Sector in the news: The energy companies

Public anger has been directed at energy companies in recent days, says Phil Oakley. Yet, these two providers could be worth buying for the long term.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The big energy companies are hiking their prices again. It's understandable that this is unpopular with consumers but while Labour leader Ed Miliband might think that freezing prices is the answer to this problem, it isn't.

It's difficult to say that the energy market works well for consumers. That's because none of the big players seems to be able to offer us consistently cheaper prices.

When they all increase prices at the same time, it's easy to accuse them of acting like a cartel. But they don't. Most of the costs of electricity and gas are out of their control and have been going up in recent years.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The energy companies are not ripping us off either. However, comments by some politicians who say that these firms are guilty of extracting extortionate prices have frightened investors and have led to the share prices of Centrica (LSE: CNA) and SSE (LSE: SSE) falling sharply in recent weeks.

Yet on Monday this week, the government agreed to guarantee the building of a new nuclear power station at Hinkley Point in Somerset with power prices that are twice the current market rate.

Consumers will have to face facts. If the lights are going to stay on, they will have to pay much higher prices in the future than they do today.

Cheap gas from the North Sea and electricity generated from old power stations have kept prices relatively low compared with those in other countries. With the gas running out and power stations coming to the end of their working lives, that is going to change.

Neither SSE nor Centrica are making massive profits, though. SSE's retail energy business lost money during the first six months of 2013, while the company's pre-tax profits have barely moved for the past five years despite it investing billions in electricity assets.

Centrica argues that it makes a similar profit margin to Tesco and that this is not excessive. In a letter to the Financial Times a couple of weeks ago Centrica's finance director stated that the £3bn it had invested in power stations had delivered an after-tax return of just 5% hardly an excessive profit.

Sure, there's a chance that a future government may disrupt the current status quo, but it will also need to encourage new investment. Assuming common sense prevails, both Centrica and SSE look oversold right now.

Given that they offer decent dividend yields of 4.7% and 6.1% respectively, the shares look a reasonable choice for patient, long-term investors.

Verdict: buy Centrica, buy SSE

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

Despite surging profits investors should avoid Centrica shares

Despite surging profits investors should avoid Centrica sharesTips Profits in the energy sector are booming but Centrica shares are struggling. Rupert Hargreaves explains why he’d avoid the stock.

-

Centrica: the only way is up

News Centrica's share price has fallen by nearly 90% over the past few years. New finance director Chris O’Shea will hope to reverse that.

-

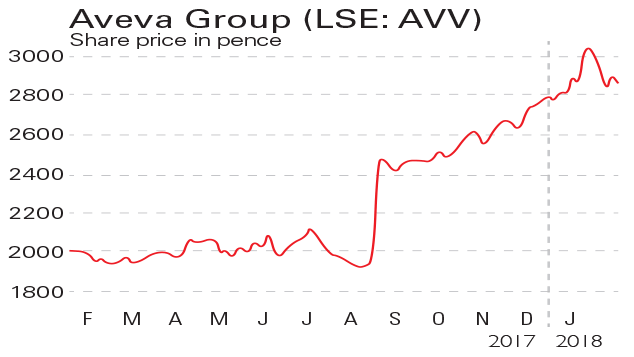

If you’d invested in: Aveva and SSE

If you’d invested in: Aveva and SSEFeatures IT software group Aveva is hoping to become a global powerhouse, while energy supplier SSE is seeing customers leaving in their droves.

-

Will Centrica slash dividends?

Will Centrica slash dividends?Features Finances are tight and payouts are under threat. The gas supplier’s new boss faces some tricky decisions, says Alice Gråhns.

-

Is it time to buy Centrica for its huge dividend?

Is it time to buy Centrica for its huge dividend?Features Shares in Centrica, owner of British Gas, come with a dividend yield of 8% after the share price fell dramatically last week. So should you buy in?

-

If you’d invested in: Persimmon and Centrica

If you’d invested in: Persimmon and CentricaFeatures Persimmon is the UK’s second-largest housebuilder. In November, it said the total sales rate per site for the third quarter was in line with the same period last year.

-

Shares in focus: Centrica’s comeback trail

Shares in focus: Centrica’s comeback trailFeatures Utility company Centrica has had a rough ride. But with the shares offering a decent dividend yield, should you still buy in? Phil Oakley investigates.