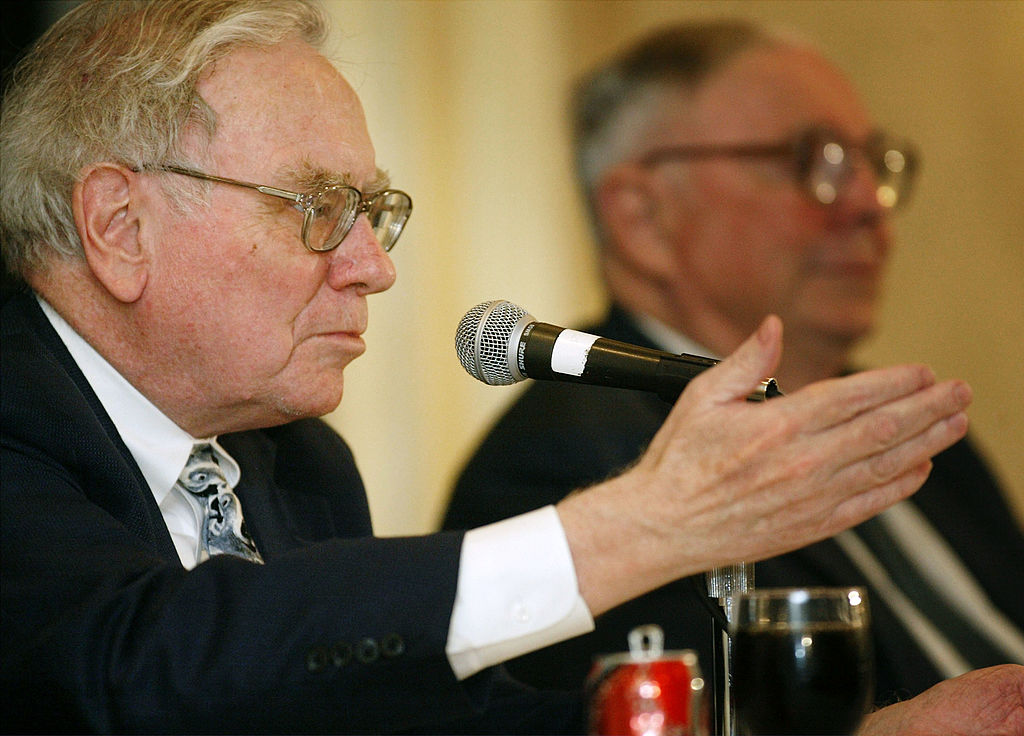

Warren Buffett is buying Exxon – but should you follow his lead?

Warren Buffett, one of the world’s most successful investors, has bought $3.45bn worth of shares in oil giant Exxon Mobil. Should you follow his lead? Ed Bowsher investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Warren Buffett, one of the world's most successful investors, has revealed his latest big buy.

Buffett's investment vehicle, Berkshire Hathaway [NYSE: BRK] has bought shares in oil giant Exxon Mobil [NYSE: XOM] worth $3.45bn. Berkshire now owns 0.9% of Exxon.

Buffett's move has triggered a fair bit of excitement about Exxon. The bulls have highlighted the fact that the company trades on a price/earnings multiple of just 11.8 times next year's earnings. It's also paying a 2.7% dividend, well ahead of the average for the S&P 500 index.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It looks cheap, and Buffett is buying. Those are two good reasons to get excited about any stock.

But I don't think you should follow Buffett's lead. Here's why

Some of Exxon's biggest businesses are struggling

Refining is the worst of the three. Profit margins are thin and look set to stay that way. There is simply too much refining capacity around the world. Things are so bad in this sector that Exxon's refining profits have slumped 81% over the last year.

On the exploration side, oil exploration is also a tough business. Most of the low-hanging fruit was found long ago. If you want to find new oil reserves these days, you have two options.

You can explore in remote locations such as the Arctic or Kazakhstan. Or you can find ways of obtaining oil from fields where extraction was previously considered too difficult.

