and last year almost made a new high. At the start of 2007, before the crisis broke, HSBC was paying a 34.75c dividend. Today, that dividend is 29.36c, only 15% less, and has been rising steadily since 2011. This suggests the bank has largely returned to pre-crisis normalcy. However, since last summer the shares have fallen by 20%. Along with the steady recovery in the underlying fundamentals, this makes HSBC a solid buy, with a price-to-book ratio of 1.05, a prospective p/e of 10.3 and a yield of 4.8%. Buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

James Ferguson qualified with an MA (Hons) in economics from Edinburgh University in 1985. For the last 21 years he has had a high-powered career in institutional stock broking, specialising in equities, working for Nomura, Robert Fleming, SBC Warburg, Dresdner Kleinwort Wasserstein and Mitsubishi Securities.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Invest in space: the final frontier for investors

Invest in space: the final frontier for investorsCover Story Matthew Partridge takes a look at how to invest in space, and explores the top stocks to buy to build exposure to this rapidly expanding sector.

-

Invest in Brazil as the country gets set for growth

Invest in Brazil as the country gets set for growthCover Story It’s time to invest in Brazil as the economic powerhouse looks set to profit from the two key trends of the next 20 years: the global energy transition and population growth, says James McKeigue.

-

5 of the world’s best stocks

5 of the world’s best stocksCover Story Here are five of the world’s best stocks according to Rupert Hargreaves. He believes all of these businesses have unique advantages that will help them grow.

-

The best British tech stocks from a thriving sector

The best British tech stocks from a thriving sectorCover Story Move over, Silicon Valley. Over the past two decades the UK has become one of the main global hubs for tech start-ups. Matthew Partridge explains why, and highlights the most promising investments.

-

Could gold be the basis for a new global currency?

Could gold be the basis for a new global currency?Cover Story Gold has always been the most reliable form of money. Now collaboration between China and Russia could lead to a new gold-backed means of exchange – giving prices a big boost, says Dominic Frisby

-

How to invest in videogames – a Great British success story

How to invest in videogames – a Great British success storyCover Story The pandemic gave the videogame sector a big boost, and that strong growth will endure. Bruce Packard provides an overview of the global outlook and assesses the four key UK-listed gaming firms.

-

How to invest in smart factories as the “fourth industrial revolution” arrives

How to invest in smart factories as the “fourth industrial revolution” arrivesCover Story Exciting new technologies and trends are coming together to change the face of manufacturing. Matthew Partridge looks at the companies that will drive the fourth industrial revolution.

-

Why now is a good time to buy diamond miners

Why now is a good time to buy diamond minersCover Story Demand for the gems is set to outstrip supply, making it a good time to buy miners, says David J. Stevenson.