Shares in focus: The champ is on the ropes

Shares in British defence stock BAE Systems have taken a battering, says Phil Oakley. Is now the time to buy in?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Britain's defence champion is taking a battering don't bet on a comeback, says Phil Oakley.

BAE Systems is a champion of Britain's manufacturing sector and one of the world's leading defence companies. The maker of planes, combat vehicles, ships, submarines and lots of clever bits of electronic kit has done reasonably well over the last decade or so.

The wars in Afghanistan and Iraq saw a surge in demand for its products, as did the fact that lots of military kit around the world needed replacing and bringing up to date.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company also sold its stake in commercial aircraft maker Airbus back in 2006 and reinvested the proceeds to buy itself more of a presence in the US defence market. Until recently, this strategy looked to be working out well.

BAE Systems' profits were able to ride out the financial crisis without too much difficulty, but the last couple of years have seen many investors questioning the company's future direction.

In 2012, its management announced that it was in talks to merge with EADS, the owner of Airbus, but the deal fell through. This raised questions regarding whether BAE had become too reliant on doing deals to grow profits, rather than trying to make its existing business better.

Now, BAE is facing up to the fact that a lot of its customers are hard pressed for cash not least the US government, which has been spending more money than it has been taking in taxes for a long time now.Consequently, America's defence budget needs to be cut by $450bn over the next decade.

BAE looked like it could work its way through these cuts by cutting costs itself and becoming more efficient. That hope was shattered a couple of weeks ago when it issued a profits warning and said that its earnings per share (EPS) for 2014 would be 5%-10% lower than in 2013.

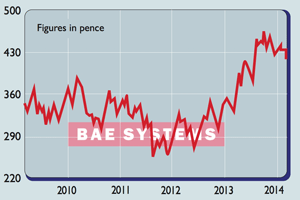

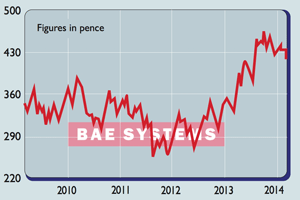

Despite this, the shares have actually held up quite well, having performed strongly in 2013. On many valuation measures, they look quite cheap while they pay a decent dividend. Could this be the time to get on board, or are the shares set to tread water?

What's the outlook for business?

But can it really grow its profits again without buying another company? It has a current order book of £42.7bn, of which around half is coming from the UK. This is just over two years' sales at current run rates.

The UK part of the business is expected to be fairly stable over the next few years, with projects on aircraft carriers and submarines. There's also been plenty of demand for Typhoon and F35 aircraft and the company is looking to secure more export orders for these.

That said, the British government's bank balance is as bad as, if not worse than, America's. It's difficult to see long-term growth coming from within the UK. This is a worry.

The outlook is more optimistic for selling to the Middle East, India and South Korea. A deal has been done to increase prices for Typhoon aircraft sold to Saudi Arabia, while there is an order to upgrade the Koreans' fleet of F16 aircraft.

But despite this, the situation in America remains a concern. Profits will be down quite sharply this year and it's difficult to see where the money is going to come from to boost BAE's business over there anytime soon.

Of course, BAE won't disappear by any means, and is still winning new contracts and maintaining market-leading positions in areas such as electronic warfare.

Should you buy the shares?

A key thing to consider will be the company's cash flow. Customers such as the Saudis tend to pay large, upfront amounts for their orders, which makes it difficult for outside investors to work out how much cash is available to be paid to the shareholders and what is needed to make aeroplanes.

There's still around £700m left over in a share buyback programme that might prop the share price up, but there's also a £3.7bn pension fund black hole to fill. It's by no means certain that BAE will have enough cash to maintain the current dividend (20.1p per share) for more than a year or two unless business picks up.

The situation in Ukraine might force a rethink among governments about what they are spending on defence, which could boost BAE's medium-term prospects. But dodgy public finances means you shouldn't bet on that happening.

The case for buying the shares is largely based on the view that, on ten times earnings and offering a 5% dividend yield, they are cheap. That might be so. On the other hand, they could be a classic value trap for the unwary, ready to spring if trading turns down again.

Verdict: steer clear

BAE Systems (LSE: BA)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how