In fairness to Exxon, it's following both of these approaches. It's exploring in the Arctic as part of a joint venture with Russia's Rosneft, while it's extracting oil from oil sands (an unconventional source of oil) in the Kearl sands project in Canada.

The trouble is, these projects are expensive. Even if a project does eventually strike oil, it can be a long time before the exploration costs are paid off. For example, with its Kashagan project in Kazakhstan, Exxon doesn't expect a decent return until 2040, even although production has already commenced.

Remember also that some oil-producing countries have been keen to develop their own national oil companies. That's made it harder for the likes of Exxon to access fresh oil fields.

Production is the jewel in Exxon's crown but it's still a tough business

But that production can only be sustained if the exploration continues to be successful, and that's a huge challenge. Indeed, production has fallen over the last two years. That decline has only been arrested by production starting at Kearl sands.

So you can't assume for a moment that Exxon is a one-way bet that will carry on producing oil at current levels for generations to come.

And this is all before you throw in the wild card of climate change. It's tough to make any firm predictions here. But there has to be at least a chance that governments will eventually decide to aggressively clamp down on carbon dioxide emissions. One way or another, that won't be good news for any oil company.

I suspect that you might by now be wondering: "But what about shale oil? Hasn't that transformed the energy industry?"

And you're right. The boom in shale oil is a major change and has dramatically increased oil production in the US. Trouble is, Exxon doesn't have a big presence in shale oil, so shareholders can't rely on that, even if Exxon has a stronger position in shale gas.

Exxon might make sense for Buffett but you and I have better options

And with Exxon, he's got a large company, trading on a low rating, which also delivers an excellent 25% return on capital.

But as I'm much poorer than Buffett, I can choose from a much larger universe of potential investments. Given all the things to worry about with Exxon especially its growing costs of production I'd rather put my money in some smaller companies where I think the risks are lower. Over the long-term, I think they'll probably do better.

I mentioned some of the small companies I'm investigating in a recent Money Morning. And if you're interested in playing the shale revolution, my colleague David Stevenson over at the Fleet Street Letter has put together a report on the prospects for fracking in Britain you can read it here.

The Fleet Street Letter is a regulated product issued by Fleet Street Publications Ltd. Your capital is at risk when you invest in shares, never risk more than you can afford to lose. Please seek independent financial advice if necessary. Fleet Street Publications Ltd. 0207 633 3600.

Our recommended articles for today

This invention transformed sports betting

Fracking debate: the readers weigh in

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Fund inflows hit a six-month high in November – where are investors putting their money?

Fund inflows hit a six-month high in November – where are investors putting their money?Investors returned to the financial markets amid the Autumn Budget in November 2025 but caution remains.

-

The top stocks of 2025 - did you pick a winner?

The top stocks of 2025 - did you pick a winner?Last year was a chaotic one for the stock market, but which stocks did investors buy the most of?

-

Canada will be a winner in this new era of deglobalisation and populism

Canada will be a winner in this new era of deglobalisation and populismGreg Eckel, portfolio manager at Canadian General Investments, selects three Canadian stocks

-

The Stella Show is still on the road – can Stella Li keep it that way?

The Stella Show is still on the road – can Stella Li keep it that way?Stella Li is the globe-trotting ambassador for Chinese electric-car company BYD, which has grown into a world leader. Can she keep the motor running?

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

Best-performing stocks in the S&P 500

Best-performing stocks in the S&P 500We take a look at the best-performing stocks in the US equity market. Are there opportunities outside of Big Tech?

-

How to beat Warren Buffett – and the fund and trusts that have managed it

How to beat Warren Buffett – and the fund and trusts that have managed itWarren Buffett has achieved stellar returns for investors over a long and illustrious career. Can you rival his investment performance?

-

What is Vix – the fear index?

What is Vix – the fear index?What is Vix? We explain how the fear index could guide your investment decisions.