Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Finding a fund with a solid long-term record can often be difficult, given the vagaries of the markets. However, this is where this fundstands out.

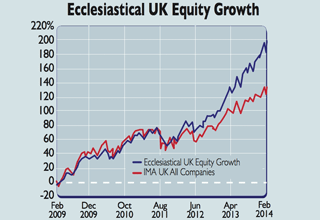

Thanks to an impressive performance over the past three years, the fund is one of the top ten best performing Investment Management Association UK All-Companies funds, says Leonora Walters in the Investors Chronicle. What's more, it has delivered over five years too, placing it in the top quartile of its sector over that period.

All in all, it has consistently outperformed its benchmark index over one year, three years and five years, delivering a respective return of 34%, 82.9% and 203.8%. The annual management fee is 1.5%.The fund's aim is to achieve long-term capital growth and a "reasonable" amount of income by investing in UK-listed stocks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Andrew Jackson, manager of Ecclesiastical UK Equity Growth,says the secret to his recent success has been keeping up a "pretty optimistic stance through wobbles" such as the 2011 euro crisis and concerns over the US Federal Reserve's tapering of its bond-buying programme.

One stock that has performed well is Howden Joinery. Around 26% of the portfolio is in industrial stocks, with 20% in consumer services and 15% in financials. Jackson thinks 2014 will be a tougher year, but that there are still opportunities to find quality bargains.

Contact: 0870-870 8056.

| Rio Tinto | 2.53% |

| GKN | 2.39% |

| WANdisco | 2.23% |

| Howden Joinery | 2.13% |

| Ashtead Group | 2.08% |

| International Consolidated | 2.00% |

| Next | 2.00% |

| Vodafone | 1.99% |

| ITV | 1.98% |

| Prudential | 1.98% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

ISA fund and trust picks for every type of investor – which could work for you?

ISA fund and trust picks for every type of investor – which could work for you?Whether you’re an ISA investor seeking reliable returns, looking to add a bit more risk to your portfolio or are new to investing, MoneyWeek asked the experts for funds and investment trusts you could consider in 2026

-

The most popular fund sectors of 2025 as investor outflows continue

The most popular fund sectors of 2025 as investor outflows continueIt was another difficult year for fund inflows but there are signs that investors are returning to the financial markets